424B3: Prospectus [Rule 424(b)(3)]

Published on February 10, 2026

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-290438

PROSPECTUS SUPPLEMENT NO. 1

(to Prospectus dated February 5, 2026)

Deep Fission, Inc.

Up to 50,874,089 Shares of Common Stock

Up to 586,666 Shares of Common Stock Issuable Upon Exercise of Warrants

This prospectus supplement supplements the prospectus dated February 5, 2026 (the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-290438). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission on February 10, 2026 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the offer and sale from time to time by the selling stockholders named in the Prospectus of up to 51,460,755 shares of our common stock, par value $0.0001 per share, consisting of: (i) up to 10,000,000 shares of our common stock issued in a private placement offering on September 5, 2025 (the “Private Placement”) to accredited investors; (ii) up to 586,666 shares of our common stock issuable upon exercise of the warrants issued to each of the U.S. registered broker-dealers acting as placement agents in connection with the Private Placement; (iii) up to 38,538,922 shares of our common stock issued to the selling stockholders that were formerly Deep Fission, Inc. (“Legacy Deep Fission”) stockholders on September 5, 2025 in connection with the closing of the reverse subsidiary merger transaction among us, Legacy Deep Fission and Deep Fission Acquisition Co. (the “Merger”); (iv) up to 2,166,667 shares of our common stock held by the stockholders of Surfside Acquisition Inc. prior to the Merger; (v) up to 85,000 shares of our common stock to an advisor in exchange for services rendered in connection with the Merger; and (vi) up to 83,500 shares of our common stock to a consultant in exchange for services to be rendered following the closing of the Merger.

There is not currently, and there has never been, any established public trading market for any of our securities. The common stock is not currently eligible for trading on any national securities exchange, including The Nasdaq Stock Market, LLC, or any over-the-counter markets, including the OTC Markets-OTCQB tier (the “OTCQB”). We have applied to have our common stock quoted on the OTCQB. We cannot assure you that the common stock will become eligible for trading on the OTCQB or any other exchange or market.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

See the section entitled “Risk Factors” beginning on page 7 of the Prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is February 10, 2026.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 5, 2026

Deep Fission, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 000-56407 | 87-4265302 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

|

2831 Garber Street Berkeley, California |

94705 (Zip Code) |

Registrant’s telephone number, including area code: (707) 400-0778

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

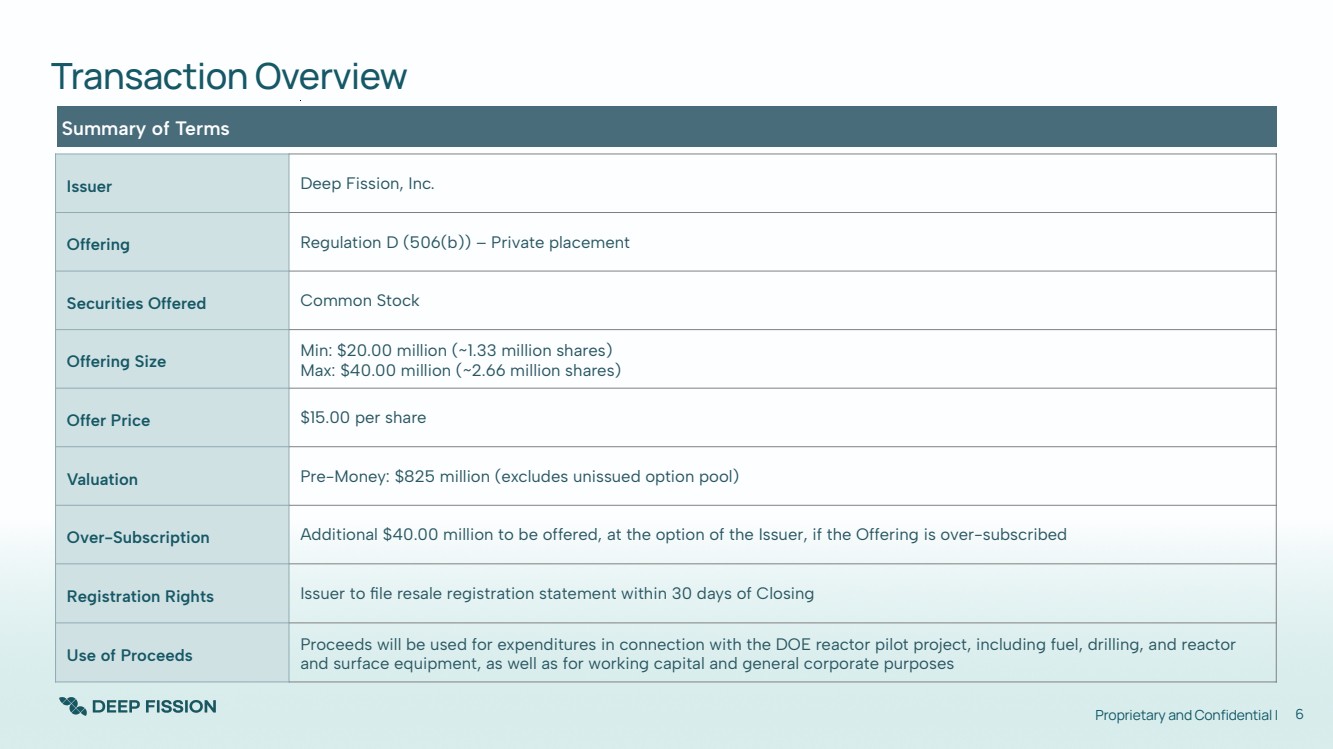

On February 5, 2026, Deep Fission, Inc. (the “Company”) entered into subscription agreements (the “Subscription Agreements”) with certain accredited and institutional investors (the “Investors”) in connection with a private placement offering of shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”).

Pursuant to the Subscription Agreements, the Company agreed to issue and sell to the Investors a minimum of 1,333,333 shares of Common Stock and a maximum of 2,666,667 shares of Common Stock, at a purchase price of $15.00 per share (the “Per Share Purchase Price”), for a minimum aggregate purchase price of $20,000,000 and a maximum aggregate purchase price of $40,000,000 (the “Offering”). In the event the Offering was oversubscribed, the Subscription Agreements granted the Company the option to issue and sell an additional 2,666,667 shares of Common Stock at the Per Share Purchase Price for an aggregate purchase price of $40,000,000 to cover over-subscriptions.

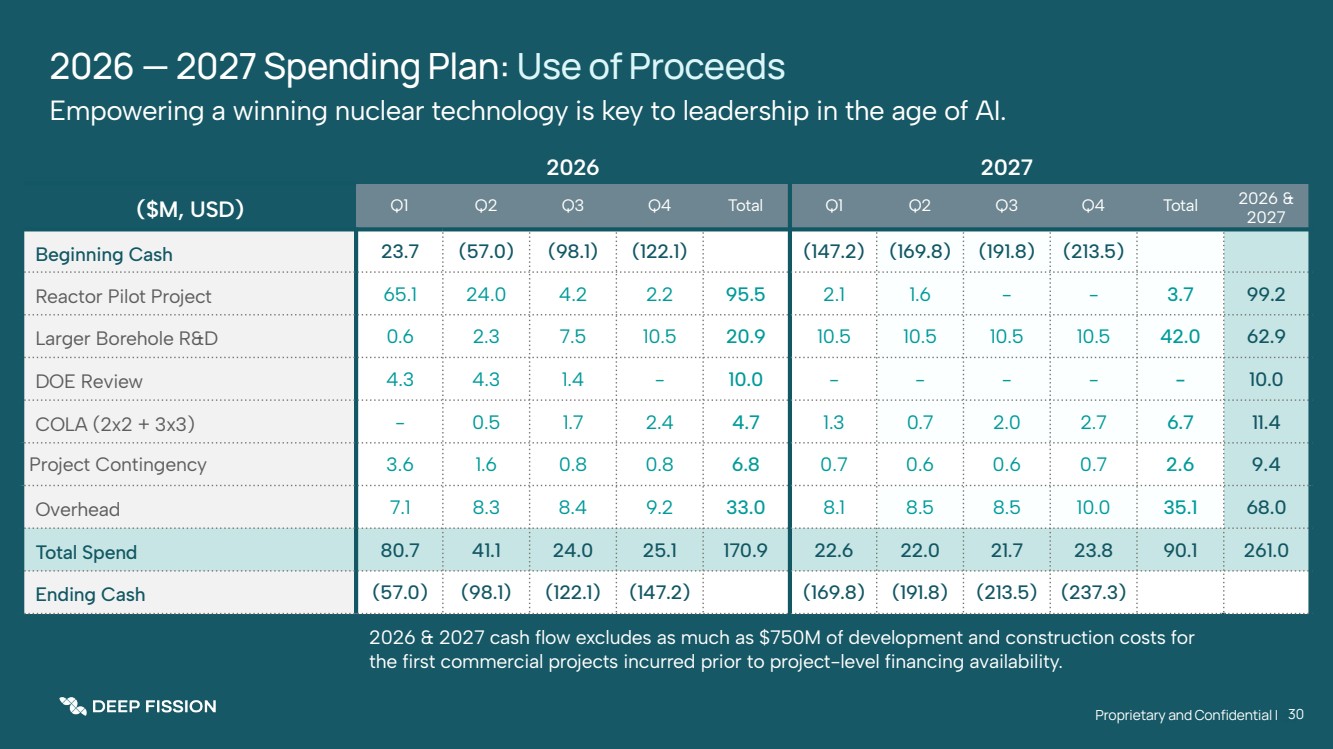

The Offering closed on February 5, 2026 (the “Closing”). At the Closing, the Company issued and sold 5,333,333 shares of Common Stock (the “Shares”) to the Investors pursuant to the Subscription Agreements for an aggregate purchase price of $80.0 million (the “Purchase Price”). The aggregate net proceeds to the Company from the Offering were approximately $76.0 million, after deducting fees to the Placement Agents (defined below) and expenses payable by the Company. The Company intends to use the net proceeds from the Offering for general working capital and corporate purposes including towards the engineering, research and development of the Company’s first nuclear reactor and related technologies. A portion of the net proceeds will also be used to cover management, overhead, legal and accounting fees and expenses relating to the Offering. The Company may also use a portion of the net proceeds for potential acquisitions of complementary businesses or assets; however, the Company has no present commitments or agreements with respect to any such transactions.

The private placement includes an investment by funds affiliated with Blue Owl Digital Infrastructure Advisors LLC (“Blue Owl”).

The Benchmark Company, LLC, Seaport Global Securities LLC, Network 1 Financial Securities, Inc. and PHX Financial, Inc. d/b/a Phoenix Financial Services acted as the placement agents (collectively, the “Placement Agents”) in connection with the Offering. Pursuant to the engagement letter, the Placement Agents were paid at the Closing from the Offering proceeds a total cash commission of approximately $3.6 million, comprised of (i) seven percent (7.0%) of the Purchase Price paid by each Investor introduced by the Placement Agents and (ii) four percent (4.0%) of the Purchase Price paid by any Investor in the Offering who was a securityholder of record of the Company prior to December 23, 2025. The total cash commission amount above excludes $0.365 million of the portion of the cash commission owed to Seaport Global Securities LLC, which amount was included in the gross proceeds from the Offering but which Seaport Global Securities LLC elected to receive in Shares as partial payment in kind. In addition, pursuant to the engagement letter, the Placement Agents were issued at the Closing warrants to purchase an aggregate of 129,417 shares of Common Stock, which is equal to (i) four percent (4.0%) of the aggregate number of shares of Common Stock sold in the Offering to the Investors, excluding Investors who were Company securityholders of record prior to December 23, 2025 and Blue Owl, and (ii) two percent (2.0%) of the aggregate number of shares of Common Stock sold in the Offering to Company securityholders of record prior to December 23, 2025 (the “Placement Agent Warrants”). The Placement Agent Warrants expire on the earlier of (i) the fifth (5th) anniversary of the Closing and (ii) the third (3rd) anniversary of the date the Company’s securities first become listed for trading on the Nasdaq Stock Market or the New York Stock Exchange, and have an exercise price of $15.00 per share. The Company has agreed to pay certain other expenses of the Placement Agents, including the reasonable and documented out-of-pocket fees and expenses of their counsel, in connection with the Offering in the amount of $100,000.

Subject to certain customary exceptions, the Company has agreed to indemnify the Placement Agents against certain liabilities that may be incurred in connection with the Offering, including certain civil liabilities under the Securities Act of 1933, as amended (the “Securities Act”), and, where such indemnification is not available, to contribute to the payments the Placement Agents and their sub-agents may be required to make in respect of such liabilities.

In connection with the Offering, the Company entered into a registration rights agreement (the “Registration Rights Agreement”), dated as of February 5, 2026, with the Investors. Pursuant to the Registration Rights Agreement, the Company is required to file a registration statement (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) to register the resale of the Shares within 30 days after the Closing. Pursuant to the Registration Rights Agreement, the Company agreed to use its reasonable efforts to cause the Registration Statement to be declared effective within 120 days after the Closing (as such 120-day period may be extended for each day of a U.S. government shutdown that results in the SEC temporarily discontinuing review of, or acceleration of the effectiveness of, registration statements). The Company will be obligated to pay certain liquidated damages to the Investors if the Company fails to file the Registration Statement when required, fails to cause the Registration Statement to be declared effective by the SEC when required, or fails to maintain the effectiveness of the Registration Statement.

The foregoing descriptions of the Subscription Agreements, the Registration Rights Agreement and the Placement Agent Warrants described herein do not purport to be complete and are subject to, and qualified in their entirety by, forms of such documents attached as Exhibits 10.1, 10.2 and 10.3, respectively, to this Current Report on Form 8-K, which are incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosure under Item 1.01 above is incorporated herein by reference. In connection with the issuance of the securities described in Item 1.01, the Company relied upon the exemption from registration provided by Section 4(a)(2) of the Securities Act and Rule 506(b) of Regulation D promulgated thereunder for transactions not involving a public offering.

