EXHIBIT 99.1

Published on February 10, 2026

| Powering Humanity from a Mile Underground DeepFission.com Investor Presentation January 2026 |

| Legal Disclaimer— Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the U.S. federal securities laws, including, among other things, statements regarding Deep Fission, Inc.’s development plans, anticipated project timelines, cost objectives, commercialization strategy, partnerships, and other future matters. Forward-looking statements are based on current expectations and assumptions and involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied. Important factors that could cause such differences are described under “Risk Factors” and “Special Note Regarding Forward-Looking Statements” in Deep Fission’s registration statement on Form S-1 (as amended from time to time) and in other filings Deep Fission makes with the U.S. Securities and Exchange Commission (“SEC”). Deep Fission undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Nothing in this presentation constitutes an offer to sell, or a solicitation of an offer to buy, any securities of Deep Fission. |

| An investment in Deep Fission involves a high degree of risk, including, without limitation, risks related to: •Unproven nuclear reactor technology, engineering, construction, manufacturing, and scale-up risks •Early-stage company status, limited operating history, no revenue to date, history of operating losses, and a going-concern qualification •Regulatory, licensing, and permitting uncertainty, including approvals required from the U.S. Nuclear Regulatory Commission ("NRC"), Department of Energy (“DOE”), and other governmental authorities •Delays, cost overruns, and changes in design, construction, testing, or deployment timelines •Ongoing and future regulatory proceedings or litigation, including matters involving NRC licensing frameworks •Commercialization and market adoption risk, including the absence of an established market for Gravity Reactors and SMRs •Capital requirements and financing risk, including the need to raise substantial additional capital and dilution •Competition and technological obsolescence, including alternative energy technologies and competing nuclear solutions •Supply chain, manufacturing, and sourcing risks, including reliance on third-party suppliers and global supply chains •Dependence on key personnel and the ability to attract, retain, and replace highly specialized technical, regulatory, and management talent •Dependence on third-party partners, contractors, and service providers, including drillers, EPCs, fabricators, operators, and other counterparties, and risks related to their performance, availability, financial condition, and compliance with applicable requirements •Political, public perception, and community acceptance risks related to nuclear energy •Macroeconomic, geopolitical, trade, tariff, and inflationary risks •Cybersecurity, data protection, and information security risks •Intellectual property protection and infringement risks •Public company, liquidity, volatility, and stockholder-related risks, including limited trading markets for the Company’s common stock For a complete discussion of these and other risks, please refer to the “Risk Factors” section of Deep Fission’s Registration Statement on Form S-1, as amended, filed with the U.S. Securities and Exchange Commission. Proprietary and Confidential | 3 Risk Factors |

| Core Idea and Origin Story The Economist Pilot Reactor Development Fox Business Network CEO Overview EnerCom Denver Conference 3 Initial Planned Sites World Nuclear News 12.5 GW in Pipeline Bloomberg $30M Financing, Go-Public Transaction Bloomberg | Power Technology | Press Release Deep Fission is leveraging the Earth’s own physics to redefine the time and cost of nuclear power deployment. Clean energy for the AI era. Groundbreaking for DOE Reactor Pilot Program Site CNBC NPR in Kansas City *Media references are for information purposes only and should not be interpreted as endorsements. |

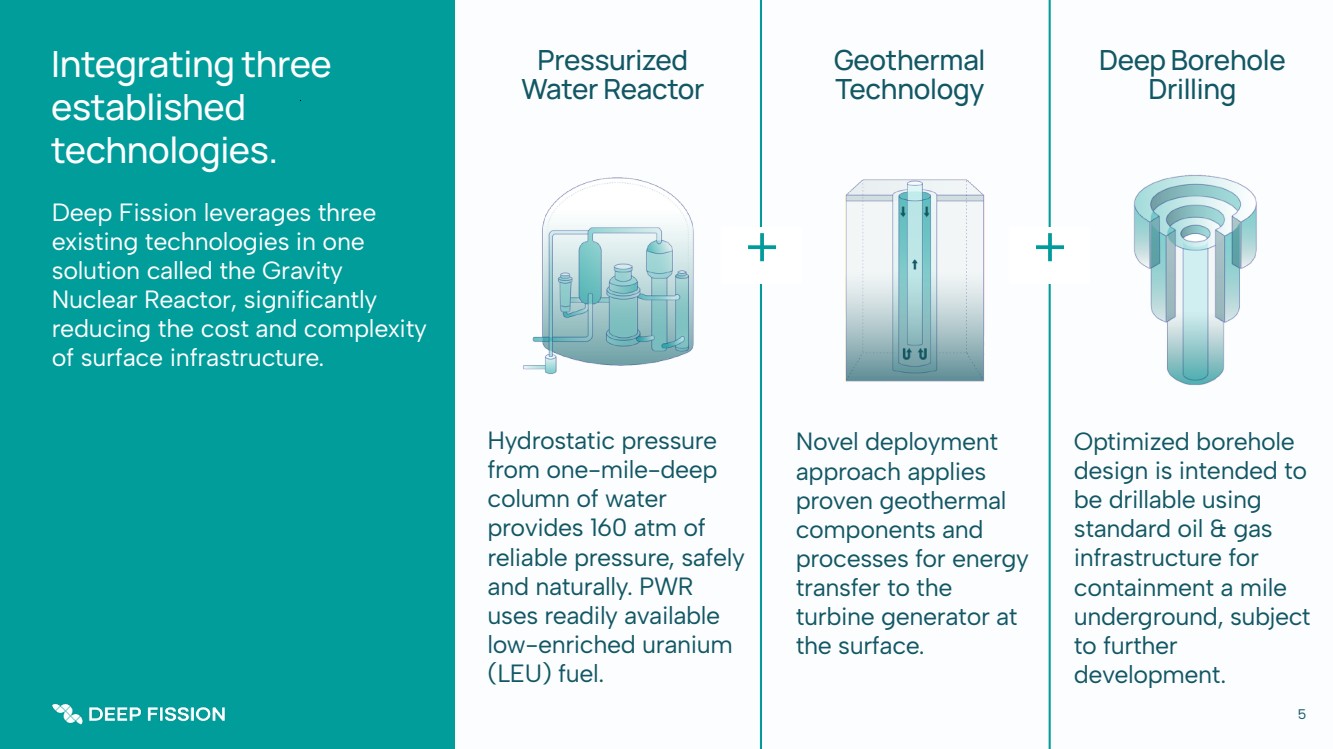

| 5 Integrating three established technologies. Geothermal Technology Deep Borehole Drilling + + Hydrostatic pressure from one-mile-deep column of water provides 160 atm of reliable pressure, safely and naturally. PWR uses readily available low-enriched uranium (LEU) fuel. Novel deployment approach applies proven geothermal components and processes for energy transfer to the turbine generator at the surface. Optimized borehole design is intended to be drillable using standard oil & gas infrastructure for containment a mile underground, subject to further development. Pressurized Water Reactor Deep Fission leverages three existing technologies in one solution called the Gravity Nuclear Reactor, significantly reducing the cost and complexity of surface infrastructure. |

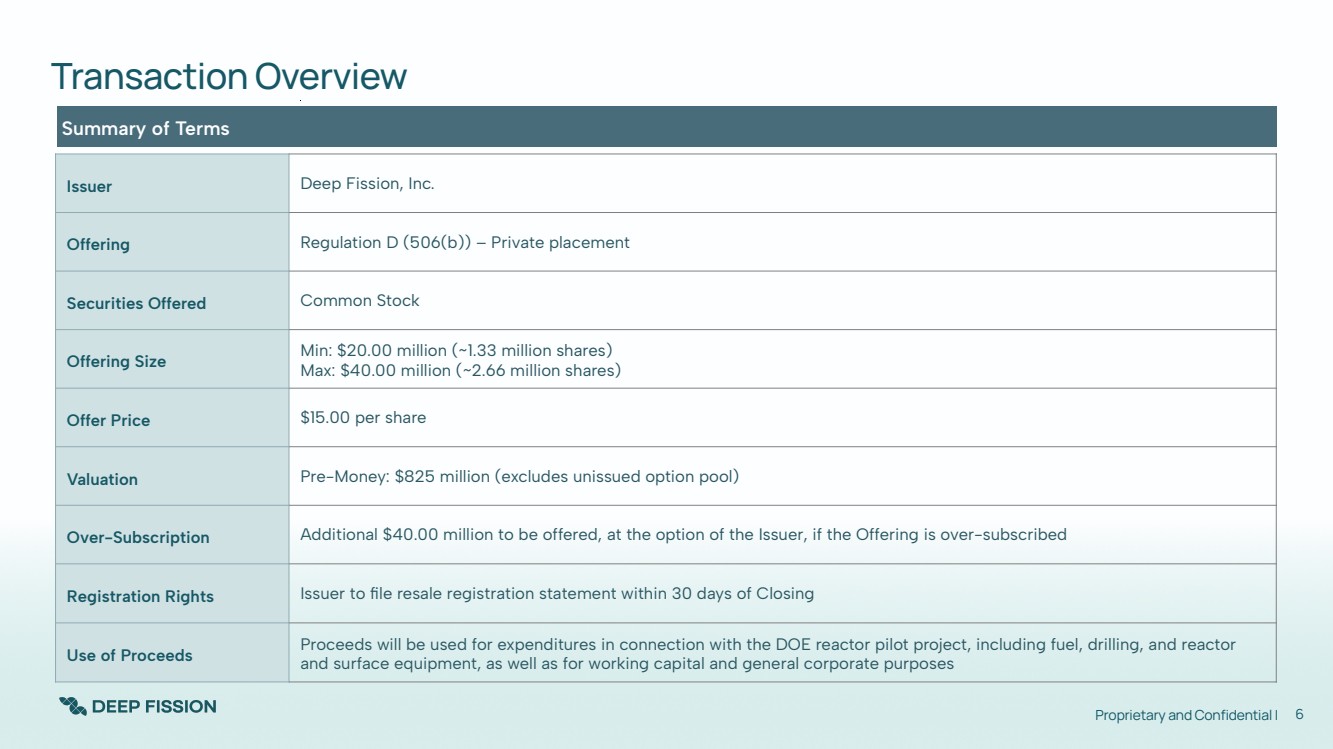

| Transaction Overview Issuer Deep Fission, Inc. Offering Regulation D (506(b)) – Private placement Securities Offered Common Stock Offering Size Min: $20.00 million (~1.33 million shares) Max: $40.00 million (~2.66 million shares) Offer Price $15.00 per share Valuation Pre-Money: $825 million (excludes unissued option pool) Over-Subscription Additional $40.00 million to be offered, at the option of the Issuer, if the Offering is over-subscribed Registration Rights Issuer to file resale registration statement within 30 days of Closing Use of Proceeds Proceeds will be used for expenditures in connection with the DOE reactor pilot project, including fuel, drilling, and reactor and surface equipment, as well as for working capital and general corporate purposes Summary of Terms Proprietary and Confidential | 6 |