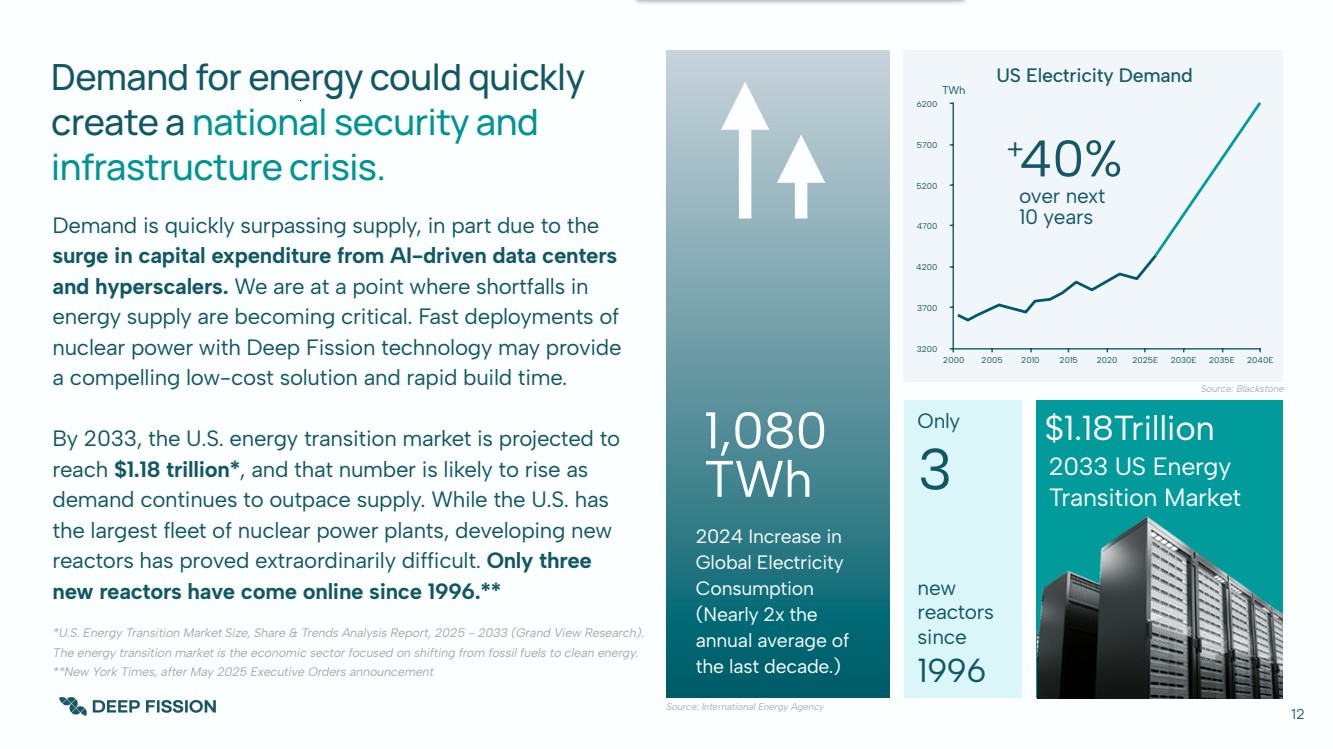

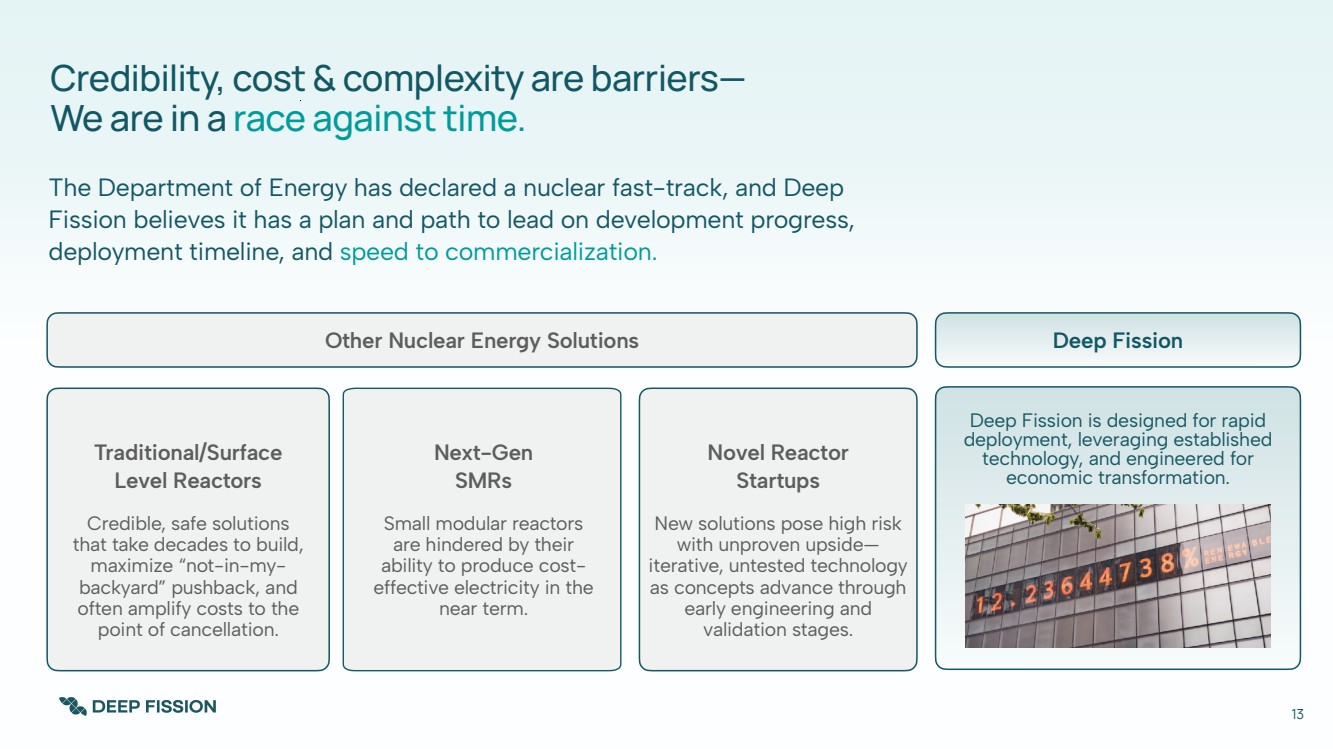

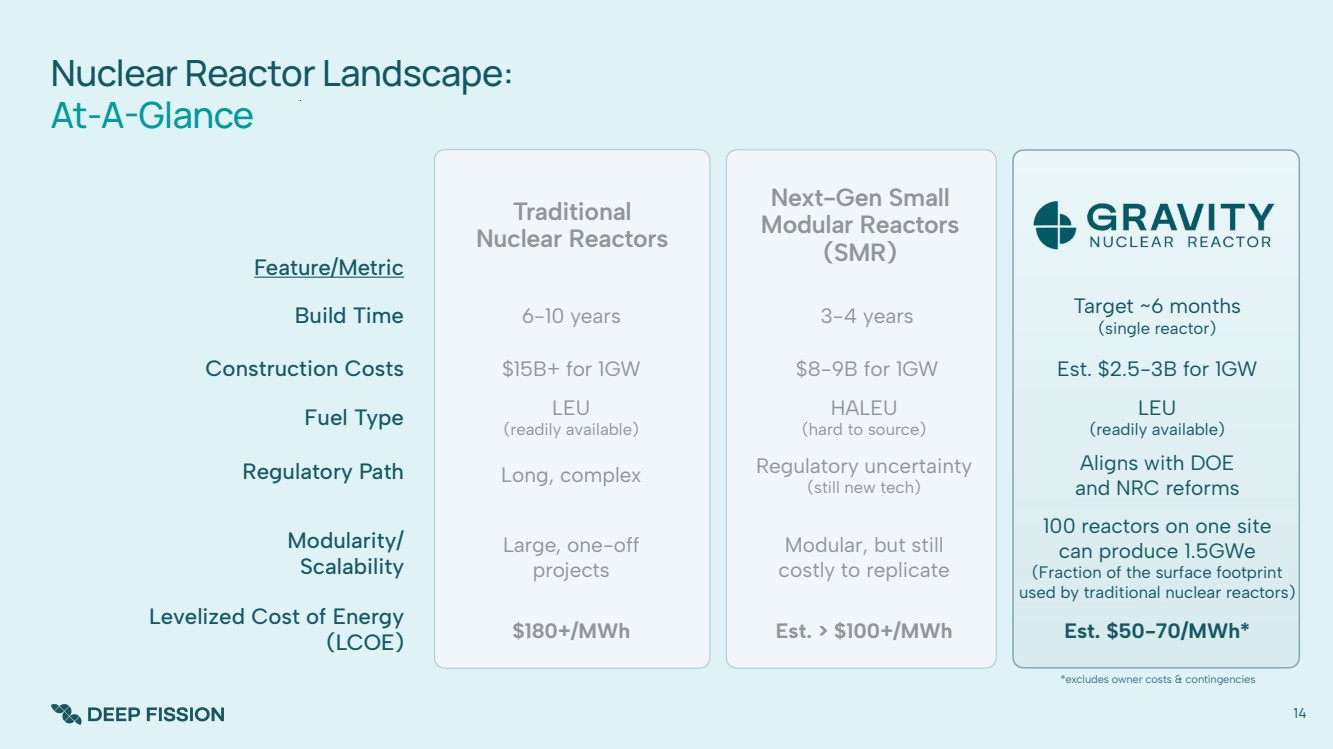

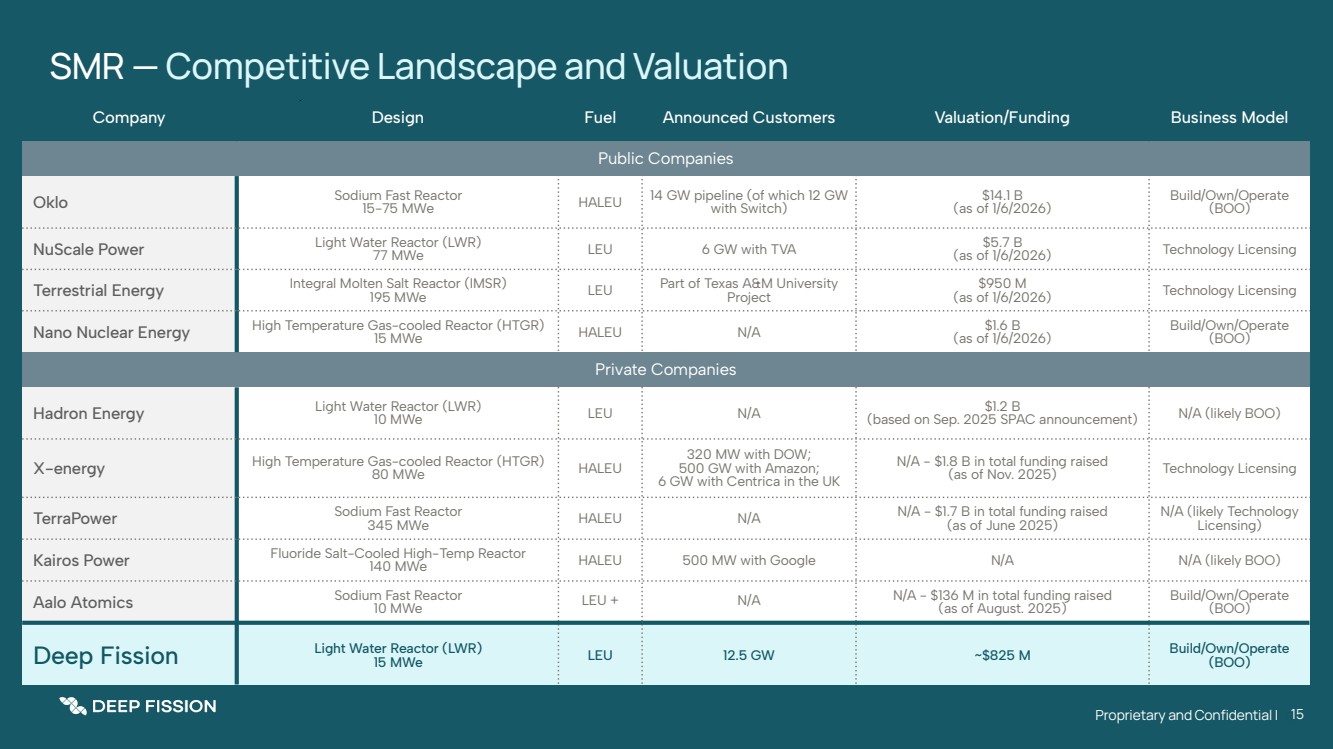

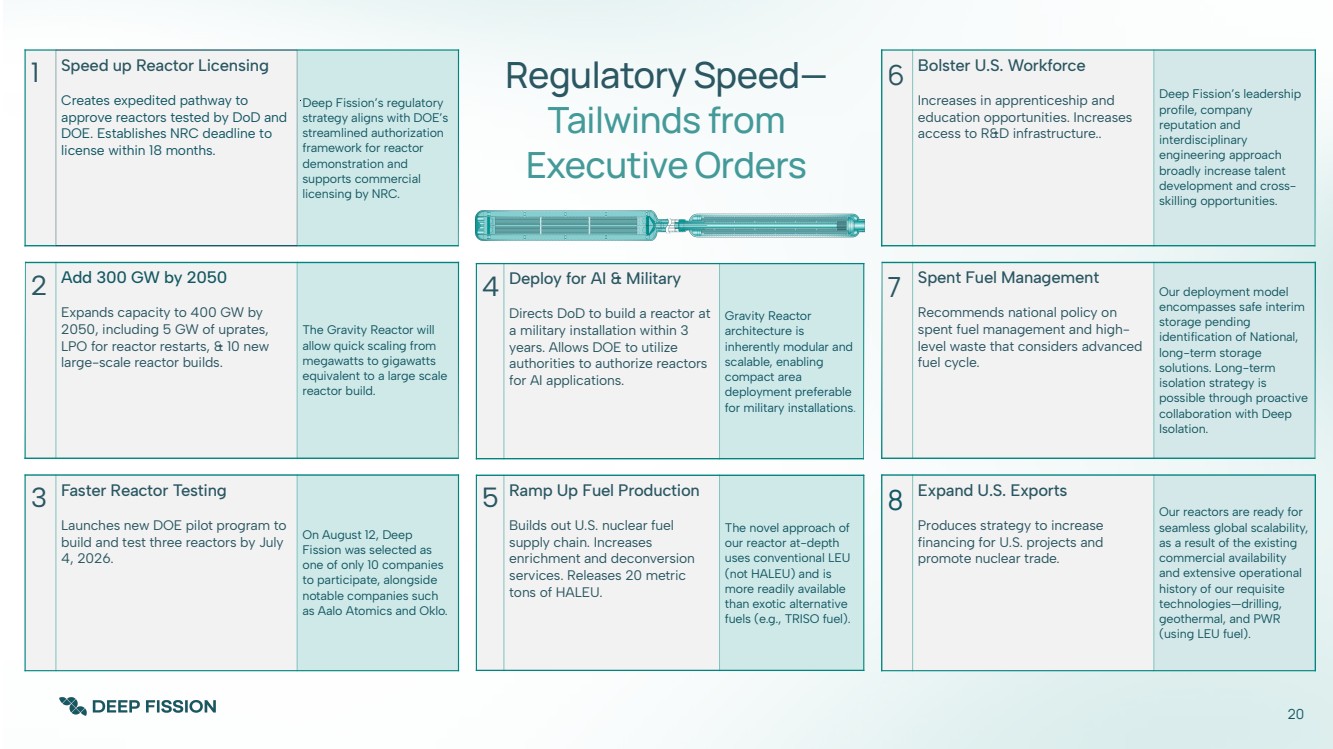

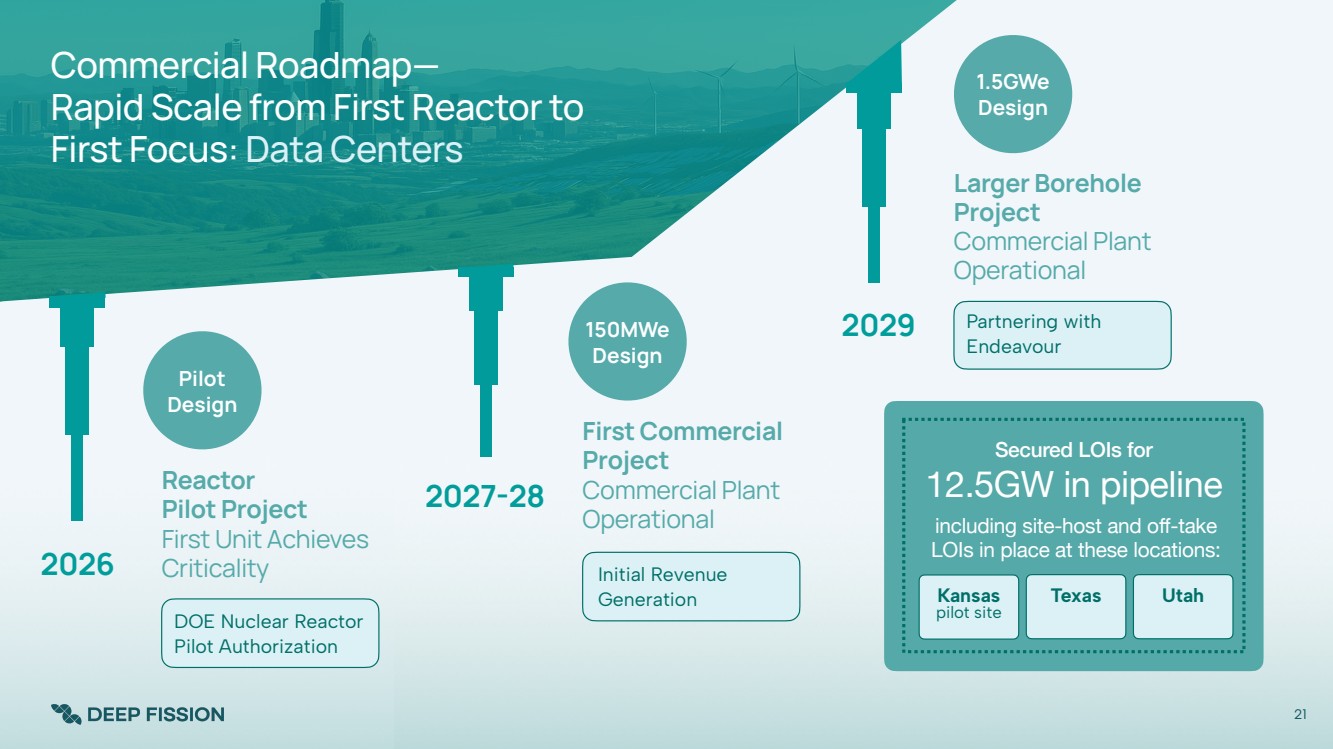

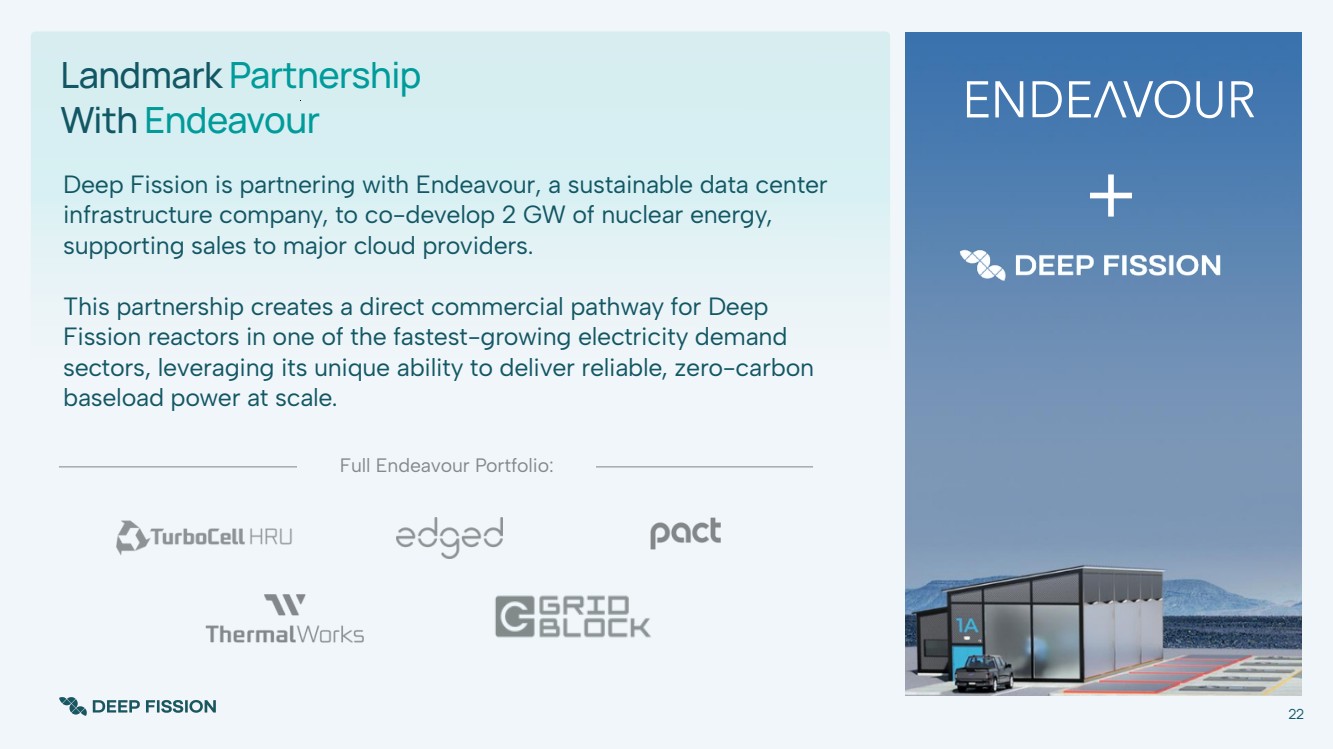

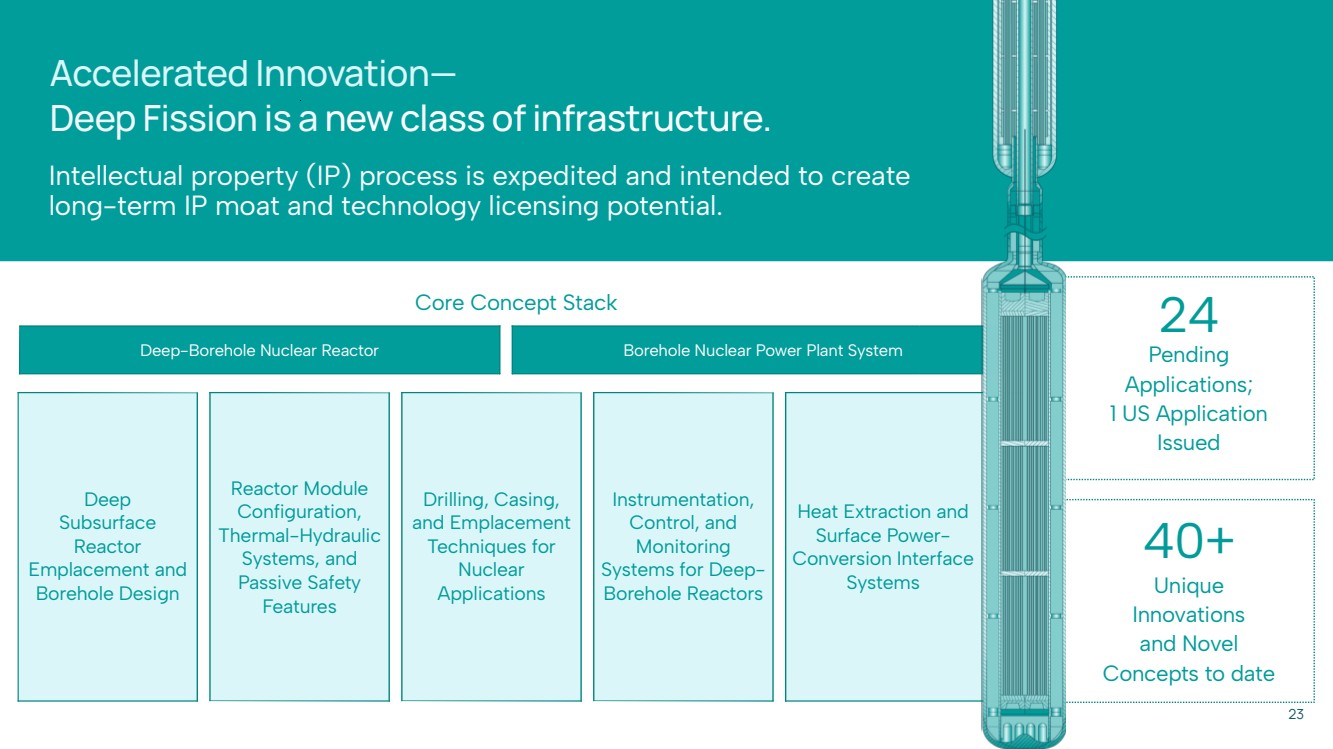

Item 7.01 Regulation FD Disclosure.