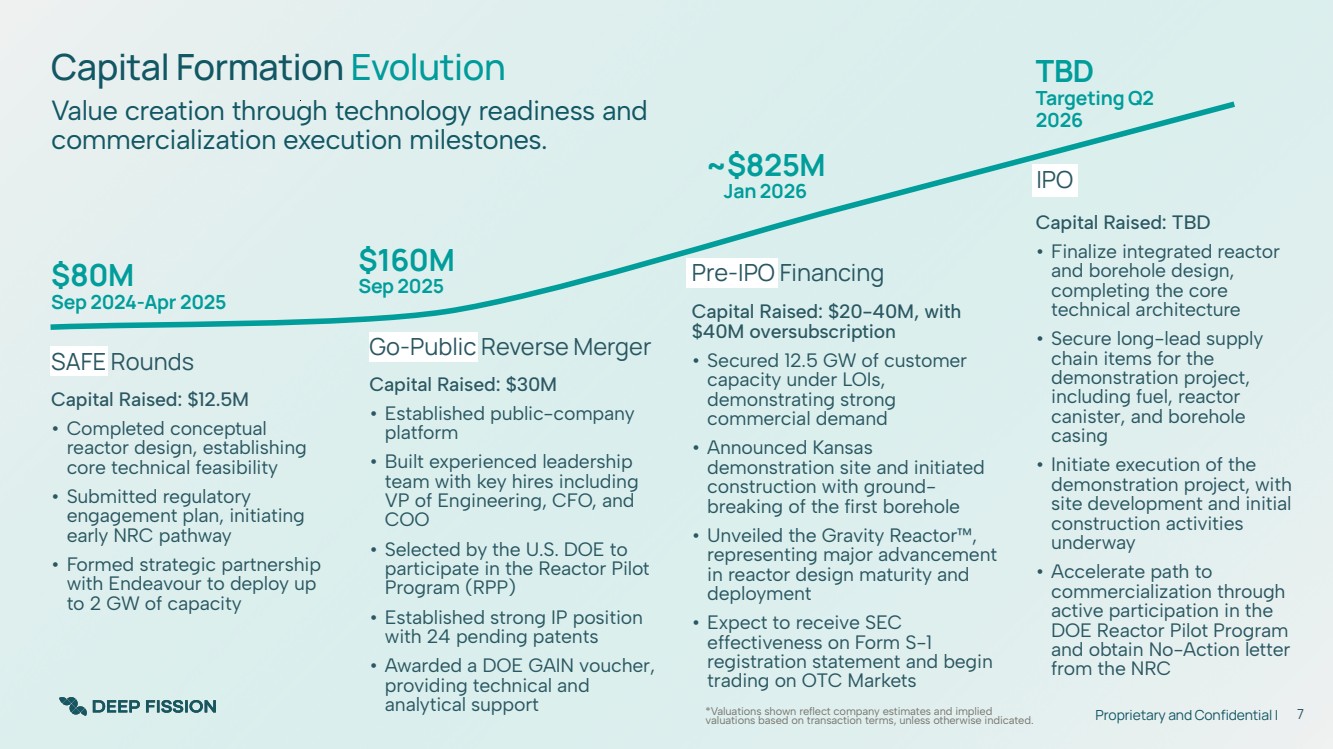

| Proprietary and Confidential | 7 $80M Sep 2024-Apr 2025 $160M Sep 2025 ~$825M Jan 2026 TBD Targeting Q2 2026 Capital Formation Evolution Value creation through technology readiness and commercialization execution milestones. Capital Raised: TBD • Finalize integrated reactor and borehole design, completing the core technical architecture • Secure long-lead supply chain items for the demonstration project, including fuel, reactor canister, and borehole casing • Initiate execution of the demonstration project, with site development and initial construction activities underway • Accelerate path to commercialization through active participation in the DOE Reactor Pilot Program and obtain No-Action letter from the NRC IPO Capital Raised: $30M • Established public-company platform • Built experienced leadership team with key hires including VP of Engineering, CFO, and COO • Selected by the U.S. DOE to participate in the Reactor Pilot Program (RPP) • Established strong IP position with 24 pending patents • Awarded a DOE GAIN voucher, providing technical and analytical support Go-Public Reverse Merger Capital Raised: $12.5M • Completed conceptual reactor design, establishing core technical feasibility • Submitted regulatory engagement plan, initiating early NRC pathway • Formed strategic partnership with Endeavour to deploy up to 2 GW of capacity SAFE Rounds Capital Raised: $20-40M, with $40M oversubscription • Secured 12.5 GW of customer capacity under LOIs, demonstrating strong commercial demand • Announced Kansas demonstration site and initiated construction with ground-breaking of the first borehole • Unveiled the Gravity Reactor™, representing major advancement in reactor design maturity and deployment • Expect to receive SEC effectiveness on Form S-1 registration statement and begin trading on OTC Markets Pre-IPO Financing *Valuations shown reflect company estimates and implied valuations based on transaction terms, unless otherwise indicated. |

| 8 Regulatory Advantage: Deep Fission selected as one of 10 companies for the U.S. Department of Energy Nuclear Reactor Pilot Program— A fast-track initiative to design, build, and operate advanced test reactors, with the ambitious goal of reaching criticality by July 4, 2026. “U.S. DEPARTMENT OF ENERGY ANNOUNCES INITIAL SELECTIONS FOR NEW REACTOR PILOT PROGRAM August 12, 2025 WASHINGTON—The U.S. Department of Energy (DOE) today officially kicked off President Trump’s Nuclear Reactor Pilot Program, announcing DOE will initially work with 11 advanced reactor projects to move their technologies towards deployment. DOE will work with industry on these 11 projects, with the goal to construct, operate, and achieve criticality of at least three test reactors using the DOE authorization process by July 4, 2026. Today’s initial selections represent an important step toward streamlining nuclear reactor testing and unleashes a new pathway toward fast-tracking commercial licensing activities. “President Trump’s Reactor Pilot Program is a call to action,” said Deputy Secretary of Energy James P. Danly. “These companies aim to all safely achieve criticality by Independence Day, and DOE will do everything we can to support their efforts.” … Seeking DOE authorization provided under the Atomic Energy Act will help today’s selected companies— Aalo Atomics Inc., Antares Nuclear Inc., Atomic Alchemy Inc., Deep Fission Inc., Last Energy Inc., Oklo Inc., Natura Resources LLC, Radiant Industries Inc., Terrestrial Energy Inc., and Valar Atomics Inc.— unlock private funding and provide a fast-tracked approach to future commercial licensing activities…” 8 *Media references are for information purposes only and should not be interpreted as endorsements. |

| 9 Mark Pérès VP Engineering 40+ years in Nuclear Engineering Michael Brasel COO 30 years across nuclear, fossil, renewable energy Anya Scuderi Strategic Finance 10 years experience in energy capital markets Rani Franovich VP Regulatory Strategy 30 years at NRC Mark Schmitz CFO 40+ years global finance leadership, former CFO, Itron, Goodyear, PlugPower David Nelson VP Drilling & Well Completion 30 years in petroleum engineering, complex $B developments Bryan Black VP Business Development 15 years in nuclear and power sectors Elizabeth Muller CEO and Co-Founder Co-Founder, Board Chair & Former CEO, Deep Isolation (nuclear waste disposal) Co-Founder, Berkeley Earth Richard Muller PhD CTO and Co-Founder Co-Founder, Deep Isolation MacArthur “Genius” 80+ nuclear patents Professor Emeritus, UC Berkeley Culture of collective drive, ecosystems over empires, and AI-native agility. Meet the new face of nuclear. Chloe Frader VP of Strategic Affairs 15 years in startups, political and finance sectors Jason Pottorf Principal I&C Safety Analysis Engineer 25 years in commercial nuclear energy safety |

| World-Class Board of Directors 10 Elizabeth Muller CEO and Co-Founder Board Chair Jonathon Angell CEO of Angell Investments Compensation Committee Chair Thomas Glanville Managing Partner of Eschelon Advisors, LP Audit Committee Chair Blake Janover Board Member and CCO of DeFi Development Corporation Leslie Tepper Managing Partner of LGT Seven Enterprises Nominating & Governance Committee Chair |

| Expert Advisory Board Steve Koonin Special Government Employee, DOE Former Chief Scientists at BP and Former Undersecretary of Energy Patrick Huston Brig. Gen. (Ret.) FBI Scientific Working Group on AI Steve Chu Nobel Laureate Former Secretary of Energy Kristin Sverchek Former President, General Counsel and President of Business Affairs at Lyft Jo Riley Co-Founder and CEO of Censia Entrepreneur focused on AI models for talent sourcing Mark Peters CEO of Mitre Corporation Former Head of Idaho National Labs Allison Salisbury Entrepreneur Building social impact companies John Mather Nobel Laureate in Physics Senior Astrophysicist at NASA’s Goddard Space Flight Center 11 Bret Johnsen CFO of SpaceX Former CFO of Mindspeed Technologies Stacy Polley Independent Board Member, Blue Owl Senior Advisor to Blackstone, Inc. and former partner of Goldman Sachs |

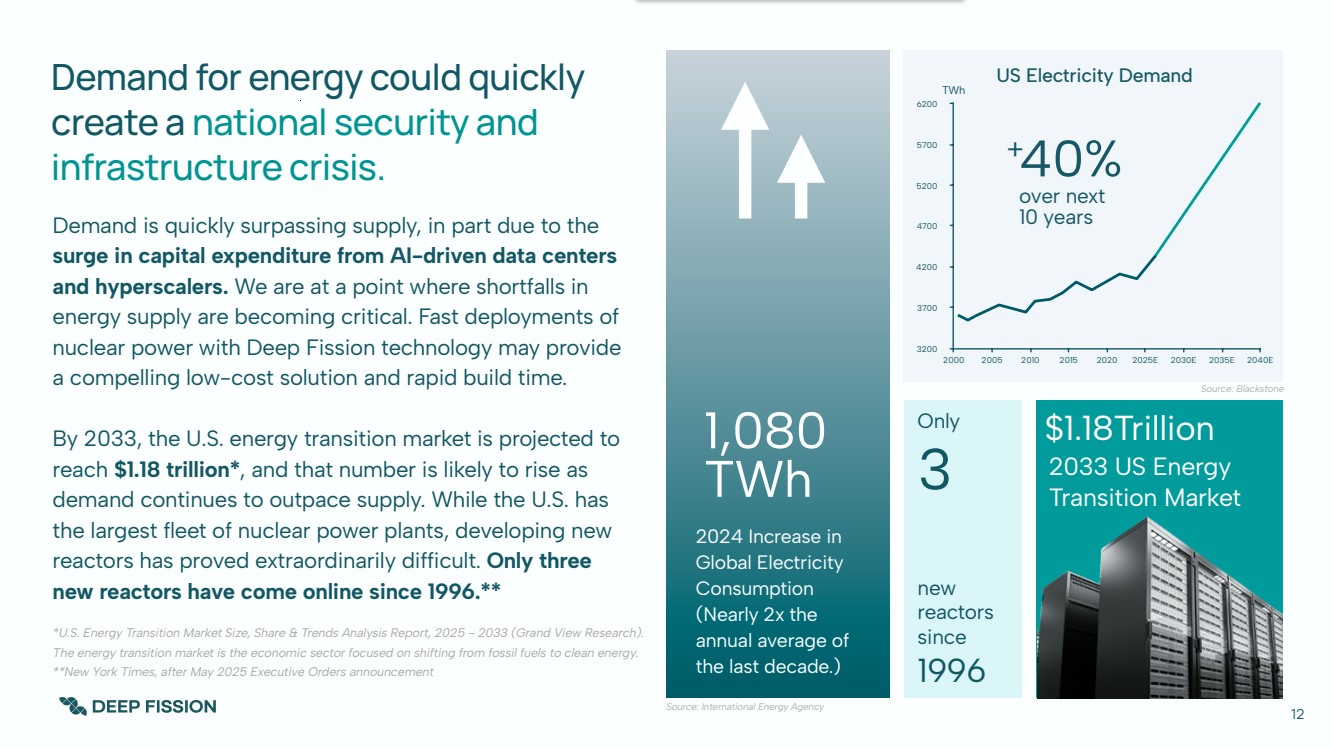

| Demand is quickly surpassing supply, in part due to the surge in capital expenditure from AI-driven data centers and hyperscalers. We are at a point where shortfalls in energy supply are becoming critical. Fast deployments of nuclear power with Deep Fission technology may provide a compelling low-cost solution and rapid build time. By 2033, the U.S. energy transition market is projected to reach $1.18 trillion*, and that number is likely to rise as demand continues to outpace supply. While the U.S. has the largest fleet of nuclear power plants, developing new reactors has proved extraordinarily difficult. Only three new reactors have come online since 1996.** *U.S. Energy Transition Market Size, Share & Trends Analysis Report, 2025 - 2033 (Grand View Research). The energy transition market is the economic sector focused on shifting from fossil fuels to clean energy. **New York Times, after May 2025 Executive Orders announcement 1,080 TWh 2024 Increase in Global Electricity Consumption (Nearly 2x the annual average of the last decade.) 2033 US Energy Transition Market Demand for energy could quickly create a national security and infrastructure crisis. $1.18Trillion Only 3 new reactors since 1996 12 from Blackstone 3200 3700 4200 4700 5200 5700 6200 2000 2005 2010 2015 2020 2025E 2030E 2035E 2040E 40% over next 10 years + US Electricity Demand TWh Source: Blackstone Source: International Energy Agency |

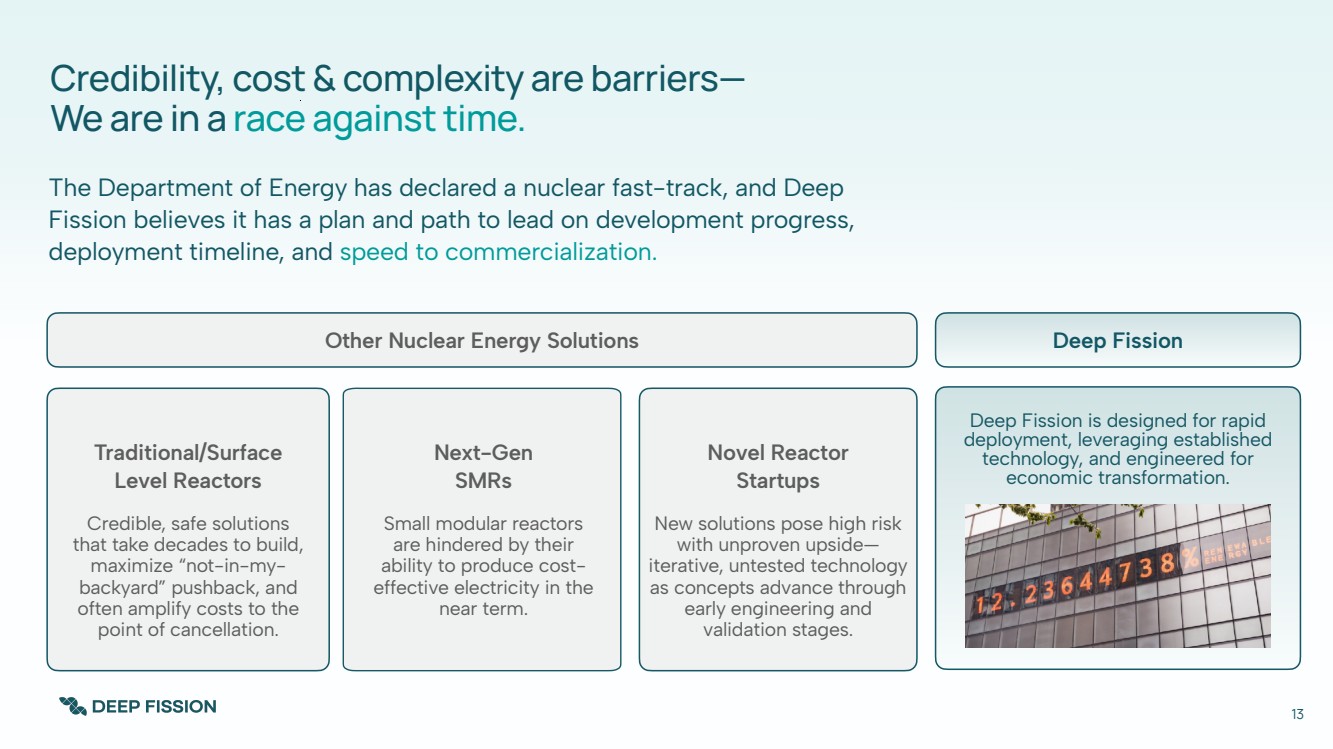

| Traditional/Surface Level Reactors Credibility, cost & complexity are barriers— We are in a race against time. Credible, safe solutions that take decades to build, maximize “not-in-my-backyard” pushback, and often amplify costs to the point of cancellation. Next-Gen SMRs Small modular reactors are hindered by their ability to produce cost-effective electricity in the near term. Novel Reactor Startups New solutions pose high risk with unproven upside— iterative, untested technology as concepts advance through early engineering and validation stages. Deep Fission is designed for rapid deployment, leveraging established technology, and engineered for economic transformation. The Department of Energy has declared a nuclear fast-track, and Deep Fission believes it has a plan and path to lead on development progress, deployment timeline, and speed to commercialization. 13 Other Nuclear Energy Solutions Deep Fission |

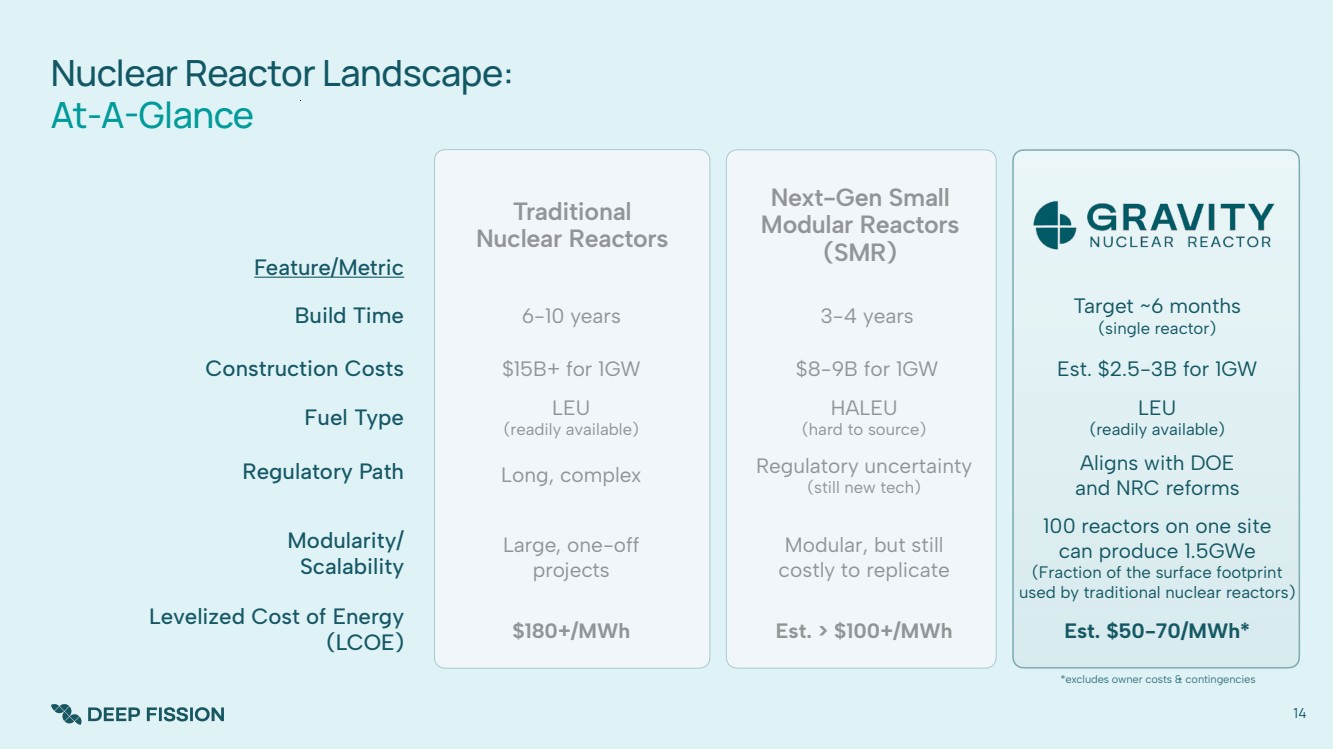

| Nuclear Reactor Landscape: At-A-Glance 14 6-10 years 3-4 years Target ~6 months (single reactor) $15B+ for 1GW $8-9B for 1GW Est. $2.5-3B for 1GW LEU (readily available) HALEU (hard to source) LEU (readily available) Long, complex Regulatory uncertainty (still new tech) Aligns with DOE and NRC reforms Large, one-off projects Modular, but still costly to replicate 100 reactors on one site can produce 1.5GWe (Fraction of the surface footprint used by traditional nuclear reactors) $180+/MWh Est. > $100+/MWh Est. $50-70/MWh* 8 Build Time Construction Costs Fuel Type Regulatory Path Feature/Metric Traditional Nuclear Reactors Next-Gen Small Modular Reactors (SMR) Modularity/ Scalability Levelized Cost of Energy (LCOE) *excludes owner costs & contingencies |