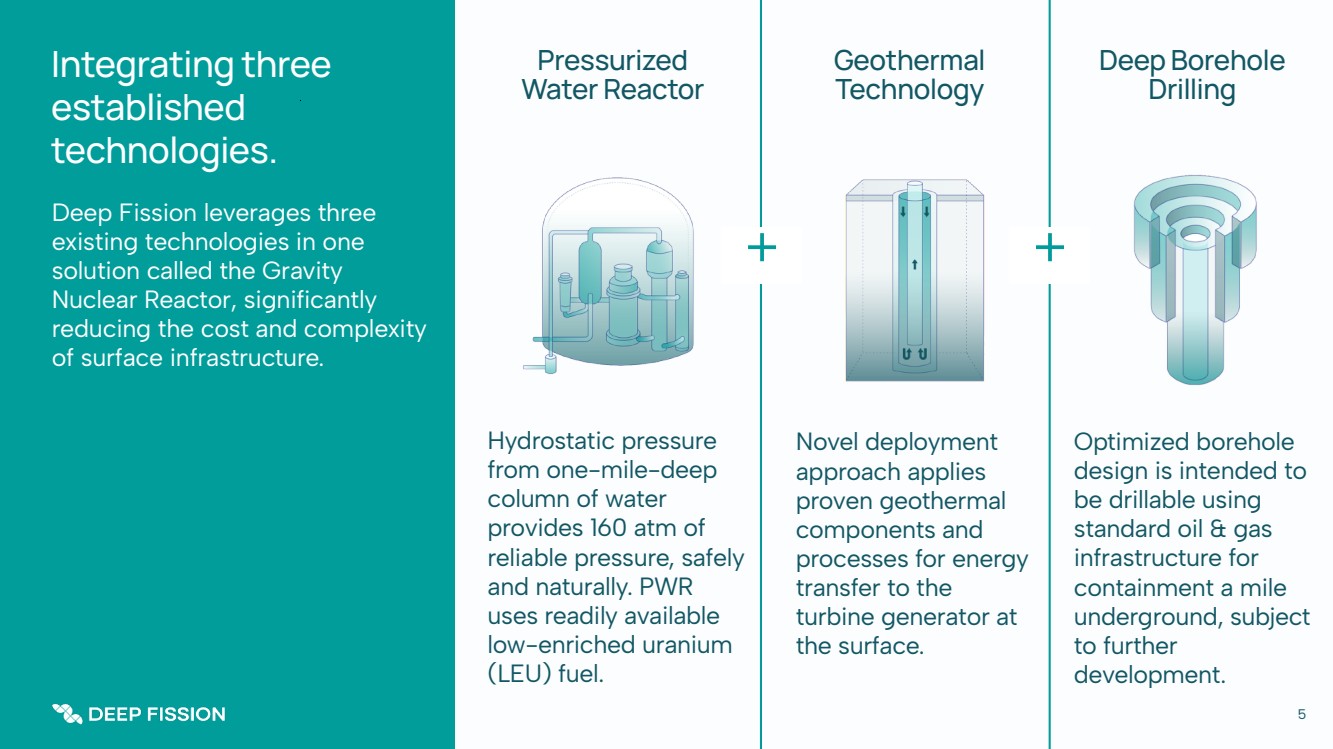

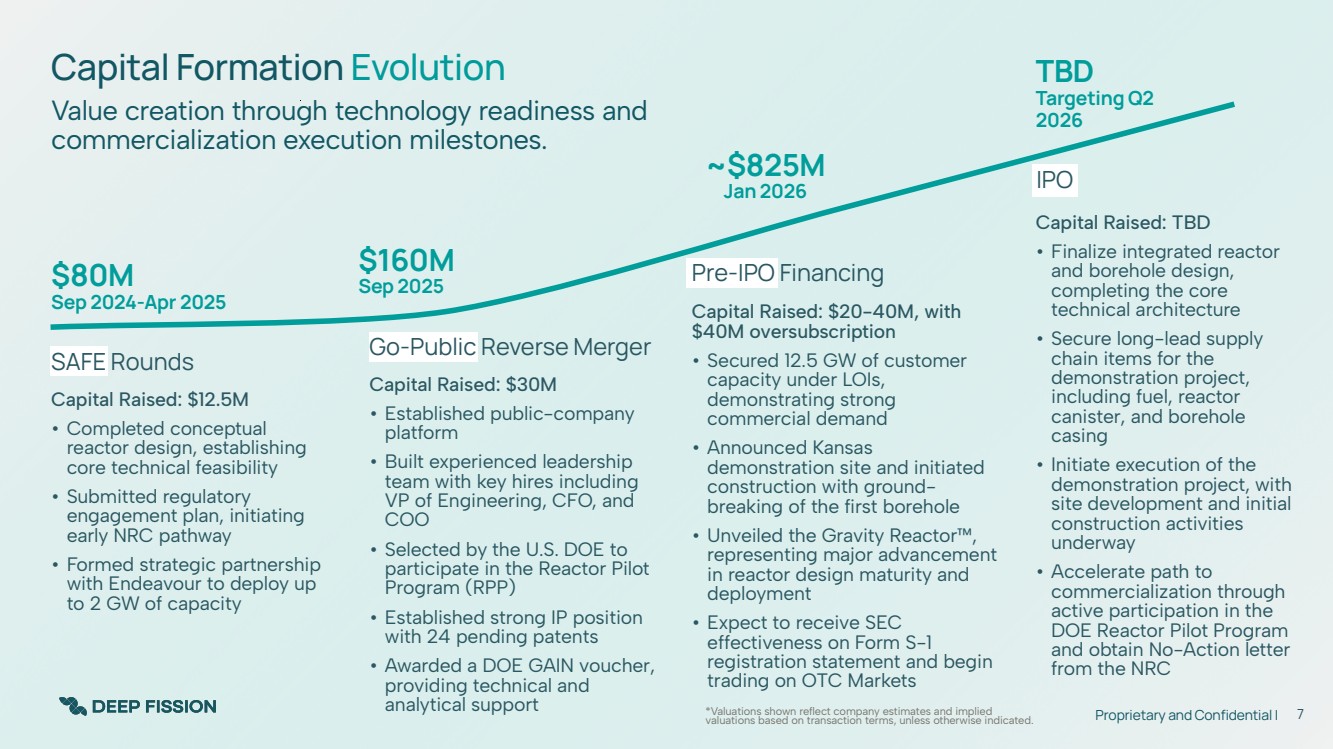

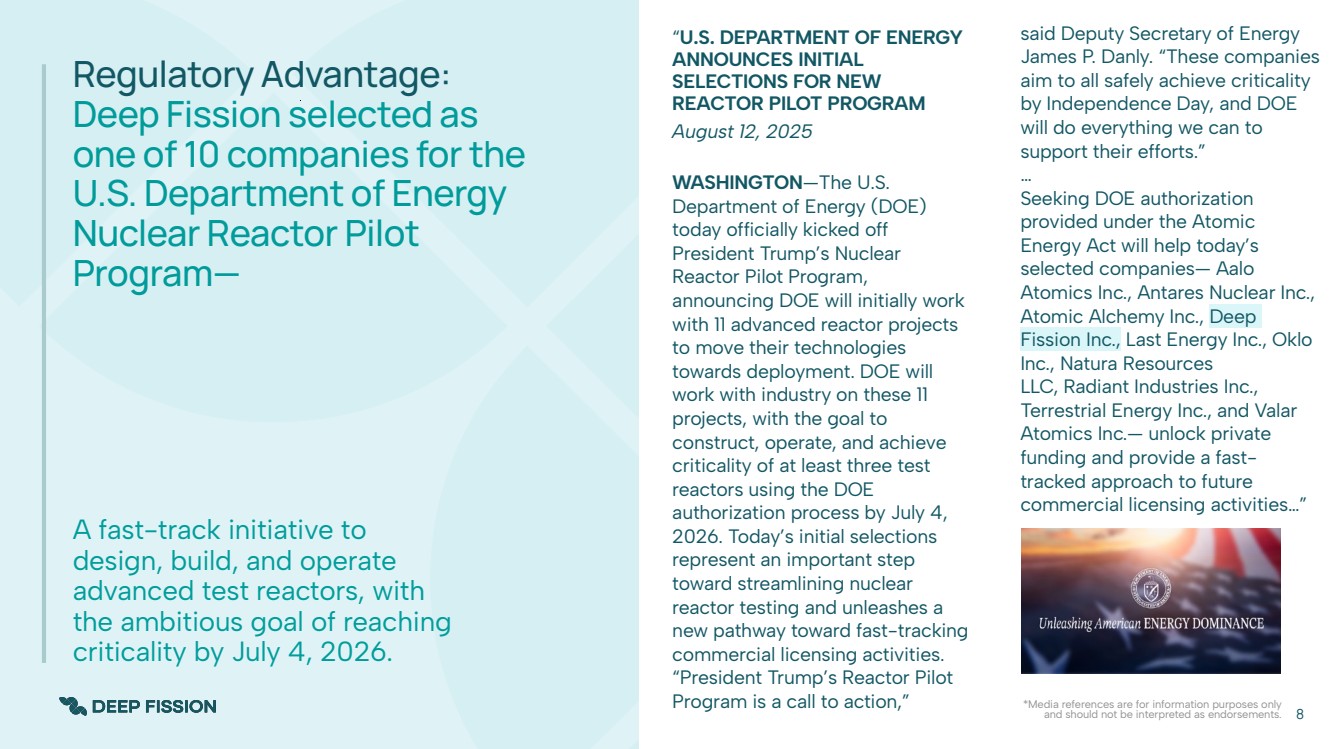

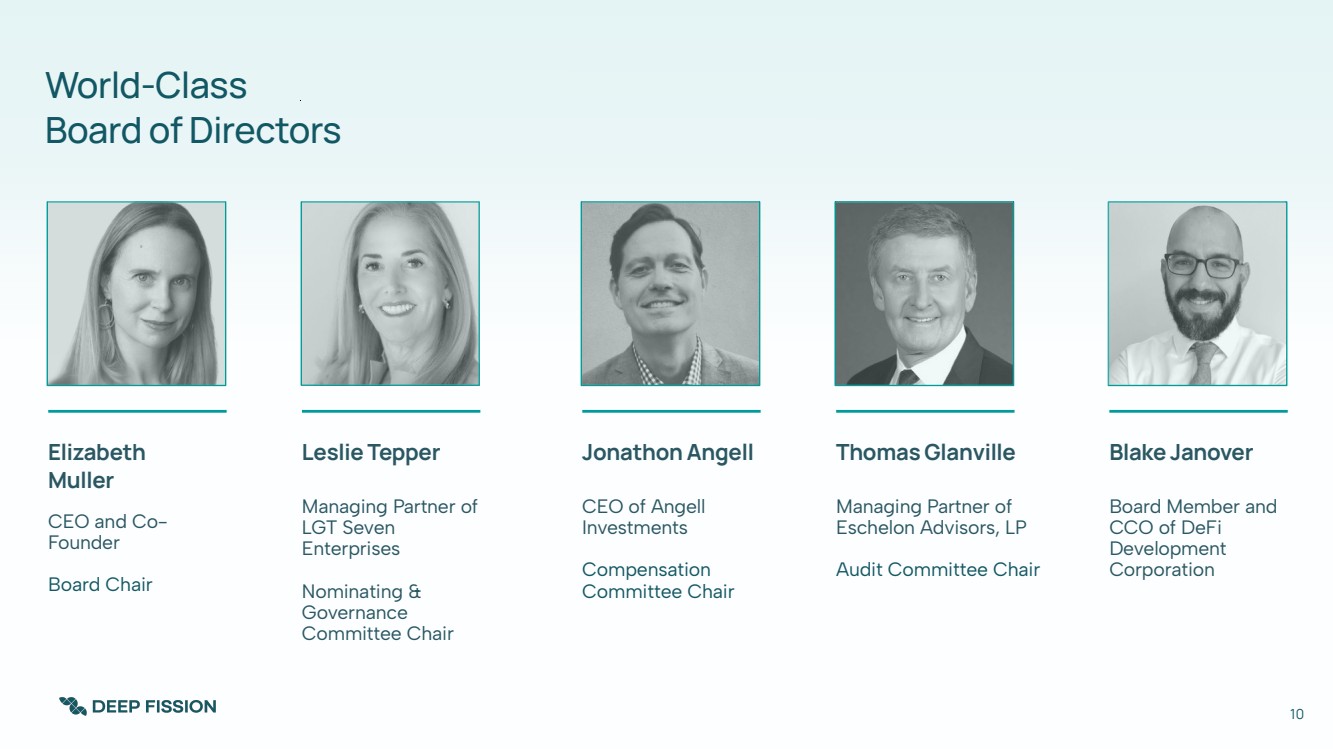

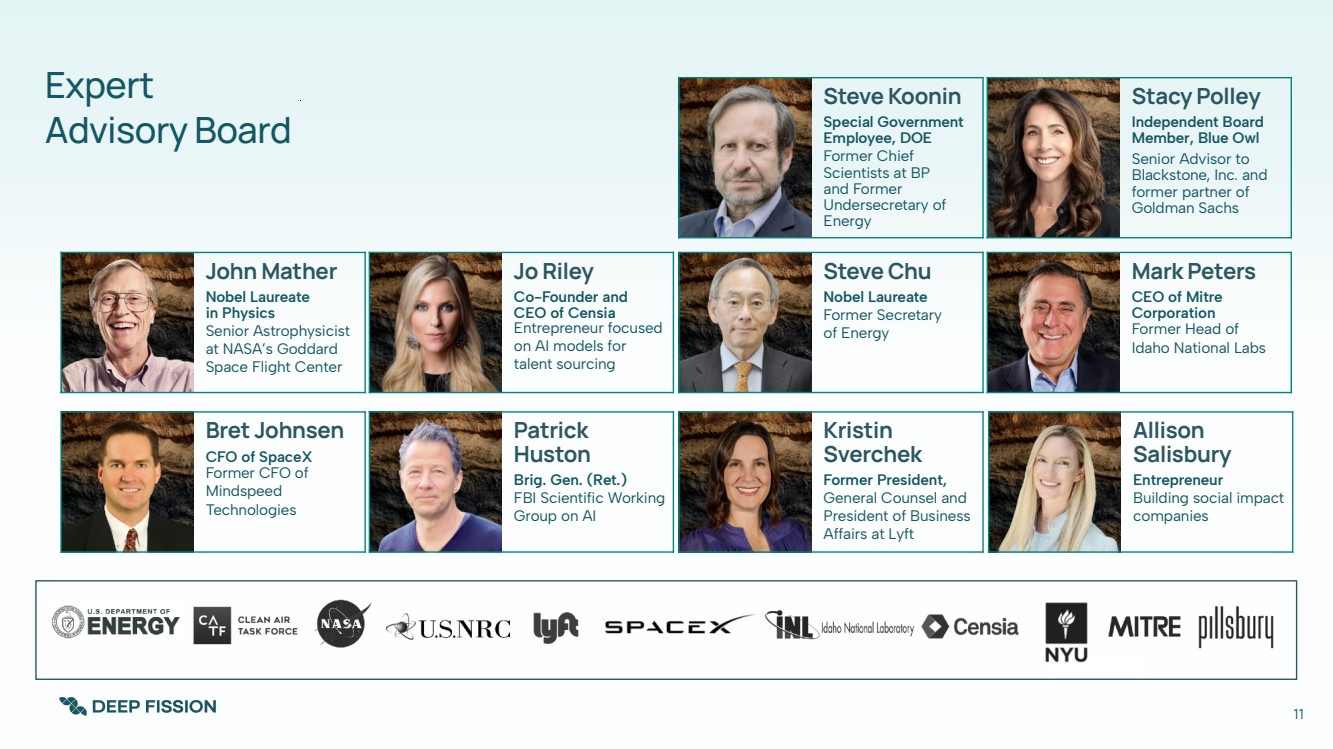

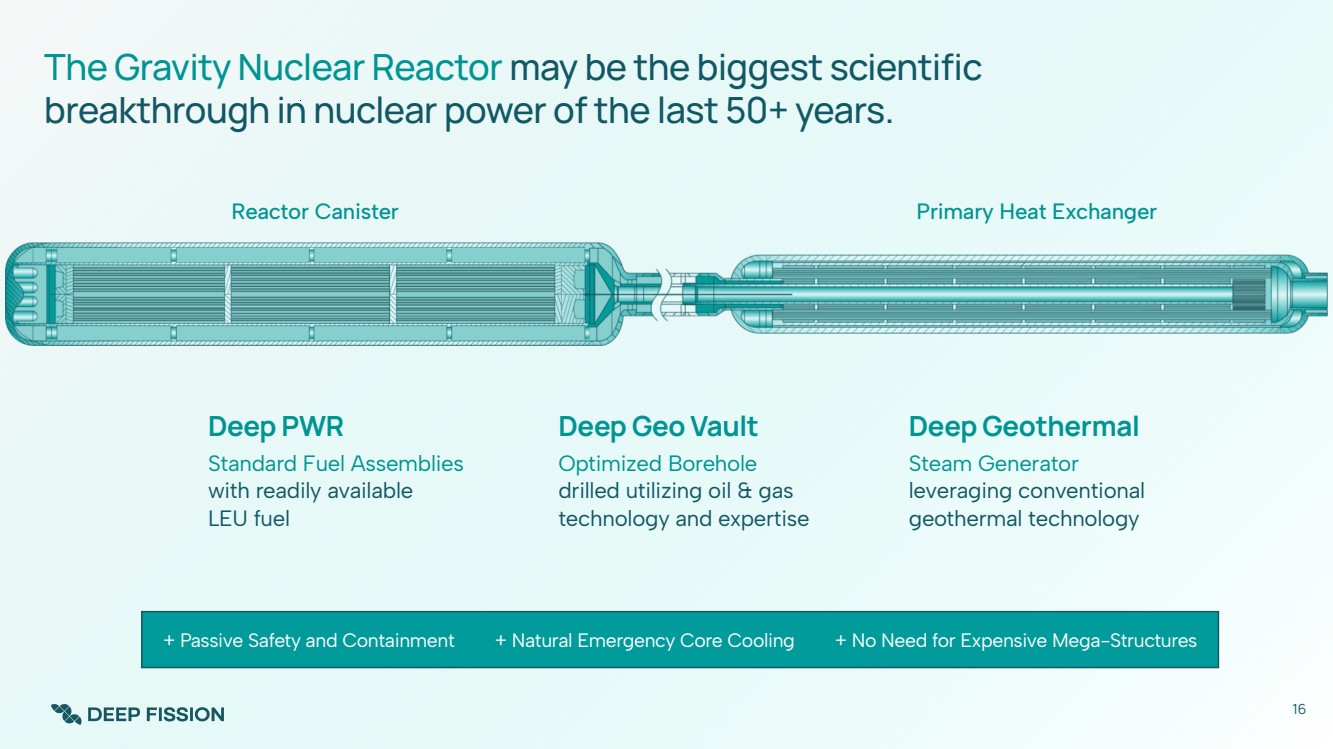

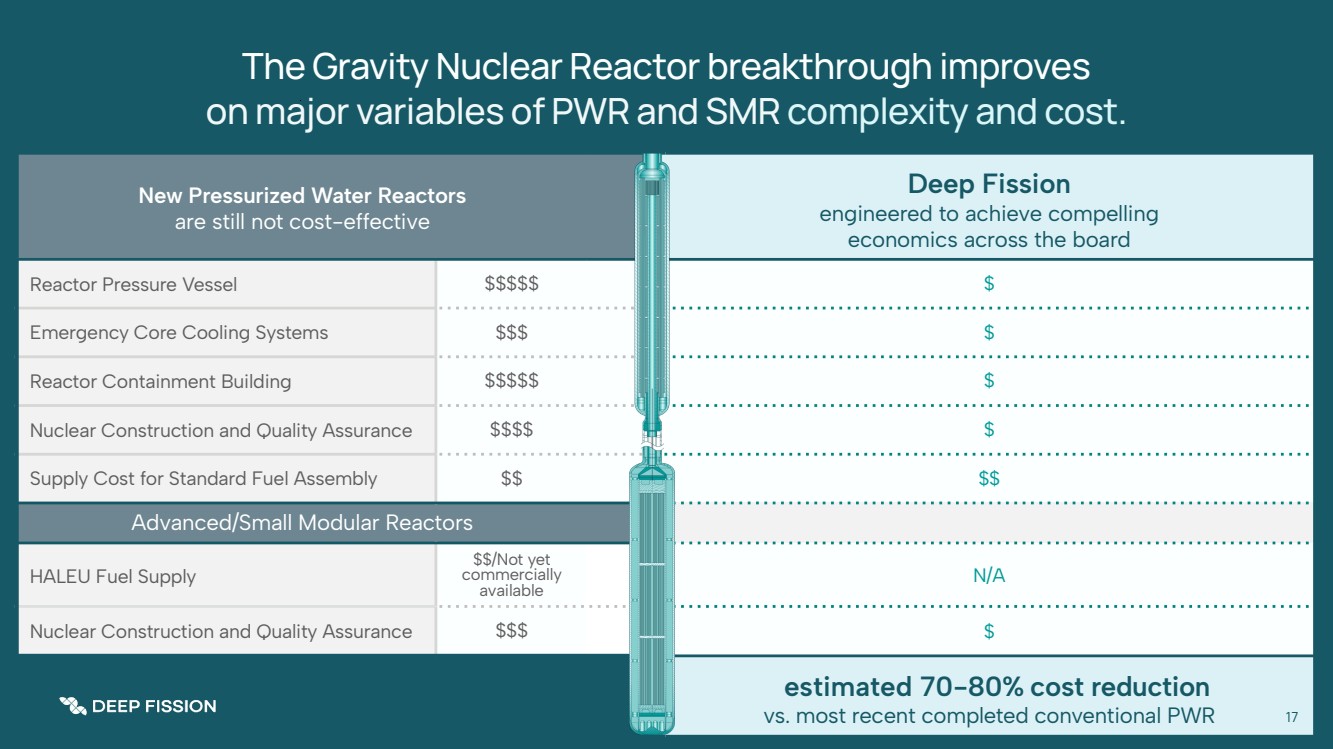

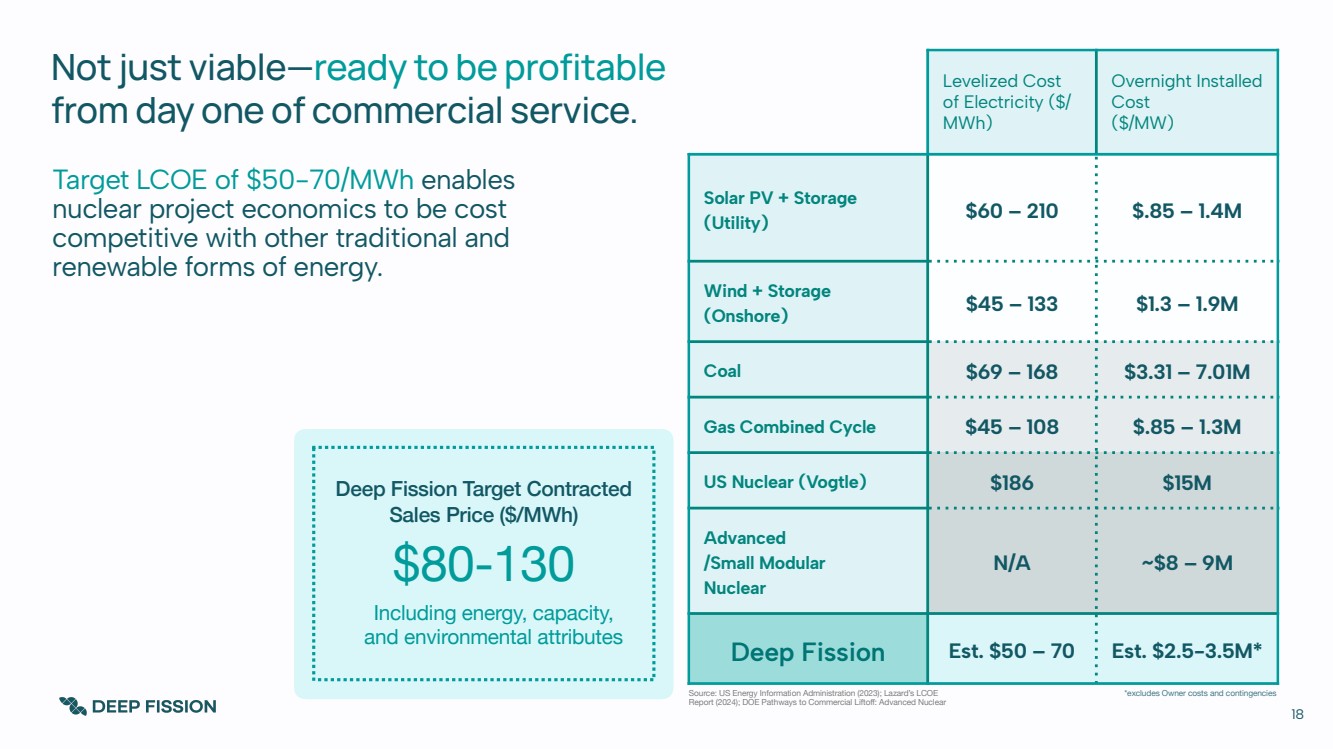

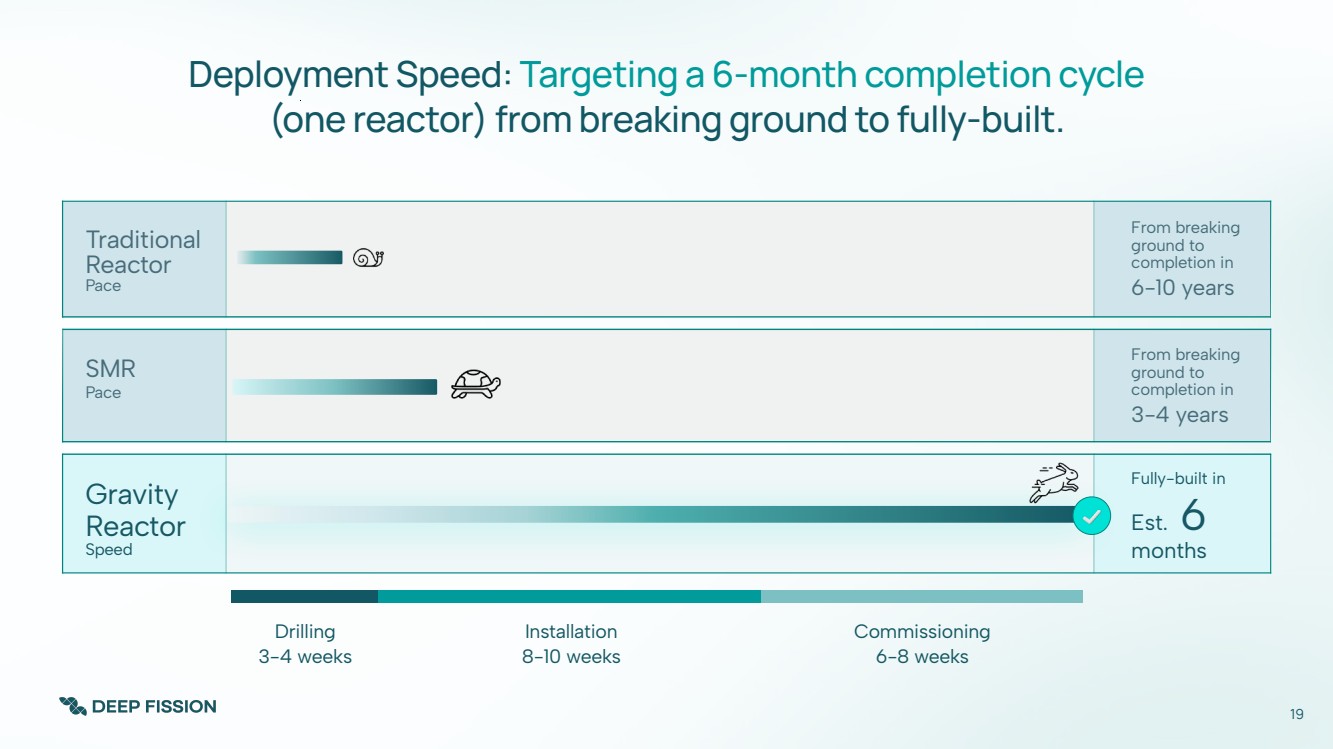

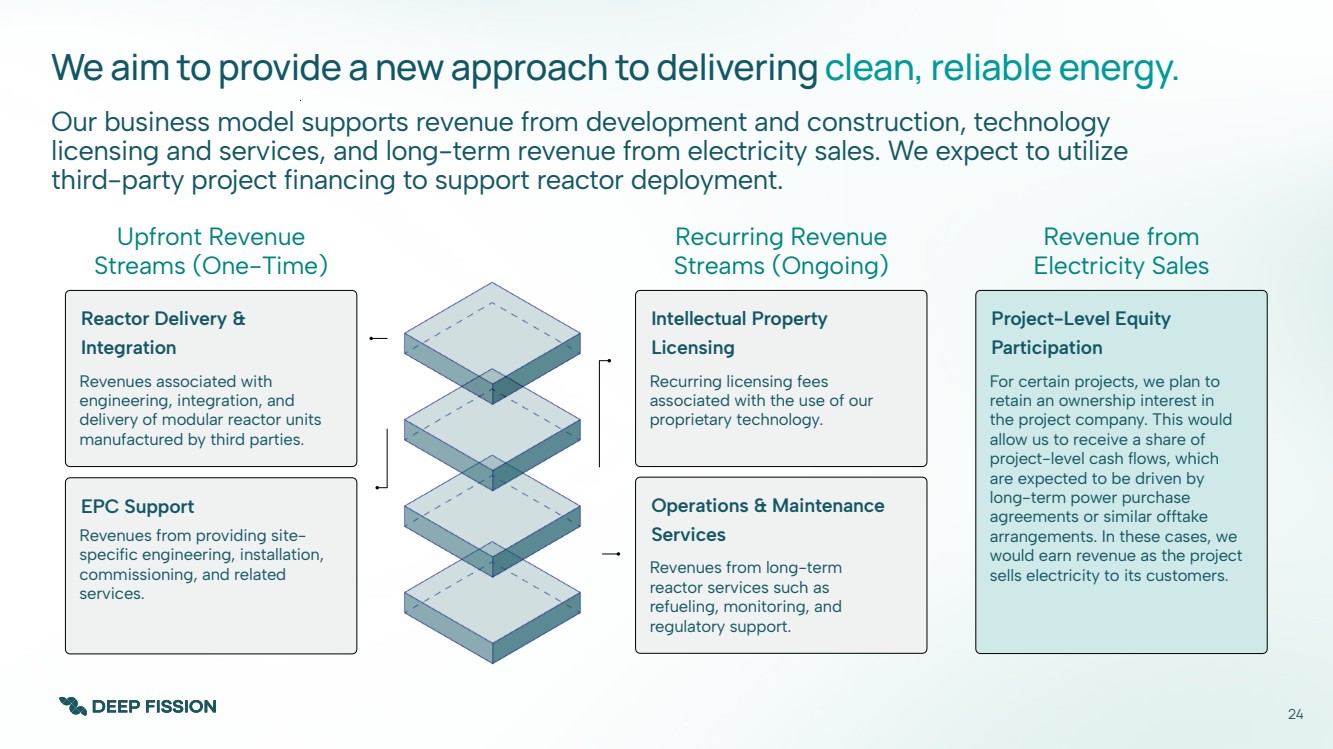

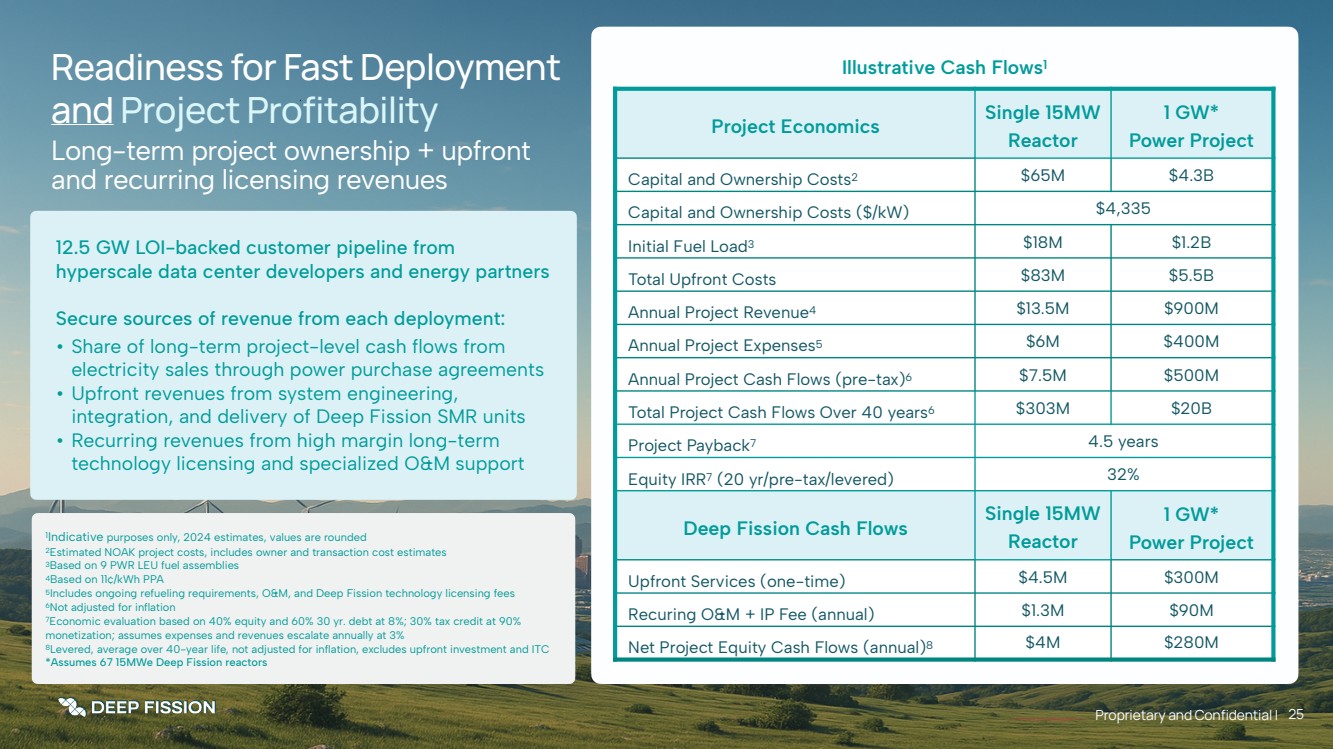

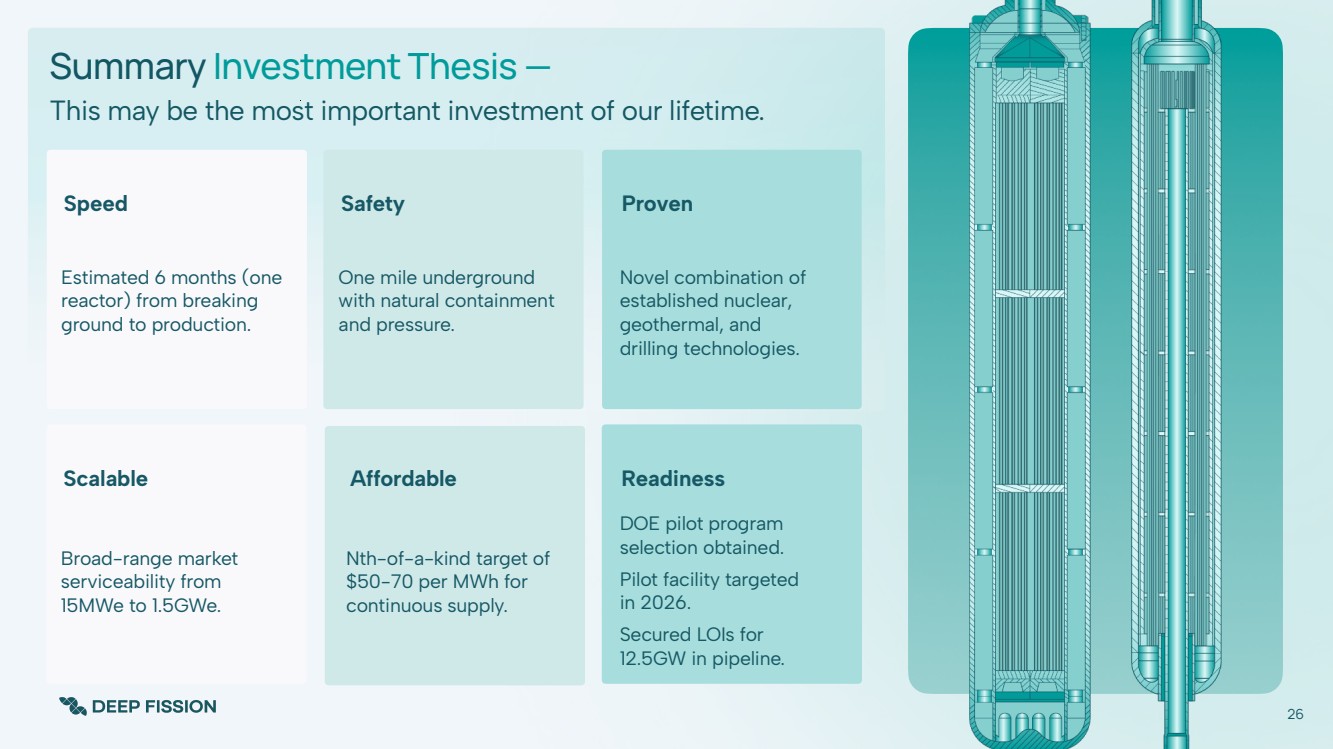

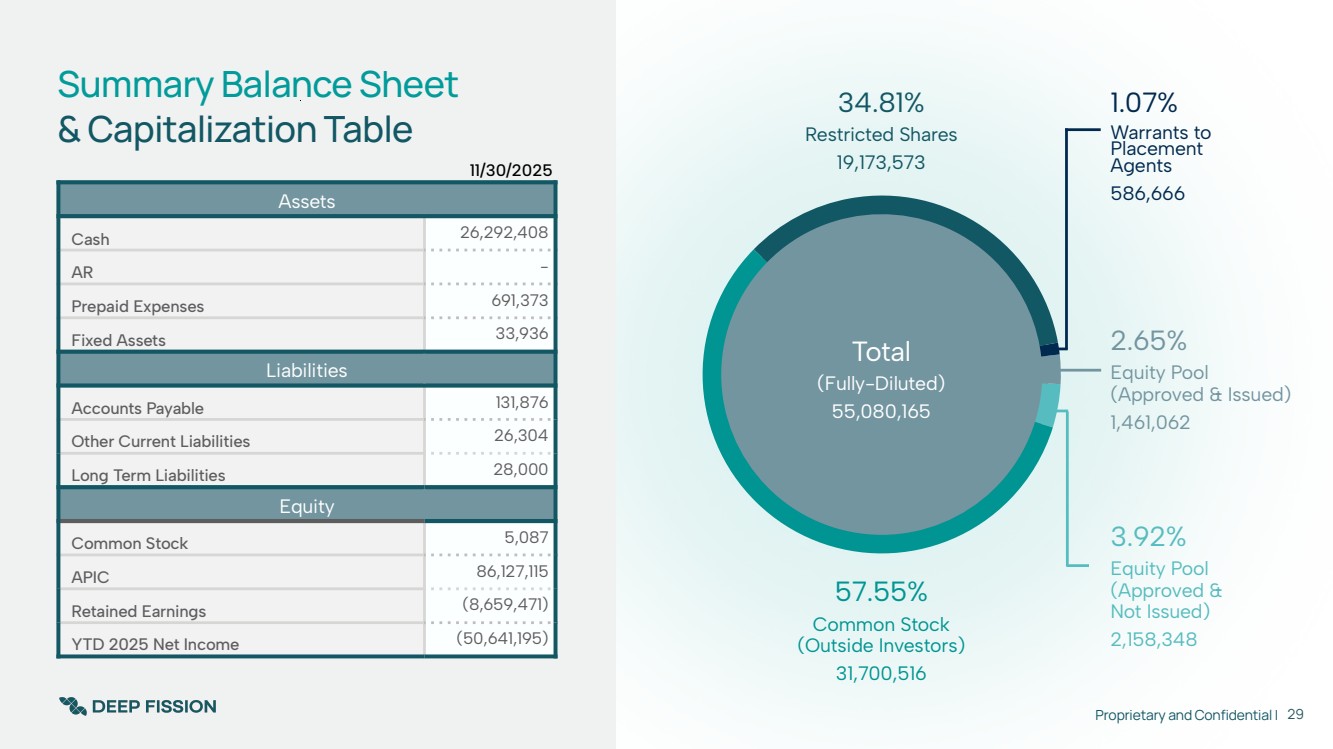

The Company is furnishing an investor presentation that management intends to use in upcoming meetings with investors and other stakeholders. A copy of the presentation is attached hereto as Exhibit 99.1 and incorporated by reference herein.

The information contained in this Item 7.01 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

Memorandum of Understanding