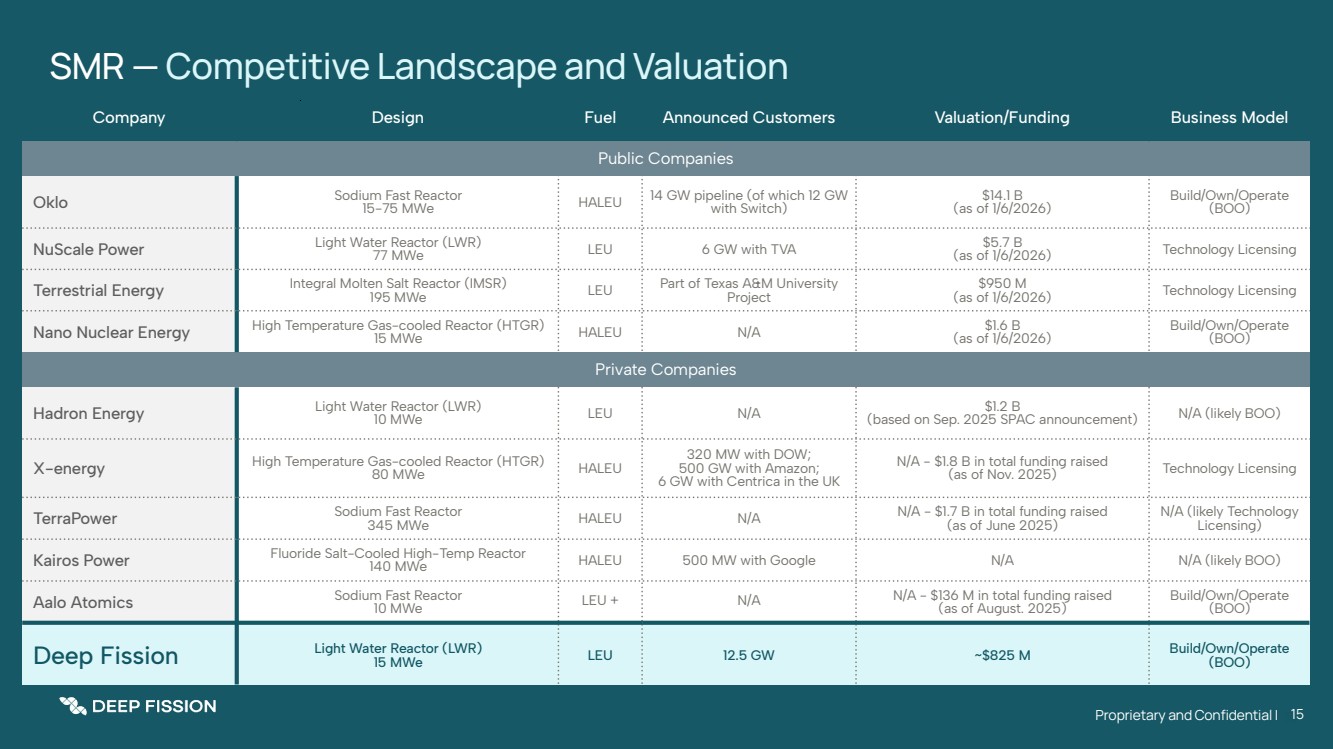

| Company Design Fuel Announced Customers Valuation/Funding Business Model Public Companies Oklo Sodium Fast Reactor 15-75 MWe HALEU 14 GW pipeline (of which 12 GW with Switch) $14.1 B (as of 1/6/2026) Build/Own/Operate (BOO) NuScale Power Light Water Reactor (LWR) 77 MWe LEU 6 GW with TVA $5.7 B (as of 1/6/2026) Technology Licensing Terrestrial Energy Integral Molten Salt Reactor (IMSR) 195 MWe LEU Part of Texas A&M University Project $950 M (as of 1/6/2026) Technology Licensing Nano Nuclear Energy High Temperature Gas-cooled Reactor (HTGR) 15 MWe HALEU N/A $1.6 B (as of 1/6/2026) Build/Own/Operate (BOO) Private Companies Hadron Energy Light Water Reactor (LWR) 10 MWe LEU N/A $1.2 B (based on Sep. 2025 SPAC announcement) N/A (likely BOO) X-energy High Temperature Gas-cooled Reactor (HTGR) 80 MWe HALEU 320 MW with DOW; 500 GW with Amazon; 6 GW with Centrica in the UK N/A - $1.8 B in total funding raised (as of Nov. 2025) Technology Licensing TerraPower Sodium Fast Reactor 345 MWe HALEU N/A N/A - $1.7 B in total funding raised (as of June 2025) N/A (likely Technology Licensing) Kairos Power Fluoride Salt-Cooled High-Temp Reactor 140 MWe HALEU 500 MW with Google N/A N/A (likely BOO) Aalo Atomics Sodium Fast Reactor 10 MWe LEU + N/A N/A - $136 M in total funding raised (as of August. 2025) Build/Own/Operate (BOO) Deep Fission Light Water Reactor (LWR) 15 MWe LEU 12.5 GW ~$825 M Build/Own/Operate (BOO) SMR — Competitive Landscape and Valuation Proprietary and Confidential | 1515 |

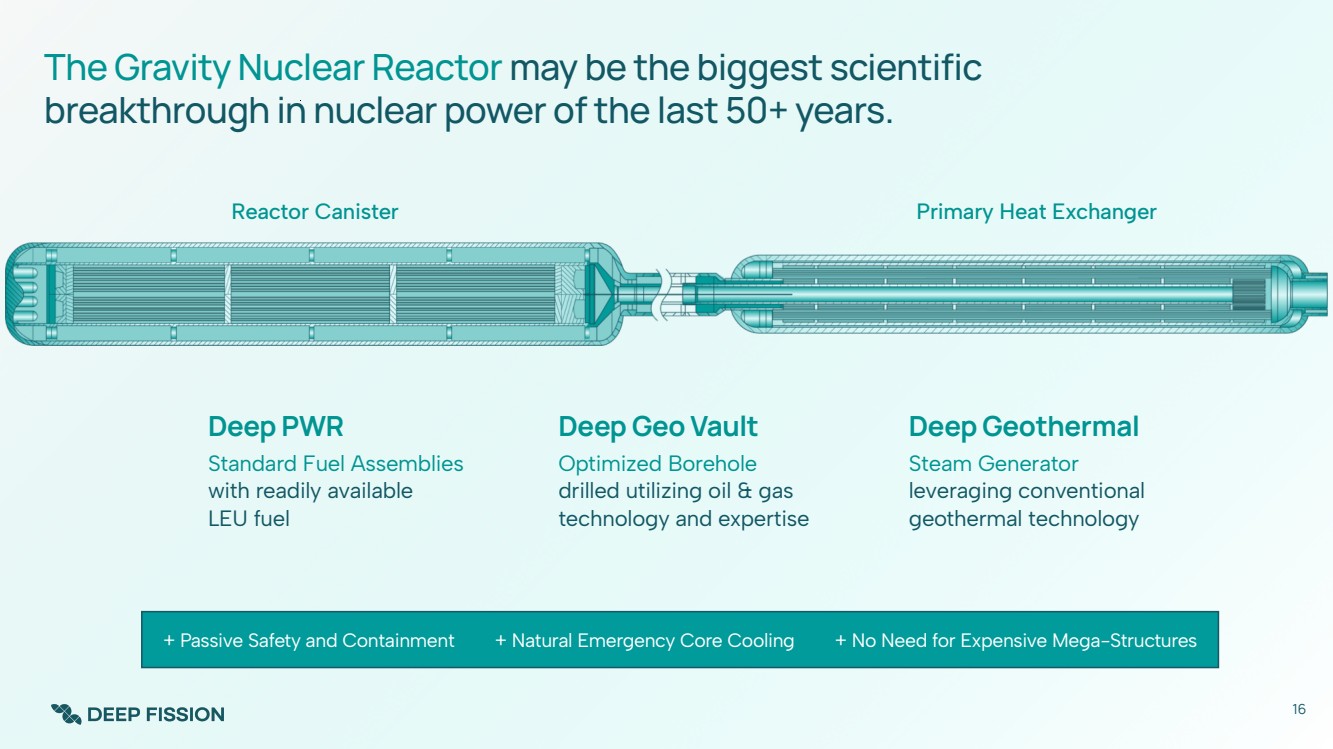

| The Gravity Nuclear Reactor may be the biggest scientific breakthrough in nuclear power of the last 50+ years. Standard Fuel Assemblies with readily available LEU fuel Deep PWR Optimized Borehole drilled utilizing oil & gas technology and expertise Deep Geo Vault Steam Generator leveraging conventional geothermal technology Deep Geothermal Reactor Canister Primary Heat Exchanger + Passive Safety and Containment + Natural Emergency Core Cooling + No Need for Expensive Mega-Structures 16 |

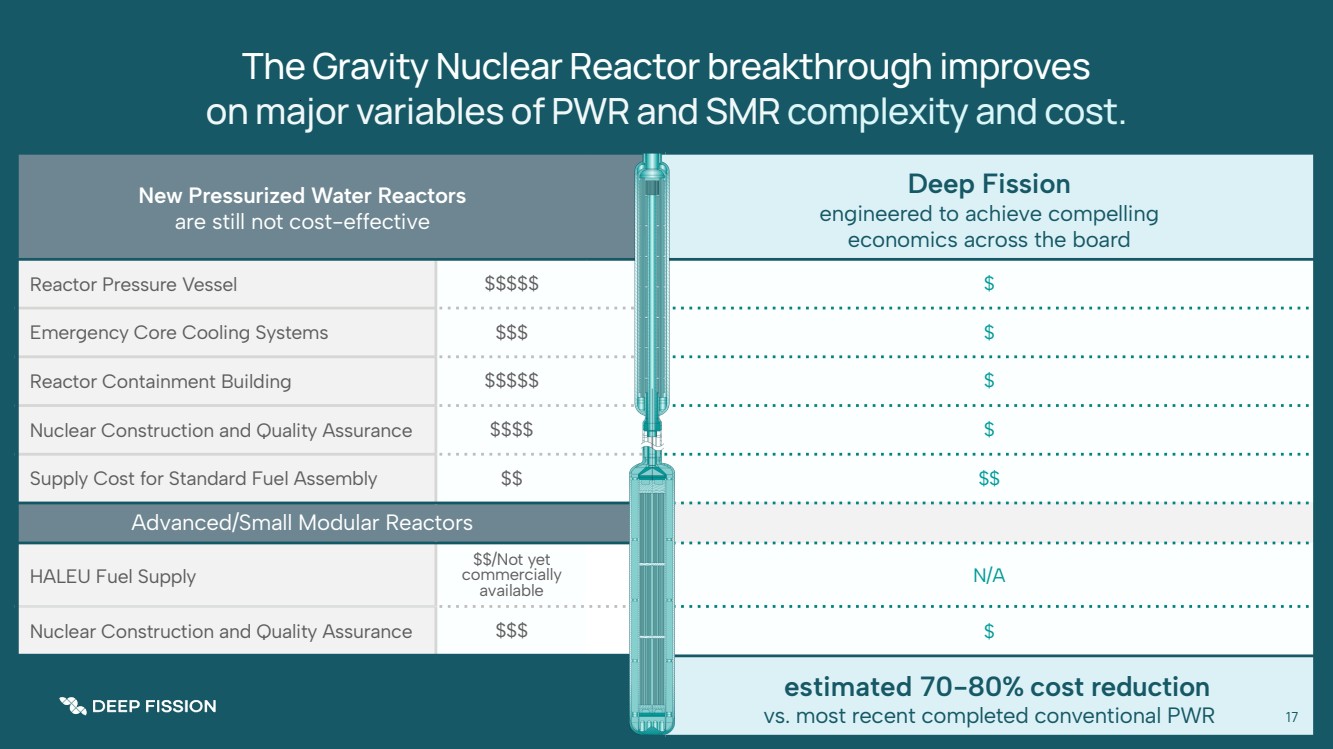

| New Pressurized Water Reactors are still not cost-effective Deep Fission engineered to achieve compelling economics across the board Reactor Pressure Vessel $$$$$ $ Emergency Core Cooling Systems $$$ $ Reactor Containment Building $$$$$ $ Nuclear Construction and Quality Assurance $$$$ $ Supply Cost for Standard Fuel Assembly $$ $$ Advanced/Small Modular Reactors HALEU Fuel Supply $$/Not yet commercially available N/A Nuclear Construction and Quality Assurance $$$ $ estimated 70-80% cost reduction vs. most recent completed conventional PWR The Gravity Nuclear Reactor breakthrough improves on major variables of PWR and SMR complexity and cost. 17 |

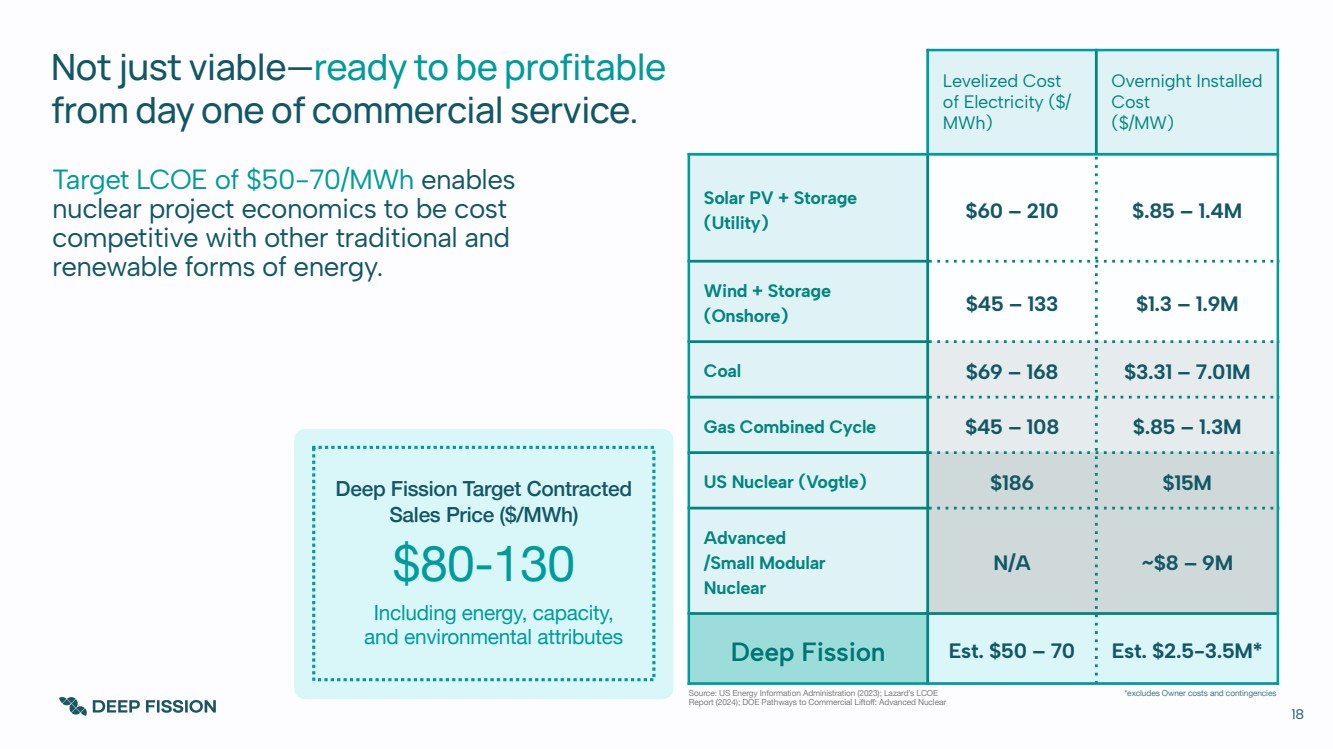

| Not just viable—ready to be profitable from day one of commercial service. Source: US Energy Information Administration (2023); Lazard’s LCOE Report (2024); DOE Pathways to Commercial Liftoff: Advanced Nuclear Including energy, capacity, and environmental attributes Deep Fission Target Contracted Sales Price ($/MWh) $80-130 Levelized Cost of Electricity ($/ MWh) Overnight Installed Cost ($/MW) Solar PV + Storage (Utility) $60 – 210 $.85 – 1.4M Wind + Storage (Onshore) $45 – 133 $1.3 – 1.9M Coal $69 – 168 $3.31 – 7.01M Gas Combined Cycle $45 – 108 $.85 – 1.3M US Nuclear (Vogtle) $186 $15M Advanced /Small Modular Nuclear N/A ~$8 – 9M Deep Fission Est. $50 – 70 Est. $2.5-3.5M* 18 Target LCOE of $50-70/MWh enables nuclear project economics to be cost competitive with other traditional and renewable forms of energy. *excludes Owner costs and contingencies |

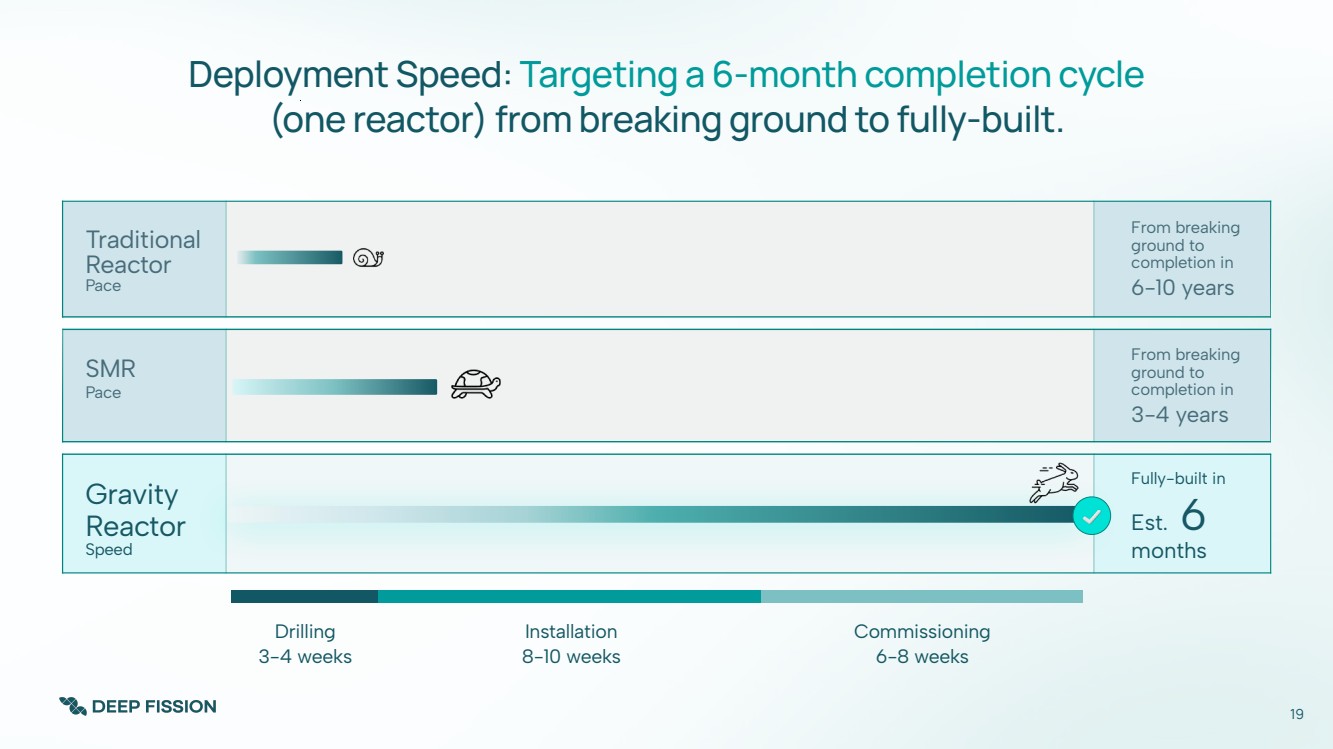

| Traditional Reactor Pace From breaking ground to completion in 6-10 years SMR Pace From breaking ground to completion in 3-4 years Gravity Reactor Speed Fully-built in Est. 6 months Drilling 3-4 weeks Installation 8-10 weeks Deployment Speed: Targeting a 6-month completion cycle (one reactor) from breaking ground to fully-built. Commissioning 6-8 weeks 19 |

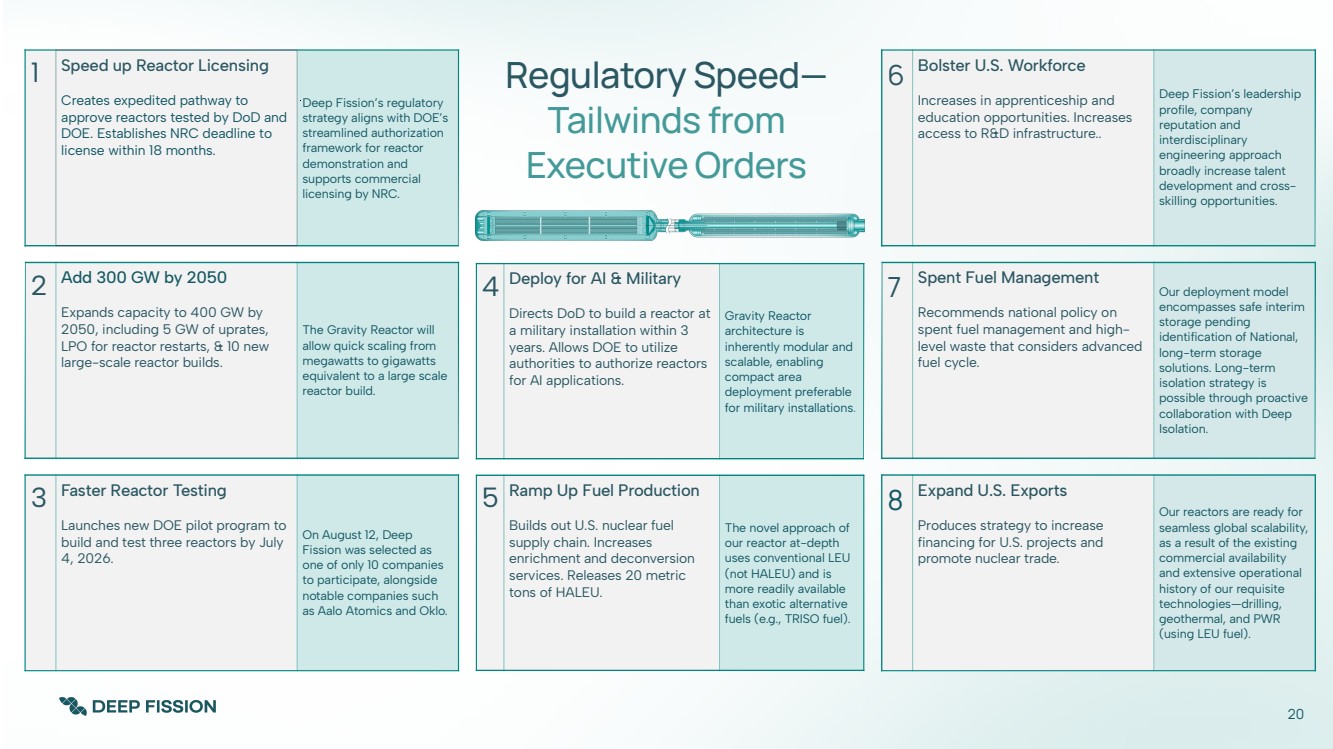

| Regulatory Speed— Tailwinds from Executive Orders 1 Speed up Reactor Licensing Creates expedited pathway to approve reactors tested by DoD and DOE. Establishes NRC deadline to license within 18 months. Deep Fission’s regulatory strategy aligns with DOE’s streamlined authorization framework for reactor demonstration and supports commercial licensing by NRC. 2 Add 300 GW by 2050 Expands capacity to 400 GW by 2050, including 5 GW of uprates, LPO for reactor restarts, & 10 new large-scale reactor builds. The Gravity Reactor will allow quick scaling from megawatts to gigawatts equivalent to a large scale reactor build. 3 Faster Reactor Testing Launches new DOE pilot program to build and test three reactors by July 4, 2026. On August 12, Deep Fission was selected as one of only 10 companies to participate, alongside notable companies such as Aalo Atomics and Oklo. 6 Bolster U.S. Workforce Increases in apprenticeship and education opportunities. Increases access to R&D infrastructure.. Deep Fission’s leadership profile, company reputation and interdisciplinary engineering approach broadly increase talent development and cross-skilling opportunities. 7 Spent Fuel Management Recommends national policy on spent fuel management and high-level waste that considers advanced fuel cycle. Our deployment model encompasses safe interim storage pending identification of National, long-term storage solutions. Long-term isolation strategy is possible through proactive collaboration with Deep Isolation. 8 Expand U.S. Exports Produces strategy to increase financing for U.S. projects and promote nuclear trade. Our reactors are ready for seamless global scalability, as a result of the existing commercial availability and extensive operational history of our requisite technologies—drilling, geothermal, and PWR (using LEU fuel). 4 Deploy for AI & Military Directs DoD to build a reactor at a military installation within 3 years. Allows DOE to utilize authorities to authorize reactors for AI applications. Gravity Reactor architecture is inherently modular and scalable, enabling compact area deployment preferable for military installations. 5 Ramp Up Fuel Production Builds out U.S. nuclear fuel supply chain. Increases enrichment and deconversion services. Releases 20 metric tons of HALEU. The novel approach of our reactor at-depth uses conventional LEU (not HALEU) and is more readily available than exotic alternative fuels (e.g., TRISO fuel). 20 |