Concurrent with the private placement described above, the Company entered into a non-binding memorandum of understanding with Blue Owl pursuant to which the parties intend to explore a potential strategic collaboration related to the development and deployment of nuclear energy projects, including the evaluation of potential power offtake and project-level financing opportunities. The memorandum of understanding does not obligate either party to consummate any transaction. In connection with the collaboration, the Company granted Blue Owl customary, non-exclusive rights of first offer with respect to certain potential future power offtake opportunities and project-level financing opportunities, in each case subject to definitive documentation and mutual agreement.

Press Release

On February 10, 2026, the Company issued a press release announcing the Offering, a copy of which is attached hereto as Exhibit 99.2 and is incorporated by reference into this Item 8.01 of this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

* Certain exhibits or schedules to this exhibit have been omitted in accordance with Item 601(a)(5) of Regulation S-K. The registrant hereby agrees to furnish supplementally a copy of any omitted exhibit or schedule to the SEC upon its request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| DEEP FISSION, INC. | |

| Date: February 10, 2026 | /s/ Jon Gordon |

| Jon Gordon | |

| General Counsel & Secretary |

SUBSCRIPTION AGREEMENT

This Subscription Agreement (this “Agreement”) has been entered into by and between the purchaser set forth on the Omnibus Signature Page hereof (the “Purchaser”) and Deep Fission, Inc., a Delaware corporation (the “Company”), in connection with a private placement offering (the “Offering”) by the Company of Common Stock (as defined below).