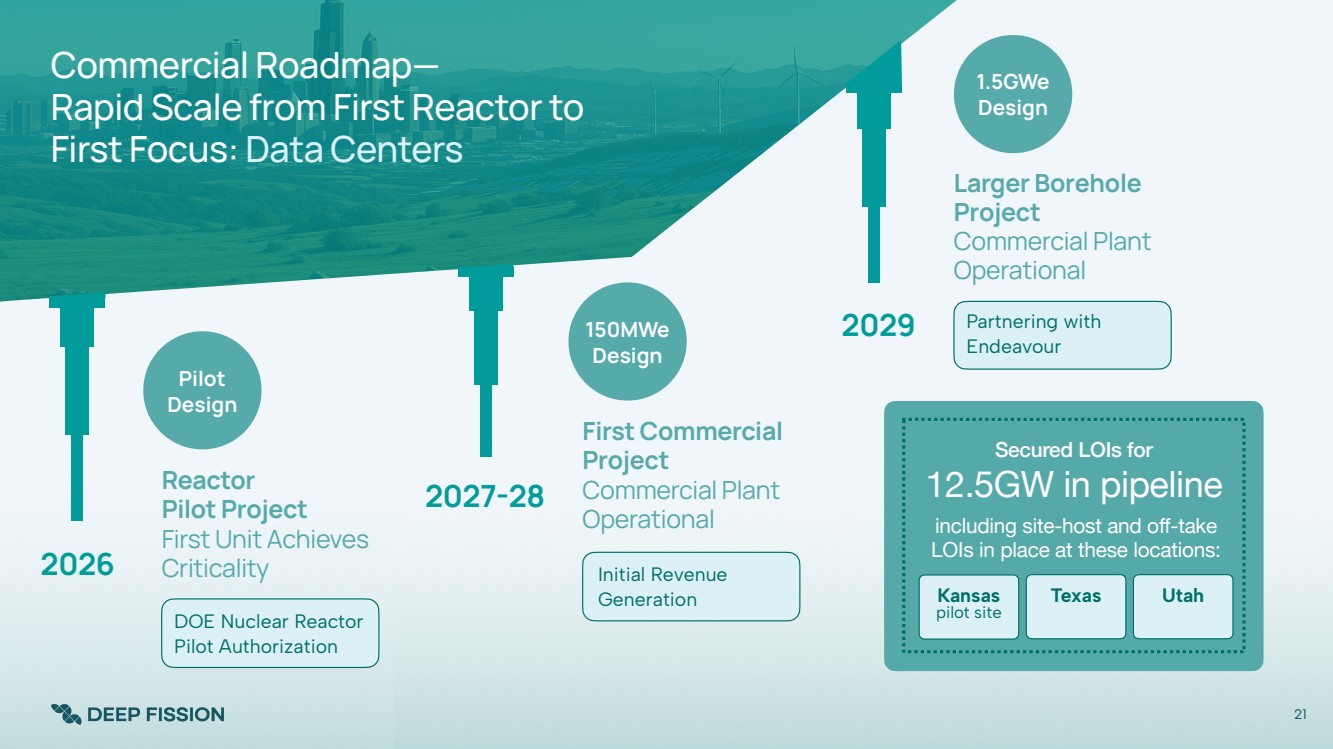

| 1.5GWe Design Commercial Roadmap— Rapid Scale from First Reactor to First Focus: Data Centers Larger Borehole Project Commercial Plant Operational 21 First Commercial Project Commercial Plant Operational 2027-28 2029 DOE Nuclear Reactor Pilot Authorization 2026 Reactor Pilot Project First Unit Achieves Criticality Initial Revenue Generation Partnering with Endeavour including site-host and off-take LOIs in place at these locations: Secured LOIs for 12.5GW in pipeline Kansas pilot site Texas Utah 150MWe Design Pilot Design |

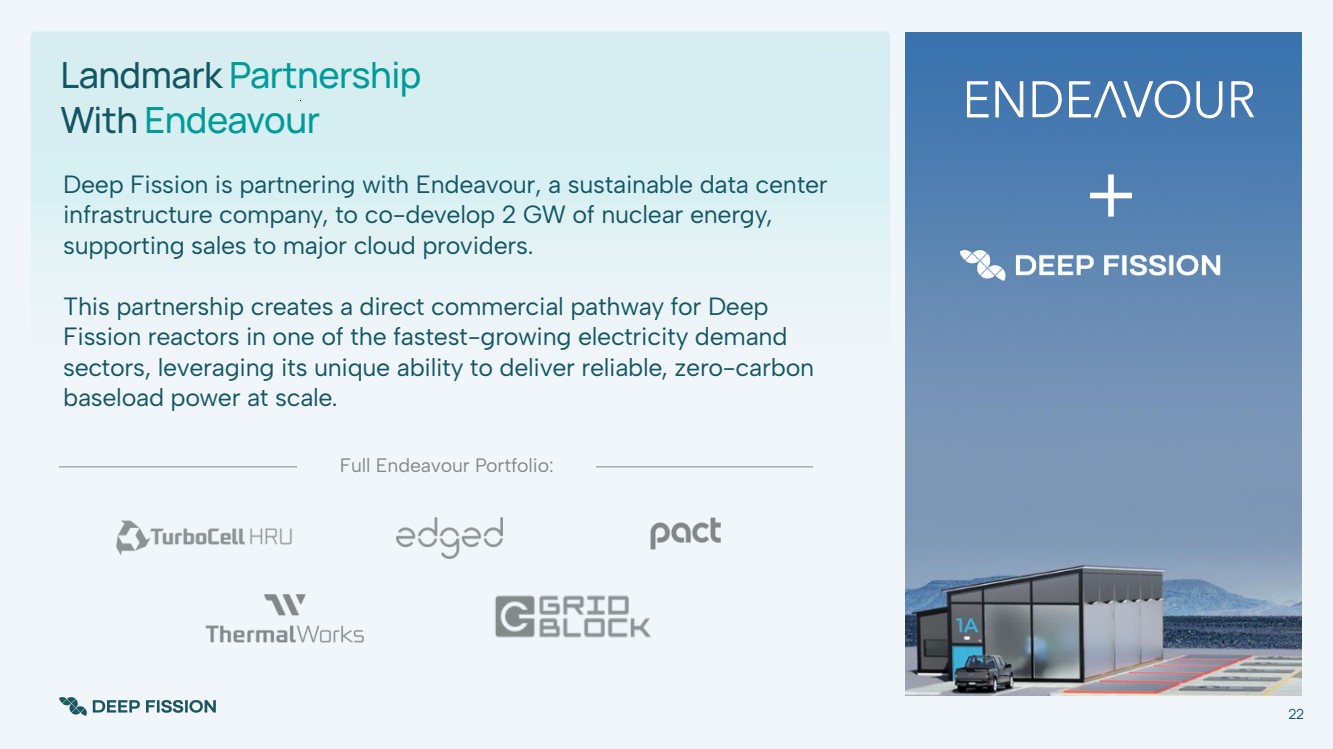

| Deep Fission is partnering with Endeavour, a sustainable data center infrastructure company, to co-develop 2 GW of nuclear energy, + supporting sales to major cloud providers. This partnership creates a direct commercial pathway for Deep Fission reactors in one of the fastest-growing electricity demand sectors, leveraging its unique ability to deliver reliable, zero-carbon baseload power at scale. Landmark Partnership With Endeavour 22 Full Endeavour Portfolio: |

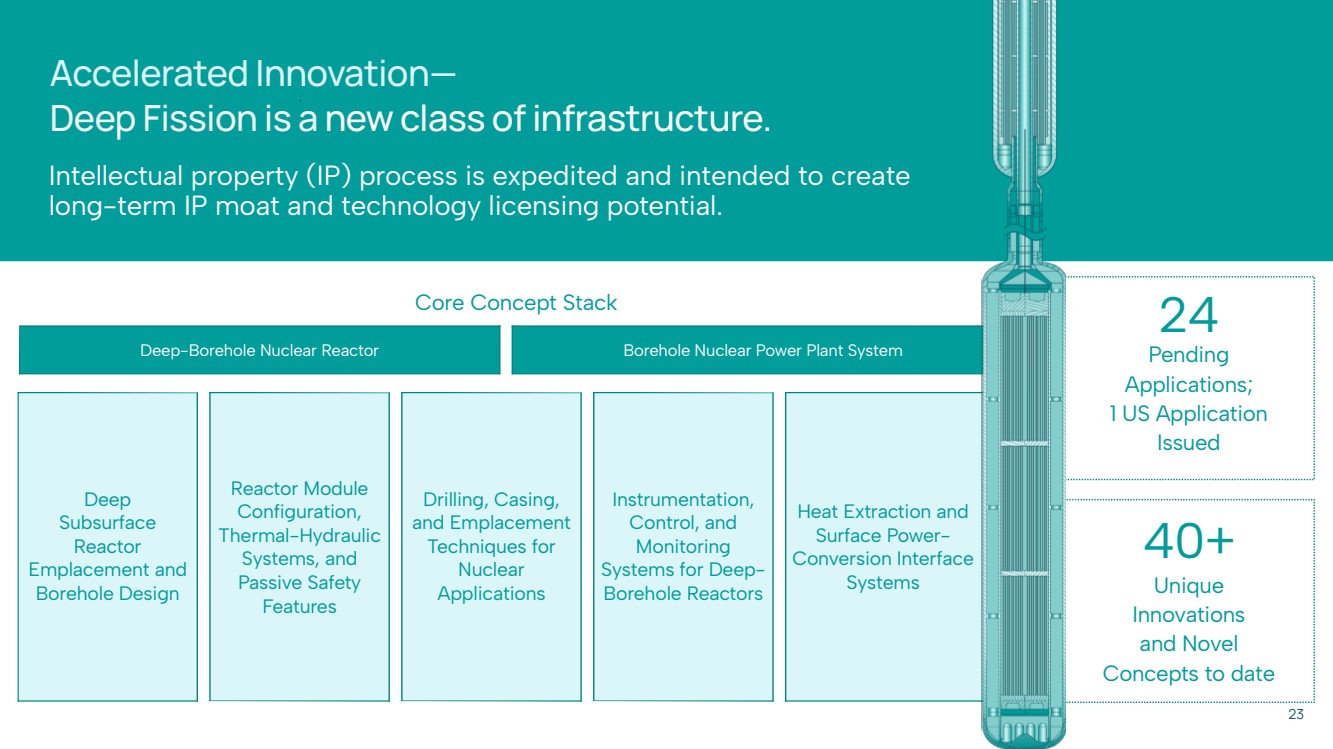

| Accelerated Innovation— Deep Fission is a new class of infrastructure. Deep Subsurface Reactor Emplacement and Borehole Design Reactor Module Configuration, Thermal-Hydraulic Systems, and Passive Safety Features Drilling, Casing, and Emplacement Techniques for Nuclear Applications Instrumentation, Control, and Monitoring Systems for Deep-Borehole Reactors Heat Extraction and Surface Power-Conversion Interface Systems Core Concept Stack Deep-Borehole Nuclear Reactor Borehole Nuclear Power Plant System 24 Pending Applications; 1 US Application Issued 40+ Unique Innovations and Novel Concepts to date Intellectual property (IP) process is expedited and intended to create long-term IP moat and technology licensing potential. 23 |