R E C I T A L S

A. The Company is offering, pursuant to this Agreement and the Other Subscription Agreements (as defined below), a minimum of 1,333,333 shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), at a purchase price of $15.00 per share (the “Per Share Purchase Price”), for an aggregate purchase price of $20,000,000 (the “Minimum Offering Amount”), and a maximum of 2,666,667 shares of Common Stock at the Per Share Purchase Price for an aggregate purchase price of $40,000,000.

B. The Company may also sell an additional 2,666,667 shares of Common Stock at the Per Share Purchase Price for an aggregate purchase price of $40,000,000 to cover over-subscriptions (the “Over-Subscription Option”), in the event the Offering is oversubscribed.

C. The Shares (as defined below) subscribed for pursuant to this Agreement have not been registered under the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder (the “Securities Act”) or any state or foreign securities Law. The Offering is being made on a reasonable best efforts basis to “accredited investors,” as defined in Regulation D promulgated under the Securities Act, in reliance upon the exemption from securities registration afforded by Section 4(a)(2) of the Securities Act and Rule 506(b) of Regulation D promulgated thereunder. For purposes of this Agreement, “Law” or “Laws” means any federal, state, local or foreign or provincial statute, law (including, for the avoidance of doubt, any statutory, common, or civil law), ordinance, rule, regulation, order, injunction, decree or agency requirement having the force of law or any undertaking to or agreement with any Governmental Authority (as defined below).

AGREEMENT

The Company and the Purchaser hereby agree as follows:

1. Subscription.

(a) Purchase and Sale of the Shares.

(i) Subject to the terms and conditions of this Agreement, the Purchaser agrees to purchase, and the Company agrees to sell and issue to the Purchaser, that number of Shares set forth on the Purchaser’s Omnibus Signature Page attached hereto at the Per Share Purchase Price, for a total aggregate purchase price for the Shares as set forth on such Omnibus Signature Page (the “Purchase Price”). The minimum subscription amount for each purchaser in the Offering is $25,000 (or 1,667 Shares). The Company may accept subscriptions for less than $25,000 from any Purchaser in the Offering in its sole discretion. For the purposes of this Agreement, “Shares” means the shares of Common Stock being issued and sold to the Purchaser hereunder in the Offering at the Closing (as defined below), subject to the terms and conditions set forth herein.

2

(ii) In connection with the Offering, the Company has entered or will enter into other subscription agreements in the same form and containing the same terms and conditions as this Agreement (each, an “Other Subscription Agreement”) for shares of Common Stock (“Other Shares”) with purchasers in the Offering other than the Purchaser (collectively, “Other Purchasers”).

(b) Subscription Procedure; Closing.

(i) Closing. Subject to the terms and conditions of this Agreement, the initial closing of the Offering shall take place upon the satisfaction (or waiver as provided herein) of the conditions set forth in Section 5 and Section 6 of this Agreement (other than those conditions that by their nature will be satisfied at the Closing, but subject to the satisfaction (or waiver as provided herein) of such conditions) or at such other time and place as is mutually agreed to by the Company and the Placement Agents (as defined below) (the “Closing” and the date that the Closing occurs, the “Closing Date”). The Closing may take place remotely via the exchange by electronic transmission of documents and signatures.

If there are over-subscriptions, the Company may sell additional shares of Common Stock in the Offering at the Per Share Purchase Price in connection with the Over-Subscription Option to such persons as may be approved by the Company and who are reasonably acceptable to the Placement Agents. For the avoidance of doubt, such shares issued and sold to the Purchaser shall be deemed to be “Shares” for all purposes under this Agreement and shall be sold at the Closing.

(ii) Subscription Procedure. To complete a subscription for the Shares, the Purchaser must fully comply with the subscription procedure provided in subparagraphs (A) through (D) of this paragraph (iii) on or before the Closing Date:

(A) Subscription Documents. At or before the Closing, the Purchaser shall review, complete and execute the Omnibus Signature Page to this Agreement and the Registration Rights Agreement substantially in the form of Exhibit A hereto (the “Registration Rights Agreement”), the Selling Securityholder Questionnaire (as defined in the Registration Rights Agreement), the Purchaser Profile, the Anti-Money Laundering Form and the Accredited Investor Certification, attached hereto following the Omnibus Signature Page (collectively, the “Subscription Documents”), and deliver the Subscription Documents to the party indicated thereon at the address set forth under the caption “How to subscribe for Shares in the private offering of Deep Fission, Inc.” below. At or promptly following the Closing, the Purchaser shall review, complete and execute the Selling Securityholder Questionnaire (as defined in the Registration Rights Agreement) that is included as an exhibit to the Registration Rights Agreement and deliver such executed questionnaires to the Company at the address specified in the Registration Rights Agreement. Executed documents may be delivered to such party by .pdf sent by electronic mail (e-mail).

3

(B) Purchase Price. At or before the Closing and subject to the conditions thereto, the Purchaser shall deliver to CSC Delaware Trust Company, in its capacity as escrow agent (the “Escrow Agent”), under an escrow agreement among the Company, the Lead Placement Agents (as defined below) and the Escrow Agent (the “Escrow Agreement”) the full Purchase Price set forth on the Purchaser’s Omnibus Signature Page attached hereto, by certified or other bank check or by wire transfer of immediately available funds, pursuant to the instructions set forth under the caption “How to subscribe for Shares in the private offering of Deep Fission, Inc.” below. Pending the Closing, such funds will be held for the Purchaser’s benefit in the escrow account established for the Offering (the “Escrow Account”), without interest or offset.

(C) Termination. This Agreement shall terminate and be of no further force and effect, and any amounts deposited into the Escrow Account by or on behalf of the Purchaser shall be returned to the Purchaser or its designee promptly, without interest, charges, withholding or offset, if (i) the Purchaser and the Company agree in writing to terminate this Agreement prior to the Closing, (ii) the subscription has been revoked in full by the Purchaser in accordance with Section 8, or (iii) prior to the Closing, in the Purchaser’s sole and absolute discretion, upon written notice to the Company, if any representation or warranty of the Company set forth in Section 3 hereof shall be or shall have become inaccurate or the Company shall have breached or failed to perform any of its covenants or other agreements set forth in this Agreement, which inaccuracy, breach or failure to perform would give rise to the failure to satisfy any of the conditions set forth in Section 6(a) or Section 6(b) of this Agreement and which inaccuracy, breach or failure to perform cannot be cured by the Company or, if capable of being cured, is not cured within two (2) Business Days of the Purchaser’s notice to the Company thereof. For the purposes of this Agreement, “Business Day” means a day, other than a Saturday or Sunday, on which commercial banks in New York City are open for the general transaction of business.

(D) Company Discretion. The Purchaser understands and agrees that, prior to the execution and delivery of this Agreement by the Company, the Company, in its sole discretion, reserves the right to accept or reject the Purchaser’s tender of this subscription for Shares, in whole or in part. The Company and the Purchaser shall have no obligation hereunder until the Company shall execute and deliver to the Purchaser an executed copy of this Agreement.

4

2. Placement Agents. The Benchmark Company, LLC and Seaport Global Securities LLC (together, the “Lead Placement Agents”), Network 1 Financial Securities, Inc. and PHX Financial, Inc., d/b/a Phoenix Financial Services (each of The Benchmark Company, LLC, Seaport Global Securities LLC, Network 1 Financial Securities, Inc., and PHX Financial, Inc., d/b/a Phoenix Financial Services, a “Placement Agent” and collectively, the “Placement Agents”), each a U.S.-registered broker-dealer, have been engaged by the Company as placement agents, on a reasonable “best efforts” basis, for the Offering. The Placement Agents (a) will be paid at the Closing from the Offering proceeds a total cash commission of (i) seven percent (7.0%) of the aggregate Purchase Price paid by the Purchaser, but only if the Purchaser was introduced by the Placement Agents, and the aggregate purchase price paid by all Other Purchasers in the Offering introduced by the Placement Agents and (ii) four percent (4.0%) of the aggregate Purchase Price paid by the Purchaser, but only if the Purchaser is a securityholder of record of the Company prior to December 23, 2025, and the aggregate purchase price paid by all Other Purchasers in the Offering who are securityholders of record of the Company prior to December 23, 2025 at the Closing (the “Cash Fee”) and (b) will receive at the Closing warrants to purchase a total number of shares of Common Stock equal to (i) four percent (4.0%) of the aggregate number of shares of Common Stock sold in the Offering to the Purchaser and all Other Purchasers, excluding Purchasers who are Company securityholders of record prior to December 23, 2025, and (ii) two percent (2.0%) of the aggregate number of shares of Common Stock sold in the Offering to Company securityholders of record prior to December 23, 2025, with a term expiring on the earlier of (i) the fifth (5th) anniversary of the date of issuance of such warrants and (ii) the third (3rd) anniversary of the date the Company’s securities first become listed for trading on the Nasdaq or the New York Stock Exchange, and an exercise price of $15.00 per share (the “Placement Agent Warrants”). Each of the Placement Agent Warrants shall be transferable by the holder thereof only to an affiliate of the initial holder thereof unless at the time of transfer the Common Stock is then listed on a national securities exchange. Any sub-agent of a Placement Agent that introduces investors to the Offering will be entitled to share in the Cash Fee and Placement Agent Warrants attributable to those investors pursuant to the terms of an executed sub-agent agreement with such Placement Agent, which Cash Fee shall be payable to such sub-agent by the Placement Agent and such Placement Agent shall provide the Company with customary transfer documentation with respect to the Placement Agent Warrant to be transferred to such sub-agent. The Company has agreed to pay certain other expenses of the Placement Agents, including the reasonable and documented out-of-pocket fees and expenses of their counsel, in connection with the Offering. For avoidance of doubt, no Cash Fee will be paid and no Placement Agent Warrants will be issuable in respect of the issuance of shares of Common Stock upon the acceleration and vesting of options to acquire Company shares or the conversion or exchange of the Company convertible securities that may be outstanding, if any, the proceeds of which will be included in the gross proceeds of the Offering.

5

3. Representations and Warranties of the Company. Except as set forth in the Company’s SEC Reports (as defined below), the Company hereby represents and warrants to the Purchaser, as of the date hereof and as of the Closing Date, the following (provided that any qualification as to “knowledge” shall refer to the knowledge of the officers of the Company, both actual knowledge or knowledge that they would have had upon reasonable inquiry of the personnel of the Company responsible for the applicable subject matter):

(a) Organization and Qualification. The Company and each of its Subsidiaries is a corporation or limited liability company, as the case may be, duly organized, validly existing and in good standing under the Laws of the jurisdiction of its incorporation or formation, and has the requisite corporate or limited liability company power to own, lease and operate its properties and to carry on its business as currently conducted and as described in the SEC Reports. The Company and each of its Subsidiaries is duly qualified as a foreign corporation or limited liability company, as the case may be, to do business and is in good standing in every jurisdiction in which the nature of the business as currently conducted and as described in the SEC Reports makes such qualification necessary, except to the extent that the failure to be so qualified or be in good standing would not have a Material Adverse Effect. For purposes of this Agreement, “Material Adverse Effect” means any event, circumstance, development, condition, occurrence, state of facts, change or effect that, individually or in the aggregate with any other event, circumstance, development, condition, occurrence, state of facts, change or effect, has or would reasonably be expected to (x) prevent or materially delay or materially impair the ability of the Company or its Subsidiaries to carry out its obligations under this Agreement or any of the other Transaction Documents (as defined below), or (y) have any material adverse effect on the business, properties, assets, liabilities, operations or condition (financial or otherwise), results of operations or future prospects of the Company and its Subsidiaries, taken as a whole, provided, however, that for purposes of clause (y), none of the following shall be deemed in themselves, either alone or in combination, to constitute, and none of the following shall be taken into account in determining whether there has been or would reasonably be expected to have a “Material Adverse Effect”: (i) general economic, financial, credit, capital market or regulatory conditions or any changes therein (provided, however, that such effects do not affect the Company and its Subsidiaries taken as a whole disproportionately as compared to the Company’s similarly-situated competitors), (ii) any effects alone or in combination that arise out of, or result from, directly or indirectly, the announcement, pendency, execution or performance of this Agreement, the transactions contemplated hereby or any action contemplated by this Agreement, (iii) acts of God, war (whether or not declared), disease, including pandemics, the commencement, continuation or escalation of a war, acts of armed hostility, sabotage or terrorism or other international or national calamity or any material worsening of such conditions (provided, however, that such changes do not affect the Company or its Subsidiaries disproportionately as compared to the Company’s similarly-situated competitors), (iv) any matter disclosed in the SEC Reports, (v) any failure by the Company or its Subsidiaries to meet any projections, budgets or estimates of revenue or earnings (it being understood that the facts giving rise to such failure may be taken into account in determining whether there has been a Material Adverse Effect (except to the extent such facts are otherwise excluded from being taken into account by this proviso)), (vi) changes affecting the industry generally in which the Company or its Subsidiaries operate (provided, however, that such changes do not affect the Company or its Subsidiaries disproportionately as compared to the Company’s similarly-situated competitors), or (vii) changes in Law or U.S. generally accepted accounting principles (“GAAP”) (provided, however, that such changes do not affect the Company or its Subsidiaries disproportionately as compared to the Company’s similarly-situated competitors). For purposes of this Agreement, “Subsidiary” means, with respect to the Company, any corporation, partnership, limited liability company, joint venture or other legal entity of any kind (i) of which more than fifty percent (50%) of the capital stock or other equity interests or voting power are, directly or indirectly, controlled, owned or held by, or (ii) that is, at the time any determination is made, controlled (whether by voting power, Contract (as defined below) or otherwise) by, in each case, the Company (either alone or through or together with one or more of its other Subsidiaries).

6

(b) Authorization, Enforcement, Compliance with Other Instruments. (i) The Company and each of its Subsidiaries party thereto has the requisite corporate or limited liability company power and authority to enter into and perform its obligations under this Agreement, the Registration Rights Agreement, and the Escrow Agreement (collectively with all other documents, certificates or instruments executed and delivered in connection with the transactions contemplated hereby or thereby, the “Transaction Documents”) and to consummate the transactions contemplated hereby and thereby, including to issue the Shares, in accordance with the terms hereof and thereof; (ii) the execution and delivery by the Company and each of its Subsidiaries party thereto of each of the Transaction Documents and the consummation by it of the transactions contemplated hereby and thereby, including, without limitation, the issuance of the Shares, have been, or will be at the time of execution of such Transaction Document, duly authorized by the Company’s board of directors (the “Board”) or other applicable governing body of the Company or such Subsidiary, and no further action, proceeding, consent, waiver or authorization is, or will be at the time of execution of each such Transaction Document, required by or from the Company or any such Subsidiary, its respective board of directors or other governing body or its respective stockholders or equity holders; (iii) this Agreement has been, and at the Closing each of the other Transaction Documents will be when delivered at the Closing, duly executed and delivered by the Company and each of its Subsidiaries party thereto; and (iv) this Agreement constitutes and, when delivered at the Closing, the other Transaction Documents will constitute, the valid and binding obligations of the Company and its Subsidiaries party thereto enforceable against the Company and its Subsidiaries party thereto in accordance with their terms, except as such enforceability may be limited by general principles of equity or applicable bankruptcy, insolvency, reorganization, moratorium, liquidation or similar laws relating to, or affecting generally, the enforcement of creditors’ rights and remedies and, with respect to any rights to indemnity or contribution contained in the Transaction Documents, as such rights may be limited by state or federal laws or public policy underlying such laws.