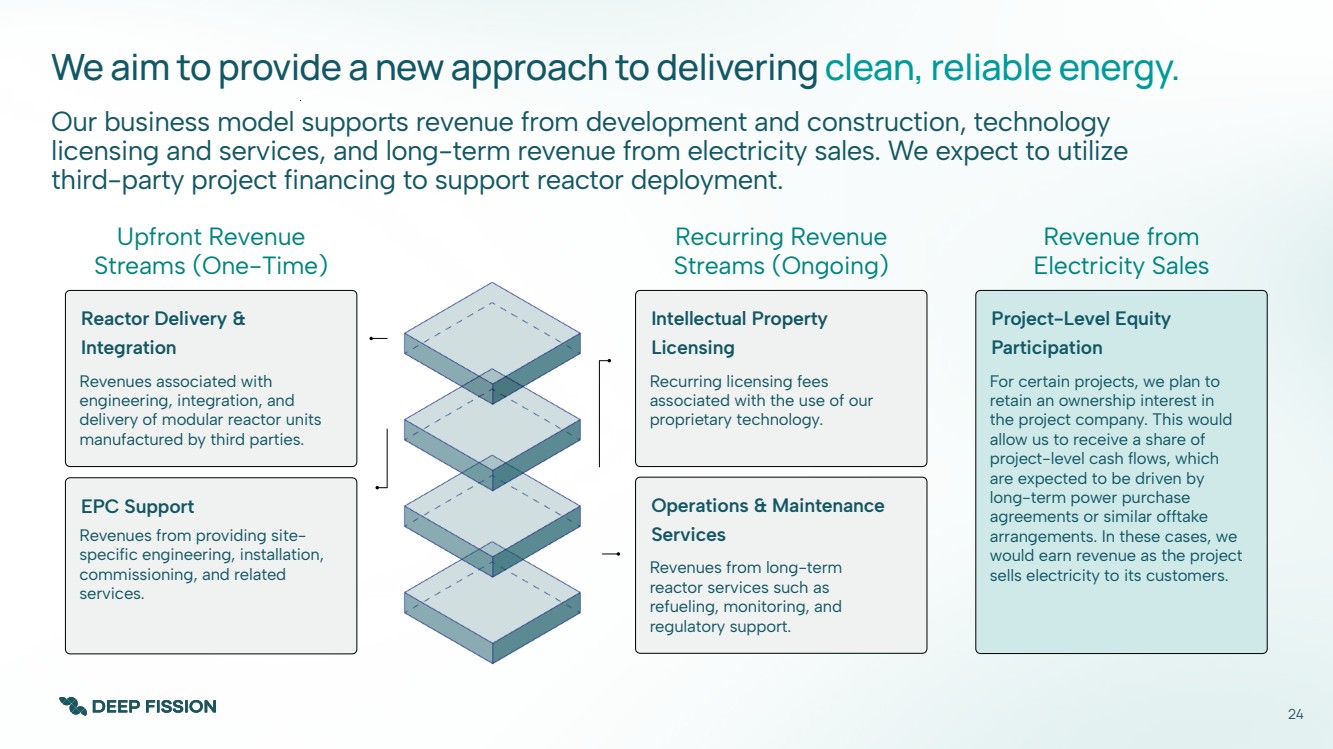

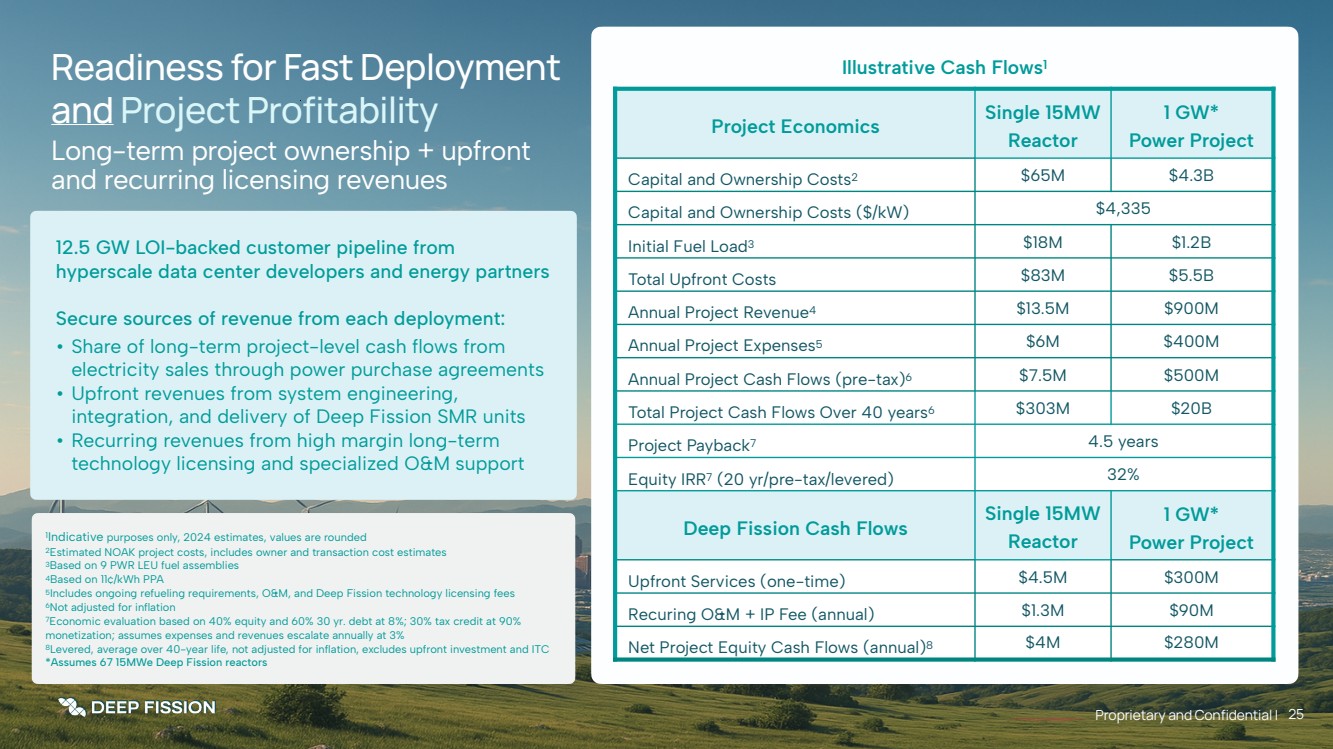

| 24 We aim to provide a new approach to delivering clean, reliable energy. Our business model supports revenue from development and construction, technology licensing and services, and long-term revenue from electricity sales. We expect to utilize third-party project financing to support reactor deployment. Upfront Revenue Streams (One-Time) Reactor Delivery & Integration Revenues associated with engineering, integration, and delivery of modular reactor units manufactured by third parties. EPC Support Revenues from providing site-specific engineering, installation, commissioning, and related services. Intellectual Property Licensing Recurring licensing fees associated with the use of our proprietary technology. Operations & Maintenance Services Revenues from long-term reactor services such as refueling, monitoring, and regulatory support. Recurring Revenue Streams (Ongoing) Project-Level Equity Participation For certain projects, we plan to retain an ownership interest in the project company. This would allow us to receive a share of project-level cash flows, which are expected to be driven by long-term power purchase agreements or similar offtake arrangements. In these cases, we would earn revenue as the project sells electricity to its customers. Revenue from Electricity Sales |

| Project Economics Single 15MW Reactor 15 MWe 1 GW* Power Project Capital and Ownership Costs2 $65M $4.3B Capital and Ownership Costs ($/kW) $4,335 Initial Fuel Load3 $18M $1.2B Total Upfront Costs $83M $5.5B Annual Project Revenue4 $13.5M $900M Annual Project Expenses5 $6M $400M Annual Project Cash Flows (pre-tax)6 $7.5M $500M Total Project Cash Flows Over 40 years6 $303M $20B Project Payback7 4.5 years Equity IRR7 (20 yr/pre-tax/levered) 32% Deep Fission Cash Flows Single 15MW Reactor 15 MWe 1 GW* Power Project Upfront Services (one-time) $4.5M $300M Recuring O&M + IP Fee (annual) $1.3M $90M Net Project Equity Cash Flows (annual)8 $4M $280M Proprietary and Confidential | 25 12.5 GW LOI-backed customer pipeline from hyperscale data center developers and energy partners Secure sources of revenue from each deployment: • Share of long-term project-level cash flows from electricity sales through power purchase agreements • Upfront revenues from system engineering, integration, and delivery of Deep Fission SMR units • Recurring revenues from high margin long-term technology licensing and specialized O&M support 1 Indicative purposes only, 2024 estimates, values are rounded 2Estimated NOAK project costs, includes owner and transaction cost estimates 3Based on 9 PWR LEU fuel assemblies 4Based on 11¢/kWh PPA 5Includes ongoing refueling requirements, O&M, and Deep Fission technology licensing fees 6Not adjusted for inflation 7Economic evaluation based on 40% equity and 60% 30 yr. debt at 8%; 30% tax credit at 90% monetization; assumes expenses and revenues escalate annually at 3% 8Levered, average over 40-year life, not adjusted for inflation, excludes upfront investment and ITC *Assumes 67 15MWe Deep Fission reactors Readiness for Fast Deployment Illustrative Cash Flows1 and Project Profitability Long-term project ownership + upfront and recurring licensing revenues |