(c) Capitalization. As of January 7, 2026, the Company had 51,460,755 shares of Common Stock issued and outstanding and no shares of preferred stock issued and outstanding. All of the outstanding shares of Common Stock and of the capital stock of each of the Company’s Subsidiaries have been duly authorized, validly issued and are fully paid and non-assessable and free of preemptive or similar rights and other Liens (as defined below) and were issued in compliance with all applicable Laws concerning the issuance of securities. All of the issued and outstanding capital stock of each Subsidiary of the Company are owned, directly or indirectly, by the Company, free and clear of any Liens (other than restrictions on transfer under applicable federal or state securities Laws). Immediately after giving effect to the Closing: (i) no shares of capital stock of the Company or any of its Subsidiaries will be subject to preemptive rights or any other similar rights or any Liens suffered or permitted by the Company; (ii) other than as set forth in the SEC Reports, there will be no outstanding options, warrants, scrip, rights to subscribe to, calls or commitments of any character whatsoever relating to, or securities or rights convertible, exercisable or exchangeable into, any shares of capital stock of the Company or any of its Subsidiaries, or any Contracts by which the Company or any of its Subsidiaries is or may become bound or pursuant to which the Company or any of its Subsidiaries is otherwise obligated to issue additional shares of capital stock of the Company or any of its Subsidiaries; (iii) there will be no outstanding debt securities of the Company or any of its Subsidiaries; (iv) there will be no agreements or arrangements under which the Company or any of its Subsidiaries is obligated to register the sale of any of their securities under the Securities Act, other than pursuant to the Registration Rights Agreement; (v) there will be no outstanding registration statements of the Company or any of its Subsidiaries, other than pursuant to the Registration Rights Agreement; (vi) other than as set forth in the SEC Reports, there will be no securities or instruments of the Company or any of its Subsidiaries containing anti-dilution or similar provisions, including the right to adjust the exercise, exchange or reset price of such securities, that will be triggered by the issuance of the Shares as described in this Agreement; (vii) no co-sale right, right of first refusal or other similar right will exist with respect to the Shares or the issuance and sale thereof and (viii) no shares of Common Stock shall be reserved for future issuances, other than the shares of Common Stock reserved for future issuances (A) under the Company’s 2025 Equity Incentive Plan and its 2025 Employee Stock Purchase Plan and (B) upon exercise or conversion of the securities listed in clause (ii) above. The Company has made available to the Purchaser true and correct copies of the Company’s Certificate of Incorporation, as in effect as of the Closing, and the Company’s Bylaws, as in effect as of the Closing. Except for the interests in the Company’s Subsidiaries, neither the Company nor any of its Subsidiaries owns any equity interest or other interest of any nature in, or any interest convertible, exchangeable, or exercisable for, equity interests or other interests of any nature in any other person. The Company does not have outstanding stockholder purchase rights or a “poison pill” or any similar arrangement in effect giving any person the right to purchase any equity interest in the Company upon the occurrence of certain events.

7

(d) Issuance of Shares. The Shares that are being issued to the Purchaser hereunder, when issued, sold and delivered in accordance with the terms and upon payment of the consideration therefor as set forth in this Agreement, will be duly and validly issued, fully paid and non-assessable, and free of preemptive or similar rights, Taxes and other Liens with respect to the issuance thereof, and restrictions on transfer other than restrictions on transfer under the Transaction Documents, applicable state and federal securities Laws and Liens created by or imposed by the Purchaser. Assuming the accuracy of each of the representations and warranties of the Purchaser herein, and of the Other Purchasers in each of their respective Other Subscription Agreements, the offer, issuance and sale by the Company of the Shares to the Purchaser is exempt from registration under the Securities Act and exempt from (or not subject to) registration, qualification or prospectus delivery requirements under the securities laws of any state or other jurisdiction.

(e) No Conflicts. The execution, delivery and performance of each of the Transaction Documents by the Company, and the consummation by the Company of the transactions contemplated hereby and thereby, including the issuance and sale of the Shares in accordance with this Agreement, have not and will not (i) result in a violation of the Certificate of Incorporation or the Bylaws (or equivalent constitutive document) of the Company or any of its Subsidiaries; (ii) violate or conflict with, or result in a breach of any provision of, or constitute a default (or an event that with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any Contract to which the Company or any Subsidiary is a party, except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect, or (iii) result in a violation of any Law applicable to the Company or any Subsidiary or by which any property or asset of the Company or any Subsidiary is bound or affected, except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. Neither the Company nor any Subsidiary is in violation of or in default under, any provision of its Certificate of Incorporation or Bylaws or any other constitutive documents. Neither the Company nor any Subsidiary is in violation of any term of or in default under any Contract, judgment, decree or order or any Law applicable to the Company or any Subsidiary, which violation or breach has had, or would reasonably be expected to have, individually or in the aggregate with any other such violation or breach, a Material Adverse Effect. Neither the Company nor any of its Subsidiaries is required to obtain any Authorization of, or provide any notice to or make any filing or registration with, any Governmental Authority in order for it to execute, deliver or perform any of its obligations under or contemplated by this Agreement or the other Transaction Documents in accordance with the terms hereof or thereof, other than (i) the filings required pursuant to Section 9(k), (ii) the filing of the registration statement contemplated by the Registration Rights Agreement and (iii) the filing of a Notice of Exempt Offering of Securities on Form D with the Securities and Exchange Commission (the “SEC”) under Regulation D. Neither the execution and delivery by the Company of the Transaction Documents, nor the consummation by the Company of the transactions contemplated hereby or thereby, will require any notice, consent or waiver under any Contract to which the Company or any Subsidiary is a party or by which the Company or any Subsidiary is bound or to which any of their assets or businesses is subject, except for any notice, consent or waiver the absence of which would not reasonably be expected, individually or in the aggregate, to have a Material Adverse Effect. All notices, consents, authorizations, orders, filings and registrations which the Company or any of its Subsidiaries is required to deliver or obtain pursuant to the preceding two sentences have been or will be delivered or obtained or effected, and shall remain in full force and effect, on or prior to the Closing.

8

(f) Absence of Litigation. There is no action, suit, claim, inquiry, notice of violation, arbitration, petition, charge, citation, summons, subpoena, proceeding (including any partial proceeding such as a deposition) or investigation of any nature, civil, criminal, administrative, regulatory or otherwise, whether at law or in equity, before or by any Governmental Authority (an “Action”) pending or threatened in writing or, to the knowledge of the Company, threatened orally, against or affecting the Company or any of its Subsidiaries or, to their knowledge, any of their respective officers or directors or any of their respective assets or businesses, which has had, or would be reasonably likely to have, a Material Adverse Effect. Neither the Company nor any of its Subsidiaries is, and since December 10, 2021 (the “Lookback Date”) has been, subject to any judgment, decree, or order which has been, or would reasonably be expected to be material to the business of the Company and its Subsidiaries, taken as a whole.

(g) Acknowledgment Regarding Purchaser’s Purchase of the Shares. The Company acknowledges and agrees that the Purchaser is acting solely in the capacity of an arm’s length purchaser with respect to the Transaction Documents and the transactions contemplated hereby and thereby. The Company further acknowledges that the Purchaser is not acting as a financial advisor or fiduciary of the Company (or in any similar capacity) with respect to the Transaction Documents and the transactions contemplated thereby and any advice given by the Purchaser or any of its representatives or agents in connection with the Transaction Documents and the transactions contemplated thereby is merely incidental to the Purchaser’s purchase of the Shares.

(h) No General Solicitation. Neither the Company, nor any of its Subsidiaries, nor to its or their knowledge any of its or their Affiliates (as defined below), or any person acting on its or their behalf, has engaged in any form of general solicitation or general advertising (within the meaning of Regulation D) in connection with the offer or sale of the Shares. “Affiliate” means, with respect to any person, any other person that, directly or indirectly through one or more intermediaries, controls, is controlled by or is under common control with such person, as such terms are used in and construed under Rule 144 under the Securities Act (“Rule 144”). With respect to the Purchaser, any investment fund or managed account that is managed on a discretionary basis by the same investment manager as the Purchaser will be deemed to be an Affiliate of the Purchaser.

(i) No Integrated Offering. Neither the Company, nor any of its Affiliates, nor to the knowledge of the Company, any person acting on its or their behalf has, directly or indirectly, made any offers or sales of any security or solicited any offers to buy any security, under circumstances that would eliminate or otherwise adversely affect the availability of the exemption from registration under Rule 506(b) of Regulation D or afforded by Section 4(a)(2) of the Securities Act in connection with the Offering of the Shares contemplated hereby or cause this Offering of the Shares to be integrated with prior offerings by the Company for purposes of the Securities Act or any other applicable securities Laws.

9

(j) Employee Relations. There is, and since the Lookback Date there has been, no actual or threatened in writing, or to the knowledge of the Company, threatened orally, labor dispute, work stoppage, request for representation, union organizing activity, or unfair labor practice charges involving the employees of the Company or any of its Subsidiaries. Neither the Company nor any Subsidiary is party to any collective bargaining agreement. The Company’s and/or its Subsidiaries’ employees are not members of any union, and the Company believes that its and its Subsidiaries’ relationships with their respective employees are good.

(k) Intellectual Property Rights. The Company and each of its Subsidiaries exclusively owns, possesses, or has valid and enforceable rights to use, license, and exploit all Intellectual Property used in, necessary or advisable for the conduct of the Company’s and its Subsidiaries’ business as currently conducted and as described in the SEC Reports, except for a failure to own, possess or have such rights that would not reasonably be expected to result in a Material Adverse Effect. There are no unreleased liens or security interests which have been filed, or which the Company has received notice of, against any of the Intellectual Property owned by the Company. The Company and its Subsidiaries are in compliance with all Contracts pursuant to which they license Intellectual Property except as would not, individually or in the aggregate, reasonably be expected to result in a Material Adverse Effect. Furthermore, except as has not been and would not reasonably be expected to result in a Material Adverse Effect, since the Lookback Date (A) to the Company’s knowledge, there has been no infringement, misappropriation or violation by third parties of any such Intellectual Property of the Company or its Subsidiaries; (B) there has been no Action pending or threatened in writing (or to the Company’s knowledge, threatened orally) by others challenging the Company’s or any of its Subsidiaries’ ownership of or any rights in or to any such Intellectual Property; (C) the Intellectual Property owned by the Company and its Subsidiaries and, to the Company’s knowledge, the Intellectual Property licensed to the Company and its Subsidiaries, has not been adjudged invalid or unenforceable, in whole or in part, and there has been no Action pending or threatened in writing (or to the Company’s knowledge, threatened orally) by others challenging the validity, enforceability or scope of any such Intellectual Property; (D) there has been no Action pending or threatened in writing (or to the Company’s knowledge, threatened orally) by others that the Company or any of its Subsidiaries infringes, misappropriates or otherwise violates any Intellectual Property or other proprietary rights of others, and neither the Company nor any of its Subsidiaries has received any written notice of such Action; and (E) to the Company’s knowledge, no employee of the Company or any of its Subsidiaries has violated any term of any employment Contract, patent disclosure agreement, invention assignment agreement, non-competition agreement, non-solicitation agreement, nondisclosure agreement or restrictive covenant to or with a former employer where the basis of such violation relates to such employee’s employment with the Company or any of its Subsidiaries or actions undertaken by the employee while employed with the Company or any of its Subsidiaries. To the Company’s knowledge, the Company and its Subsidiaries have complied in all material respects with 37 C.F.R. §1.56 (Duty to disclose information material to patentability). The consummation of the transactions contemplated hereby or by the other Transaction Documents will not result in the loss or impairment of or payment of any additional amounts with respect to, nor require the consent of any other person in respect of, the Company or any of its Subsidiaries’ right to own, use or hold for use any Intellectual Property as owned, used or held for use in the conduct of the Company’s and its Subsidiaries’ business as currently conducted and as described in the SEC Reports, except in each case, which individually or in the aggregate, have not had and would not reasonably be expected to have a Material Adverse Effect. The Company and each of its Subsidiaries has taken reasonable steps to maintain their Intellectual Property and to protect and preserve the confidentiality of all of their Trade Secrets. To the Company’s knowledge, there has not been any disclosure or access to any Trade Secrets of the Company and each of its Subsidiaries by any unauthorized person. The Company and each of its Subsidiaries have taken and continue to take commercially reasonable measures, at least consistent with prevailing industry practice, to ensure that all personal information in their possession, custody or control is protected against loss and against unauthorized, access, use, modification, disclosure or other misuse. “Intellectual Property” shall mean any and all rights title and interest in, arising out of, or associated with any intellectual or intangible property, whether protected, created or arising in any jurisdiction throughout the world, including the following: (a) issued patents and patent applications (whether provisional or non-provisional), including divisionals, continuations, continuations-in-part, substitutions, reissues, reexaminations, extensions, or restorations of any of the foregoing, and other Governmental Authority (as defined below) issued indicia of invention ownership (including certificates of invention, petty patents, and patent utility models) (“Patents”); (b) trademarks, service marks, brands, certification marks, logos, trade dress, slogans, trade names, and other similar indicia of source or origin, together with the goodwill connected with the use of and symbolized by, and all registrations, applications for registration, and renewals of, any of the foregoing (“Trademarks”); (c) copyrights and works of authorship, whether or not copyrightable, and all registrations, applications for registration, and renewals of any of the foregoing (“Copyrights”); (d) internet domain names and social media account or user names (including “handles”), whether or not Trademarks, all associated web addresses, URLs, websites and web pages, social media sites and pages, and all content and data thereon or relating thereto, whether or not Copyrights; (e) mask works, and all registrations, applications for registration, and renewals thereof; (f) industrial designs, and all Patents, registrations, applications for registration, and renewals thereof; (g) trade secrets, know-how, inventions (whether or not patentable), discoveries, improvements, technology, business and technical information, databases, data compilations and collections, tools, methods, processes, techniques, and other confidential and proprietary information and all rights therein (“Trade Secrets”); (h) computer programs, operating systems, applications, firmware and other code, including all source code, object code, application programming interfaces, data files, databases, protocols, specifications, and other documentation thereof; (i) rights of publicity; and (j) all other intellectual or industrial property and proprietary rights.

10

(l) Environmental Laws.

(i) Except as, individually or in the aggregate, have not had and would not reasonably be expected to have a Material Adverse Effect: (x) the Company and each of its Subsidiaries is in compliance and has complied with all applicable Environmental Laws (as defined below); (y) the Company and each of its Subsidiaries is in possession of all Authorizations required pursuant to Environmental Laws to conduct their respective businesses as currently conducted and as described in the SEC Reports and (z) the Company and each of its Subsidiaries is in material compliance with all terms and conditions of such Authorizations. There is no Action pending or threatened in writing (or to the Company’s knowledge, threatened orally) relating to any violation or noncompliance with any Environmental Law involving the Company or any Subsidiary, except for litigation, notices of violations, formal administrative proceedings or investigations, inquiries or information requests that, individually or in the aggregate, have not had and would not reasonably be expected to have a Material Adverse Effect. For purposes of this Agreement, “Environmental Law” means any national, state, provincial or local Law, statute, rule or regulation or the common law relating to the environment or occupational health and safety, including without limitation any statute, regulation, administrative decision or order pertaining to (A) treatment, storage, disposal, generation and transportation of Hazardous Substances; (B) air, water and noise pollution; (C) groundwater and soil contamination; (D) the release or threatened release into the environment of industrial, toxic or hazardous materials or substances, or solid or hazardous waste, including without limitation emissions, discharges, injections, spills, escapes or dumping of pollutants, contaminants or chemicals; (E) the protection of wild life, marine life and wetlands, including without limitation all endangered and threatened species; (F) storage tanks, vessels, containers, abandoned or discarded barrels, and other closed receptacles; (G) health and safety of employees and other persons; and (H) manufacturing, processing, using, distributing, treating, storing, disposing, transporting or handling of Hazardous Substances. As used above, the terms “release” and “environment” shall have the meaning set forth in the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended.

11

(ii) To the knowledge of the Company, none of the Company or any of its Subsidiaries has any liability or obligation under any Environmental Law with respect to any release, spill, emission, leaking, pumping, pouring, emptying, leaching, escaping, dumping, injection, deposit, discharge or disposing of any Hazardous Substance in, onto or through the environment, except as would not reasonably be expected to have a Material Adverse Effect. “Hazardous Substances” means all materials, wastes, or substances defined by, or regulated under, any Environmental Laws, including as a hazardous waste, hazardous material, hazardous substance, extremely hazardous waste, restricted hazardous waste, contaminant, pollutant, toxic waste, or toxic substance, and specifically including petroleum and petroleum products, asbestos, radon, lead, toxic mold, radioactive materials, and polychlorinated biphenyls.