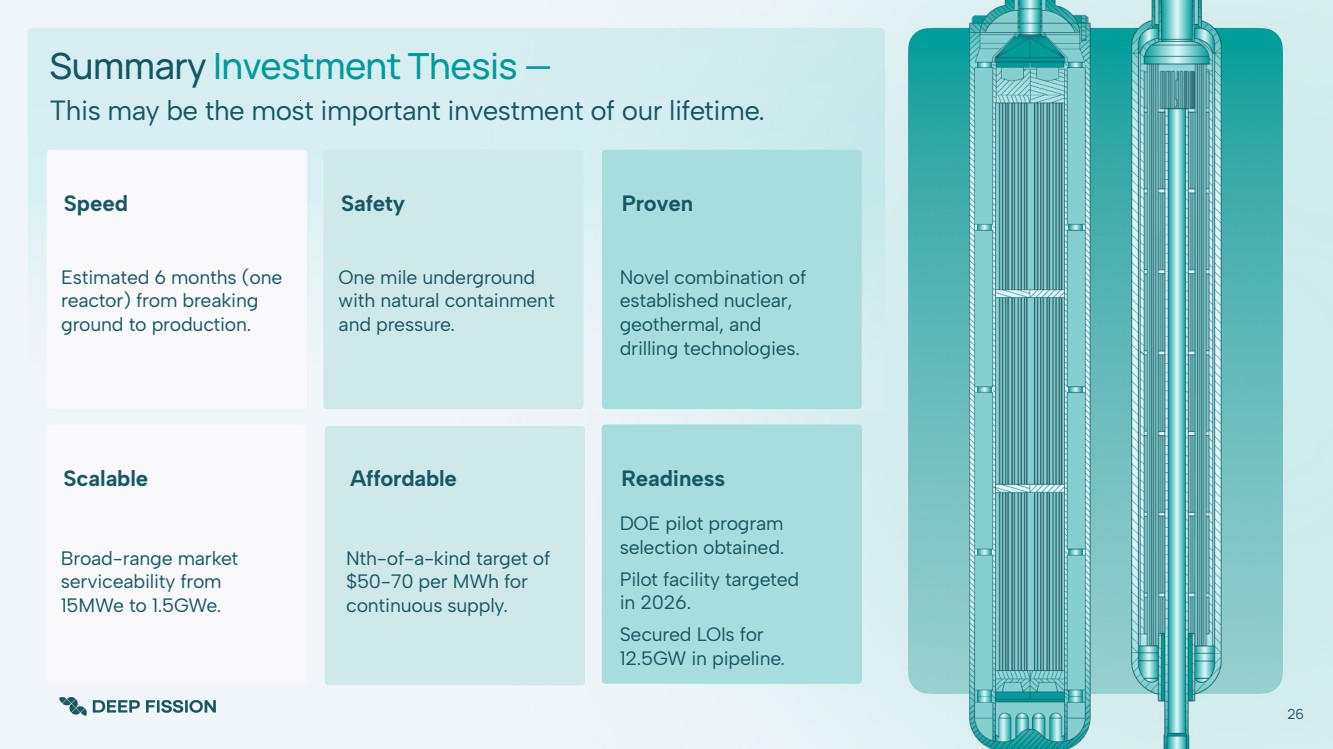

| Scalable Broad-range market serviceability from 15MWe to 1.5GWe. Readiness DOE pilot program selection obtained. Pilot facility targeted in 2026. Secured LOIs for 12.5GW in pipeline. Affordable Nth-of-a-kind target of $50-70 per MWh for continuous supply. Speed Estimated 6 months (one reactor) from breaking ground to production. Proven Novel combination of established nuclear, geothermal, and drilling technologies. Safety One mile underground with natural containment and pressure. 26 This may be the most important investment of our lifetime. Summary Investment Thesis — |

| Powering Humanity from a Mile Underground For investor inquiries, contact: Bob Prag IR@deepfission.com (858) 794-9500 For media inquiries, contact: Chloe Frader VP Strategic Affairs chloe.frader@deepfission.com The Fastest Path to Scale Nuclear Power |

| Appendix |

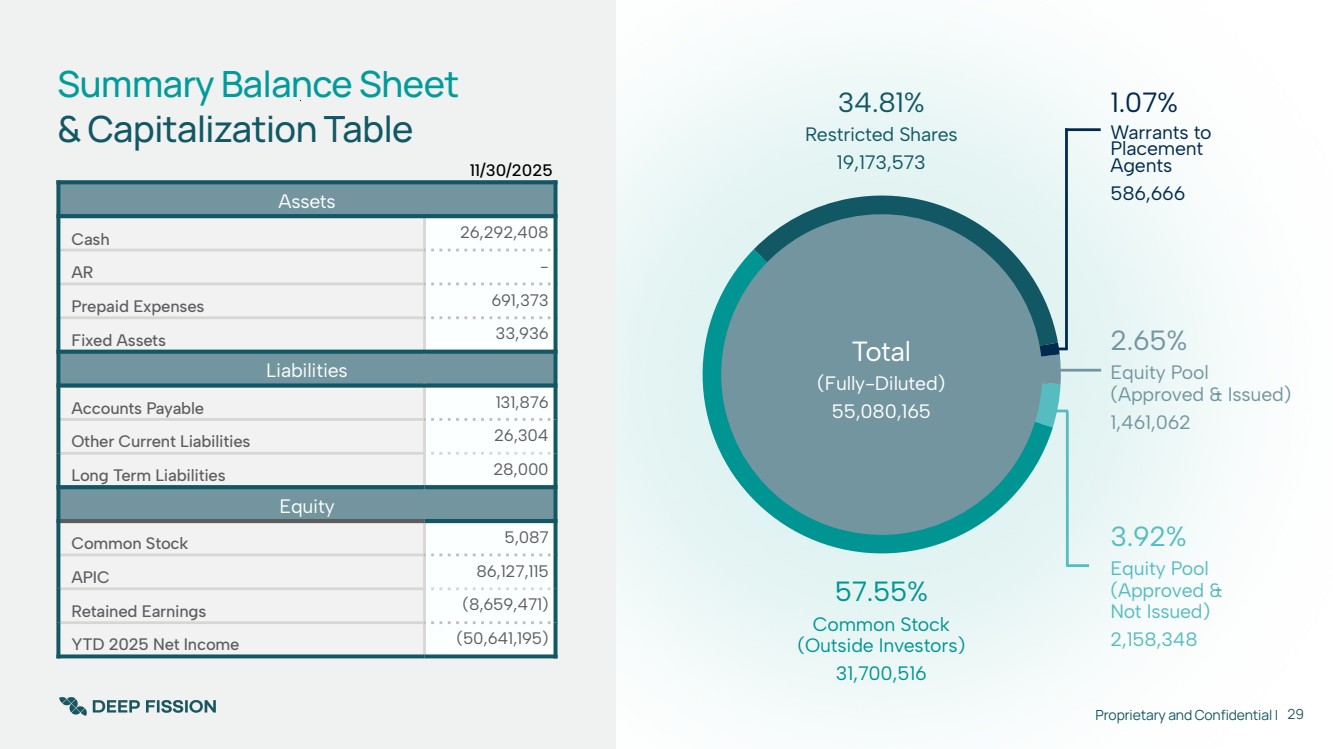

| Proprietary and Confidential | Summary Balance Sheet & Capitalization Table 29 57.55% Common Stock (Outside Investors) 31,700,516 34.81% Restricted Shares 19,173,573 1.07% Warrants to Placement Agents 586,666 2.65% Equity Pool (Approved & Issued) 1,461,062 3.92% Equity Pool (Approved & Not Issued) 2,158,348 11/30/2025 Assets Cash 26,292,408 AR - Prepaid Expenses 691,373 Fixed Assets 33,936 Liabilities Accounts Payable 131,876 Other Current Liabilities 26,304 Long Term Liabilities 28,000 Equity Common Stock 5,087 APIC 86,127,115 Retained Earnings (8,659,471) YTD 2025 Net Income (50,641,195) Total (Fully-Diluted) 55,080,165 |

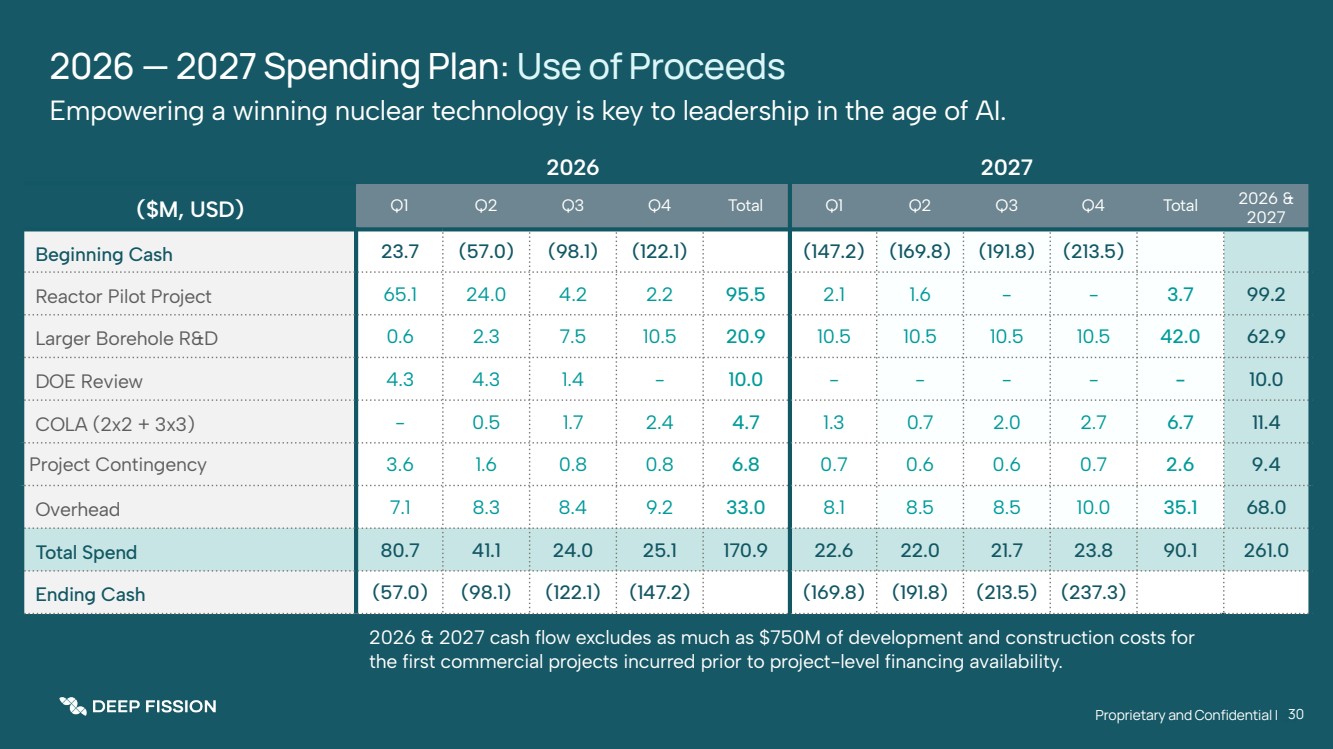

| 2026 2027 ($M, USD) Q1 Q2 Q3 Q4 Total Q1 Q2 Q3 Q4 Total 2026 & 2027 Beginning Cash 23.7 (57.0) (98.1) (122.1) (147.2) (169.8) (191.8) (213.5) Reactor Pilot Project 65.1 24.0 4.2 2.2 95.5 2.1 1.6 - - 3.7 99.2 Larger Borehole R&D 0.6 2.3 7.5 10.5 20.9 10.5 10.5 10.5 10.5 42.0 62.9 DOE Review 4.3 4.3 1.4 - 10.0 - - - - - 10.0 COLA (2x2 + 3x3) - 0.5 1.7 2.4 4.7 1.3 0.7 2.0 2.7 6.7 11.4 Project Contingency 3.6 1.6 0.8 0.8 6.8 0.7 0.6 0.6 0.7 2.6 9.4 Overhead 7.1 8.3 8.4 9.2 33.0 8.1 8.5 8.5 10.0 35.1 68.0 Total Spend 80.7 41.1 24.0 25.1 170.9 22.6 22.0 21.7 23.8 90.1 261.0 Ending Cash (57.0) (98.1) (122.1) (147.2) (169.8) (191.8) (213.5) (237.3) 2026 & 2027 cash flow excludes as much as $750M of development and construction costs for the first commercial projects incurred prior to project-level financing availability. 2026 — 2027 Spending Plan: Use of Proceeds 30 Empowering a winning nuclear technology is key to leadership in the age of AI. Proprietary and Confidential | 30 |