(m) Authorizations. The Company and each of its Subsidiaries holds, and is operating in compliance with, all authorizations, licenses, permits, approvals, clearances, registrations, exemptions, consents, certificates, waivers, filings, qualifications and orders issued by any Governmental Authority (as defined below), including the U.S. Department of Energy, U.S. Nuclear Regulatory Commission and the U.S. Department of Commerce (collectively, the “U.S. Regulatory Agencies”), their foreign counterparts, the International Atomic Energy Agency and any other entity or body exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to United States federal, state or local government or foreign, or other governmental, including any department, commission, board, agency, bureau, official or other regulatory, administrative or judicial or arbitral authority thereto (each a “Governmental Authority”) and supplements and amendments thereto (collectively, “Authorizations”) required for the conduct of its business as currently conducted and as described in the SEC Reports, or that are otherwise material to the business of the Company and its Subsidiaries, in all applicable jurisdictions, except as would not reasonably be expected, individually or in the aggregate, to have a Material Adverse Effect. All Authorizations held by the Company or its Subsidiaries are valid and in full force and effect. Neither the Company nor any of its Subsidiaries is in material violation of any terms of any such Authorizations; and neither the Company nor any of its Subsidiaries has received written notice from any Governmental Authority of any revocation or modification of any such Authorization, or written notice (or to the Company’s knowledge, oral notice) that such revocation or modification is being considered.

12

(n) Regulatory Compliance. The Company and each of its Subsidiaries is in compliance, and has since the Lookback Date been in compliance, with all applicable federal, state, local and foreign Laws, promulgated by any applicable Governmental Authority, including the U.S. Regulatory Agencies, including such Laws relating to the design, manufacture, installation, operation, and maintenance of nuclear reactors and related activities, and to export control, except as would not reasonably be expected, individually or in the aggregate, to have a Material Adverse Effect, provided that such Material Adverse Effect qualifier shall not apply to compliance with Export Control Laws (defined below). Neither the Company nor any of its Subsidiaries has received any written correspondence or notice from any Governmental Authority, alleging or asserting noncompliance with applicable federal, state, local and foreign Laws. The Company and each of its Subsidiaries, and to the Company’s knowledge, each of their respective directors, officers, employees and agents, is and has been in material compliance with applicable Laws of the United States, including, to the extent applicable, without limitation, the laws and regulations (i) pertaining to the handling and disposal in the U.S. of nuclear material and waste under the U.S. Atomic Energy Act of 1954, the U.S. Energy Reorganization Act of 1974, and the U.S. Nuclear Waste Policy Act of 1982, each as amended, and similar Laws of applicable foreign jurisdictions, and the rules and regulations of the applicable Governmental Authorities promulgated thereunder (collectively, the “Nuclear Facilities and Materials Laws”), and (ii) pertaining to export of nuclear materials, equipment, software and technology, such as the U.S. Department of Energy regulations found in 10 C.F.R. Part 810, the U.S. Nuclear Regulatory Commission regulations in 10 C.F.R. Part 110 and the U.S. Department of Commerce’s Export Administration Regulations found in 15 C.F.R. Part 730 et seq., as may be amended, and comparable state Laws and foreign Laws (collectively, “Export Control Laws”). Neither the Company nor any of its Subsidiaries has received written notice (or to the Company’s knowledge, oral notice) of any ongoing claim, action, suit, proceeding, hearing, enforcement, investigation, arbitration or other action from any Governmental Authority or third party alleging that any product, operation or activity of the Company or any of its Subsidiaries is in material violation of any applicable Laws, including Nuclear Facilities and Materials Laws and Export Control Laws, or any Authorizations. The Company and each of its Subsidiaries has filed, obtained, maintained or submitted all material reports, documents, forms, notices, applications, records, claims, submissions and supplements or amendments thereto as required by any applicable Laws, including Nuclear Facilities and Materials Laws and Export Control Laws, or any Authorizations and all such reports, documents, forms, notices, applications, records, claims, submissions and supplements or amendments, to the Company’s knowledge, were complete, correct and not misleading on the date filed in all material respects (or were corrected or supplemented by a subsequent submission). Neither the Company nor any of its Subsidiaries has, either voluntarily or involuntarily, initiated, conducted, or issued or caused to be initiated, conducted or issued, any other notice or action relating to any alleged product defect or violation, and, to the Company’s knowledge, no third party has initiated or conducted any such notice or action relating to any of the Company’s products in development. Neither the Company nor any of its Subsidiaries is a party to any corporate integrity agreement, deferred prosecution agreement, monitoring agreement, consent decree, settlement order, or similar agreements, or has any reporting obligations pursuant to any such agreement, plan or correction or other remedial measure entered into with any Governmental Authority, including any U.S. Regulatory Authority. The SEC Reports fairly and accurately describe, in all material respects, the regulatory environment applicable to the Company’s and its Subsidiaries’ businesses, including risks associated with obtaining and maintaining Authorizations, compliance with applicable Laws and potential changes in applicable Laws that could affect the operations of the Company or its Subsidiaries. The Company and its Subsidiaries have implemented and maintain safeguards and security measures that are designed to comply in all material respects with applicable Laws, including those required by the U.S. Regulatory Agencies and other applicable Governmental Authorities, to protect their respective facilities, materials and technology from unauthorized access, use, or disclosure.

13

(o) Title. Neither the Company nor any of its Subsidiaries owns any real property. Each of the Company and its Subsidiaries has good and marketable title to all of its personal property and other tangible assets (i) purportedly owned or used by them as reflected in the SEC Reports, or (ii) necessary for the conduct of their business as currently conducted and as described in the SEC Reports, free and clear of any legal or equitable, specific or floating, lien (statutory or otherwise), restriction, mortgage, deed of trust, pledge, lien, security interest, restrictive covenant, or other adverse right, charge, claim or encumbrance of any kind or nature whatsoever (collectively, “Liens”), except for Liens which would not reasonably be expected to have a Material Adverse Effect. With respect to properties and assets it leases, each of the Company and its Subsidiaries is in compliance with such leases and holds a valid leasehold interest free of any Liens, except for such Liens which would not reasonably be expected to have a Material Adverse Effect.

(p) Tax Status. The Company and each Subsidiary has filed (taking into account any valid extensions) all federal, state, local and foreign income and all other material returns, declarations, reports, elections, designations, or information returns or statements made to a Governmental Authority relating to Taxes, including any schedules or attachments thereto and any amendments thereof (collectively, “Tax Returns”) required to be made or filed by it or with respect to it by any jurisdiction to which it is subject. Such Tax Returns accurately reflect, in all material respects, the Tax liabilities of the Company and its Subsidiaries (other than Taxes not yet due and payable). The Company and each Subsidiary has timely paid all income Taxes and all other material Taxes and other material governmental assessments and material charges, shown or determined to be due on such returns, reports and declarations, except those being contested in good faith and for which the Company and its Subsidiaries have adequately reserved and accrued for in accordance with GAAP. The Company has reserved and accrued on its books provisions in accordance with GAAP amounts that are reasonably adequate for the payment of all material taxes for periods subsequent to the periods to which such returns, reports or declarations apply. There are no unpaid Taxes in any material amount claimed to be due from the Company or any Subsidiary by the taxing authority of any jurisdiction. There are no, and since the Lookback Date there have been no, pending or threatened in writing (or to the Company’s knowledge, threatened orally) Actions by the taxing authority of any jurisdiction against the Company or any of its Subsidiaries. Neither the Company nor any of its Subsidiaries is a party to, or otherwise bound by, any Tax indemnity, Tax sharing or Tax allocation agreement (but not including any agreement whose primary subject matter is not Taxes) (a “Tax Agreement”). Neither the Company nor its Subsidiaries has been a member of an affiliated group filing a consolidated federal income Tax Return (other than the affiliated group of which the Company is the common parent). The Company is not a “United States real property holding corporation” within the meaning of Section 897(c) of the Internal Revenue Code of 1986, as amended (the “Code”). For purposes of this Agreement, “Tax” or “Taxes” means (i) any and all U.S. federal, state, local, or non-U.S. taxes, assessment, levy or other charges, including net or gross income, gross receipts, net proceeds, estimated, sales, use, ad valorem, value added, franchise, license, withholding, payroll, employment, excise, property (including both real and personal), unclaimed property remittance/escheat, deed, stamp, alternative or add-on minimum, occupation, severance, unemployment, social security, workers’ compensation, capital, premium, windfall profit, environmental, custom duties, fees, transfer and registration taxes, and any governmental charges in the nature of a tax imposed by a Governmental Authority, (ii) any liability for the payment of any amounts of any of the foregoing types as a result of being a member of an affiliated, consolidated, combined or unitary group, or being a party to any agreement or arrangement whereby liability for payment of such amounts was determined or taken into account with reference to the liability of any other person and (iii) any liability for the payment of any amounts as a result of being a party to any Tax Agreement.

14

(q) Certain Transactions. All transactions that are required to be disclosed by the Company pursuant to Item 404 of Regulation S-K promulgated under the Securities Act are disclosed in the SEC Reports in accordance with Item 404 of Regulation S-K.

(r) Rights of First Refusal. The Company is not obligated to offer the securities offered hereunder on a right of first refusal basis or otherwise to any third parties including, but not limited to, current or former stockholders of the Company, underwriters, brokers, agents or other third parties.

(s) Insurance. The Company and its Subsidiaries have insurance policies (including director and officer liability insurance policies) of the type and in amounts customarily carried by organizations conducting businesses or owning assets similar to those of the Company and its Subsidiaries, and in any event maintain insurance policies in amounts as required by applicable Law or any Contract to which the Company or its Subsidiaries is a party or to which any of its assets or businesses is subject. All such insurance policies are in full force and effect and binding and enforceable in accordance with their terms, and all premiums due and payable thereon have been timely paid in full. Neither the Company nor any of its Subsidiaries is in default with respect to its obligations under any such insurance policy, nor has there been any failure to give any notice or present any claim under any such insurance policy in due and timely fashion, except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. There is no material claim pending under any such policy as to which coverage has been questioned, denied or disputed by the underwriter of such policy and there has been no notice of cancellation or nonrenewal of any such insurance policy received by the Company or any of its Subsidiaries. Since the Lookback Date, no limits on any insurance policy of the Company or any of its Subsidiaries have been exhausted, materially eroded or materially reduced.

(t) SEC Reports. The Company has timely filed or furnished, as applicable, all reports, proxy statements, schedules, forms, statements, certifications and other documents (including exhibits and all other information incorporated by reference therein) required to be filed or furnished by the Company under the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (the “Exchange Act”) (the “SEC Reports”) since the Company was first required by Law or regulation to file such material. The SEC Reports at the time they were filed complied, in all material respects with the Securities Act or the Exchange Act, as applicable. There are no Contracts (or any material change or amendment thereto, or any waiver of any material right thereunder) that are required to be described in the SEC Reports that were or are not described, in all material respects, therein or, in the case of Contracts (or any material change or amendment thereto, or any waiver of any material right thereunder). There are no Contracts (or any material change or amendment thereto, or any waiver of any material right thereunder) that are required to be filed as exhibits to the SEC Reports that were not or will not have been filed as required in the SEC Reports. There are no outstanding or unresolved comments in comment letters received from the SEC staff with respect to the SEC Reports. To the Company’s knowledge, none of the SEC Reports is the subject of an ongoing SEC review. There are no SEC inquiries or investigations, other governmental inquiries or investigations or internal investigations pending or threatened in writing (or, to the Company’s knowledge, threatened orally), in each case regarding any accounting practice of the Company or any of its Subsidiaries or otherwise relating to the Company or any of its Subsidiaries.

15

(u) Financial Statements.

(i) The audited condensed consolidated financial statements of the Company as of and for the fiscal years ended December 31, 2024 and 2023, and the unaudited interim condensed consolidated financial statements of the Company for the nine months ended September 30, 2025 (in each case consisting of the balance sheets, related statements of operations, changes in stockholders’ equity (deficit) and cash flows), and the unaudited pro forma consolidated financial statements of the Company (including, in each case, the notes thereto) included in the SEC Reports (the foregoing financial statements, the “Financial Statements”) comply in all material respects with GAAP and the rules and regulations of the SEC with respect thereto as in effect at the time of filing. The Financial Statements have been prepared in accordance with GAAP applied on a consistent basis during the periods involved and include all adjustments that are necessary for a fair presentation of the financial condition of the Company as of the date thereof, subject, in the case of the unaudited interim condensed financial statements of the Company for the nine months ended September 30, 2025, to normal year-end adjustments that are not expected, individually or in the aggregate, be material, and fairly present in all material respects the financial position of the Company as of and for the dates thereof and the results of operations and cash flows for the periods presented, subject, in the case of unaudited interim condensed financial statements, to normal, year-end audit adjustments that will not, individually or in the aggregate, be material. The unaudited pro forma consolidated financial information and the related notes included in the Company’s Current Report on Form 8-K filed with the SEC on September 11, 2025 (the “Super 8-K”), have been properly compiled and prepared in accordance with the applicable requirements of the Securities Act and the Exchange Act and fairly present in all material respects the information shown therein, and the assumptions used in the preparation thereof are reasonable and the adjustments used therein are appropriate to give effect to the transactions and circumstances referred to therein.

(ii) The Company (A) maintains a standard system of accounting established and administered in accordance with GAAP, (B) has established and maintains a system of internal controls over financial reporting designed to provide reasonable assurance regarding the reliability of the financial reporting and the preparation of the Financial Statements for external purposes in accordance with GAAP, (C) there are no material weaknesses in any system of internal accounting controls used by the Company, (D) there has not at any time been any fraud or other unlawful act on the part of any of management or other employees of the Company who have a role in the preparation of Financial Statements or the internal accounting controls used by the Company related to such preparation or controls and (E) there has not at any time been any claim or allegation regarding any of the foregoing.

(iii) Neither the Company nor any of its Subsidiaries has any liabilities (whether accrued, absolute, contingent or otherwise) other than (A) liabilities disclosed on the latest balance sheet of the Company and the latest balance sheet of the Company included in the Financial Statements balance sheet (including the notes thereto) and (B) liabilities that have been incurred since the date of the latest balance sheet of the Company and the latest balance sheet of the Company included in the Financial Statements in the ordinary course of business, which liabilities, individually or in the aggregate, are not material to the business of the Company and its Subsidiaries (taken as a whole).

16

(iv) To the knowledge of the Company, dbbmckennon LLC (the “Successor Auditor”), whose report on the audited Financial Statements will be filed with the SEC, is an independent registered public accounting firm with respect to the Company as required by the Exchange Act and the rules and regulations promulgated thereunder and the rules and regulations of the Public Company Accounting Oversight Board. The Successor Auditor has not, during the periods covered by the Financial Statements provided to the Company any prohibited non-audit services, as such term is used in Section 10A(g) of the Exchange Act.

(v) Material Changes. Since the date of the latest balance sheet of the Company and the latest balance sheet of the Company included in the Financial Statements, (i) there have been no events, occurrences or developments that have had or would reasonably be expected to have a Material Adverse Effect, (ii) there have not been any changes in the assets, financial condition, business or operations of the Company from that reflected in the Financial Statements, except changes in the ordinary course of business which have not been, either individually or in the aggregate, materially adverse to the business, properties, financial condition, results of operations or future prospects of the Company, (iii) none of the Company or any of its Subsidiaries has altered its method of accounting or the manner in which it keeps its accounting books and records, and (iv) none of the Company or any of its Subsidiaries has declared or made any dividend or distribution of cash or other property to its stockholders or equity holders or purchased, redeemed or made any agreements to purchase or redeem any shares of its capital stock (other than in connection with repurchases of unvested stock issued to employees of the Company). The Company and its Subsidiaries, individually and on a consolidated basis, are not as of the date hereof, and after giving effect to the transactions contemplated hereby to occur at the Closing, will not be Insolvent (as defined below). “Insolvent” means, with respect to the Company, on a consolidated basis with its Subsidiaries, (i) the present fair saleable value of the Company’s and its Subsidiaries’ assets is less than the amount required to pay the Company’s and its Subsidiaries’ total indebtedness, (ii) the Company and its Subsidiaries are unable to pay their debts and liabilities, subordinated, contingent or otherwise, as such debts and liabilities become absolute and matured or (iii) the Company and its Subsidiaries intend to incur or believe that they will incur debts that would be beyond their ability to pay as such debts mature.

(w) Disclosure Controls. The Company has established and maintains disclosure controls and procedures (as defined in Rules 13a-14 and 15d-15 under the Exchange Act) and such controls and procedures are effective at the reasonable assurance level to ensure that material information relating to the Company, including its Subsidiaries, is made known to the principal executive officer and the principal financial officer.

(x) Sarbanes-Oxley. The Company is, and has been since the Lookback Date, to the extent applicable, in compliance in all material respects with all of the provisions of the Sarbanes-Oxley Act of 2002 that are applicable to it.

(y) Off-Balance Sheet Arrangements. There is no transaction, arrangement, or other relationship between the Company or any Subsidiary and an unconsolidated or other off-balance sheet entity that is required to be disclosed.

17